2023 Annual Report

Creating

a world of

potential

Cisco (Nasdaq: CSCO) is the worldwide leader

in technology that powers the internet.

Discover more at thenetwork.cisco.com and

follow us on X at @Cisco

About

Cisco

Our strategy

We securely connect everything to make anything possible

Our dierentiation

Innovation

Customer outcomes at

massive scale

●

Market-leading secure networking

●

Integrated solutions across broad

portfolio

●

Unmatched, AI-driven insights

●

400B security events observed

per day

●

630B observability metrics tracked

per day

Trust

Purpose-driven, neutral,

trusted brand

●

Data protection and privacy at

foundation

●

Top-rated supply chain

●

Goal to reach net zero greenhouse

gas emissions across value chain

by 2040

Global reach

Broad customer and partner

reach

●

1M+ customers and partner

ecosystem

●

99% of world’s largest companies

●

82,000+ government organizations

Cisco 2023 Annual Report 1

TABLE OF CONTENTS

Introduction to

summary report

This summary provides an overview

of Cisco. It does not contain all the

information you should consider.

Please refer to our latest Annual Report

on Form 10-K, our Proxy Statement

for our 2023 Annual Meeting of

Stockholders, and our Purpose Report

which are all available on our website

at www.cisco.com

FORWARD-LOOKING STATEMENTS

This summary report and our annual report on Form 10-K (“Annual Report”) contain projections and other forward-looking statements

regarding future events or the future financial performance of Cisco, including future operating results. These projections, goals and

statements are only predictions. Actual events or results may differ materially from those in the projections, goals or other forward-looking

statements. See Cisco’s filing with the Securities and Exchange Commission, including its most recent Annual Report for a discussion of

important risk factors that could cause actual events or results to differ materially from those in the projections, goals or other forward-

looking statements.

Our purpose

To power an inclusive future for all

We know that when we leverage the strengths and

success of our company and people, we can positively

impact the world, including the most vulnerable and

underserved. We do this by closing the digital divide,

empowering the future of work, fighting for equality and

social justice, and building a regenerative planet.

Customer priorities

●

Transform infrastructure

●

Secure the enterprise

●

Power hybrid work

●

Reimagine applications

●

Journey to sustainability

These priorities are central to how we

innovate and develop our technology

2 Letter to stockholders

4 Fiscal 2023

financial highlights

6 Cisco strategy

7 Leadership

8 Corporate governance

12 Our purpose

2

4

6

7

8

12

Cisco 2023 Annual Report2

To our stockholders,

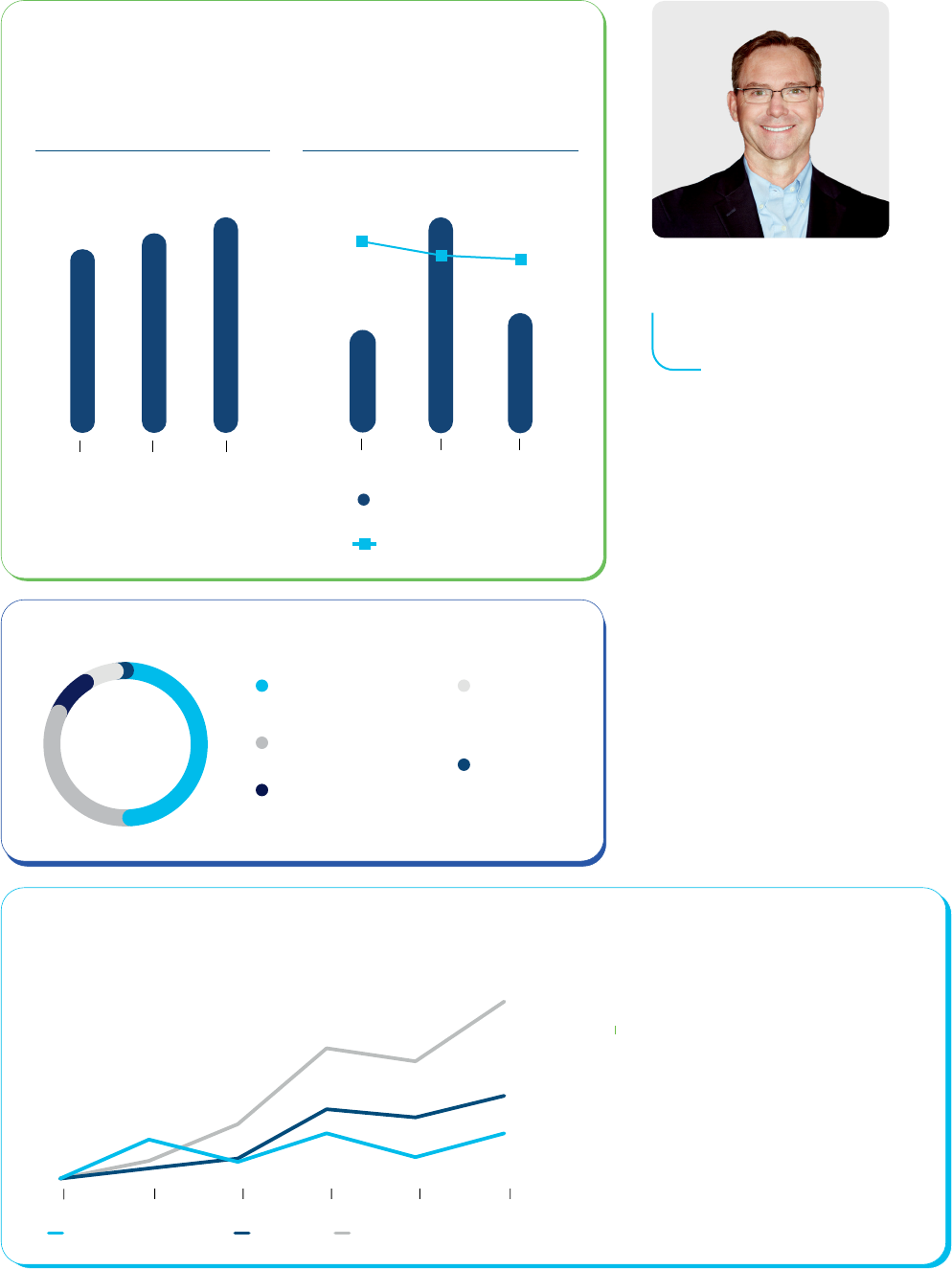

Fiscal 2023 was a milestone year for Cisco. We delivered

record revenue of nearly $57 billion, up 11% year-over-

year, which was our highest growth rate in over a decade.

We also delivered record net income, earnings per share,

and operating cash flow, and returned $10.6 billion to

stockholders. Even more impressive is that we achieved

this while successfully navigating a dynamic operating

environment. I am incredibly proud of all that our teams did

this past year to deliver these results and to create value for

our customers and stockholders.

While change is a constant in our industry, our priorities

remain the same: growing our market share; driving

innovation and extending our leadership; delivering

exceptional stockholder value; and transforming our business

model by growing recurring revenue. Fiscal 2023 marked a

year of good progress on these priorities, and we expect this

to continue into next year as well.

Strong execution and share gains

At the start of the fiscal year, we were proactively managing

through an evolving and complex market environment and

taking actions to remediate supply challenges that affected

almost every industry worldwide. Our past mitigation actions

included redesigning hundreds of products and sourcing

alternative key components to improve the resilience of our

supply chain.

Chuck Robbins

Chair and Chief Executive Officer

Letter to

stockholders

Our ability to navigate successfully through this environment

led to our record results indicating solid customer demand in

fiscal 2023. Quarterly sequential product order growth in our

fourth quarter was over 30%, the second highest rate in 20

years, which is a testament to the strength of our portfolio

and our execution.

In addition, as supply constraints eased, we were able to

deliver more of our technology to our customers which led

to market share gains of over three percentage points in

our three largest networking markets—Campus Switching,

Wireless LAN and Service Provider Routing. We expect this

market share momentum to continue in fiscal 2024.

Innovation momentum

Our customers are increasingly turning to Cisco to help them

securely connect their businesses today and to build the

networks of tomorrow. Throughout the year, we executed on

our innovation strategy and announced several new solutions

spanning generative artificial intelligence (AI), networking,

security, full stack observability, sustainability, and hybrid

work. Across our portfolio, we are focused on delivering a

simpler and more unified experience for our customers.

We know that the acceleration of AI will fundamentally

change our world and create new growth opportunities

for us. We launched new, market-leading AI technologies

across our Collaboration and Security portfolios in addition

to new infrastructure to allow our customers to process AI

workloads more efficiently.

“The visibility we achieve

through our growing recurring

revenue enables us to strengthen our

commitment to increasing shareholder

returns through capital return,

innovation, and strong execution.”

Cisco 2023 Annual Report 3

While hyperscalers are continuing their investments to grow

public cloud infrastructure, they are also beginning their

buildouts to capitalize on the possibilities of generative AI.

In fact, our core networking technology is already powering

some of the leading AI models run by hyperscalers around

the world.

We expect to see more demand for our technologies as

these use cases require higher networking requirements.

To address this demand, we launched our next generation

Silicon One switching ASICs to support large-scale Graphics

Processing Unit (GPU) clusters for AI workloads and, by the

end of fiscal 2023, we had taken cumulative orders for over

half a billion dollars for ethernet fabrics. Additionally, we

are piloting 800G capabilities for AI training fabrics. Overall,

Cisco is committed to helping our customers navigate this

transition in a trusted and responsible way, and we believe

we are well positioned to win.

Security also remains a top priority. Our Security Cloud

platform has comprehensive capabilities across the

network, endpoint, and the cloud – helping to simplify

security management while increasing efficacy. Our new

technologies like Extended Detection and Response (XDR),

Cisco Multicloud Defense, and Cisco Secure Access, a

secure service edge (SSE) solution, are seeing rapid early

adoption. These innovations, combined with our recent

acquisitions, show how we are extending our security

portfolio with deep telemetry, AI, and identity threat

capabilities.

As part of our journey to simplification, we have been

working to enable the monitoring and management of all

Cisco networking products—whether on premises or in the

cloud—from one place. At Cisco Live, we introduced the

Cisco Networking Cloud, a unified management platform

and a cloud-native Full Stack Observability (FSO) platform

to deliver unparalleled insights.

I believe our portfolio is stronger than ever, and that Cisco

has never been better positioned to help deliver our

customers’ outcomes. As we look ahead, this gives me

great confidence in our ability to drive innovation and extend

our technology leadership by investing in significant new

opportunities for growth in Cloud, Security, and AI.

Accelerating our business

transformation for greater visibility

In fiscal 2023, we continued to make progress on the

transformation of our business to more recurring-

based offerings driven by higher levels of software and

subscriptions. We generated almost $17 billion of software

revenue, 84% of which was subscription based. Total

subscription revenue including services sold as subscriptions

was over $24 billion and represented 43% of Cisco’s total

revenue.

With the success of this transformation, we have gained

greater predictability and visibility through our growing

Annualized Recurring Revenue (ARR) and Remaining

Performance Obligations (RPO). As we look ahead to fiscal

2024, we expect these factors, combined with our healthy

backlog, will account for approximately 40% of the year’s

revenue. Additionally, we have almost $1 billion of Enterprise

Networking software subscriptions available to renew in

fiscal 2024.

Long-term value creation

and sustainability

The visibility we achieve through our growing recurring

revenue enables us to strengthen our commitment to

increasing shareholder returns through capital return,

innovation, and strong execution. Our long-term strategy is

to deliver operating leverage by growing earnings per share

faster than revenue. We will also provide a high degree of

consistency in our stock repurchase program and continue

to grow our dividend.

Cisco is committed to being a sustainable business as we

believe it is not only a commercial and moral imperative, but

also a tremendous opportunity. As we work towards our net

zero goals, our technologies such as IoT, Silicon One and

power over ethernet, are helping our customers on their own

sustainability journeys by enabling significant reductions in

power consumption.

I’m incredibly proud that for the third year in a row, Cisco

was ranked #1 in the United States on Fortune Magazine’s

100 Best Companies to Work For list, as well as being a #1

Great Place to Work in 15 other countries around the world.

This positions Cisco as a premier destination for top talent

worldwide.

To summarize, we had a phenomenal year. Our fiscal

2023 results demonstrate the strength of our business

today and are a solid foundation for future growth. Our

long-established leadership in networking, the breadth of

our portfolio, the trust we’ve built with our customers and

partners, and our collective commitment to innovation and to

our purpose give me great confidence in our future and our

ability to capture the many opportunities ahead.

Thank you for your continued support.

Chuck Robbins

Chair and Chief Executive Officer

October 12, 2023

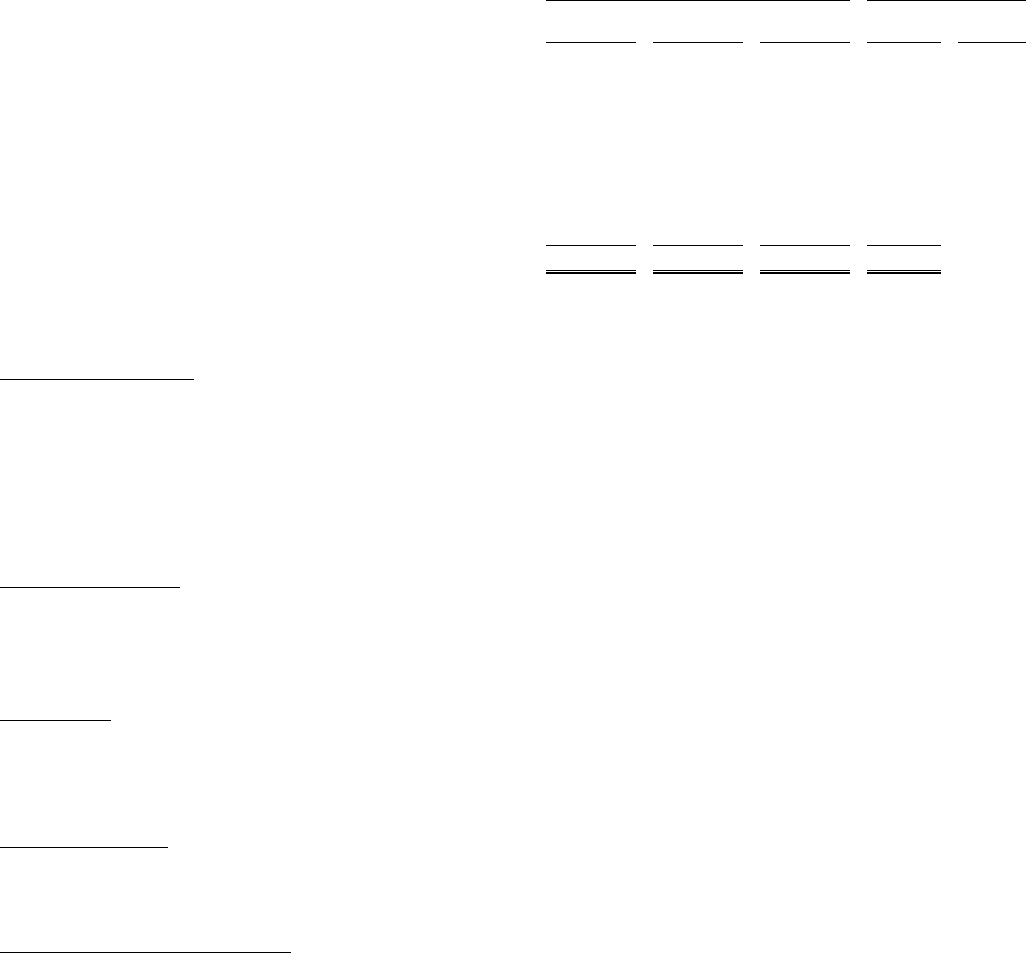

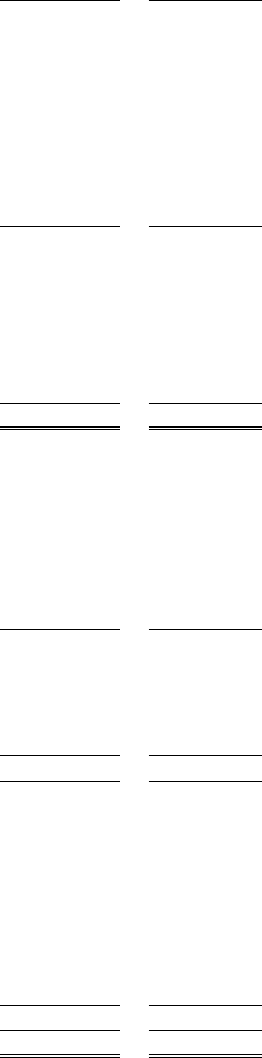

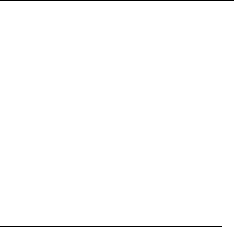

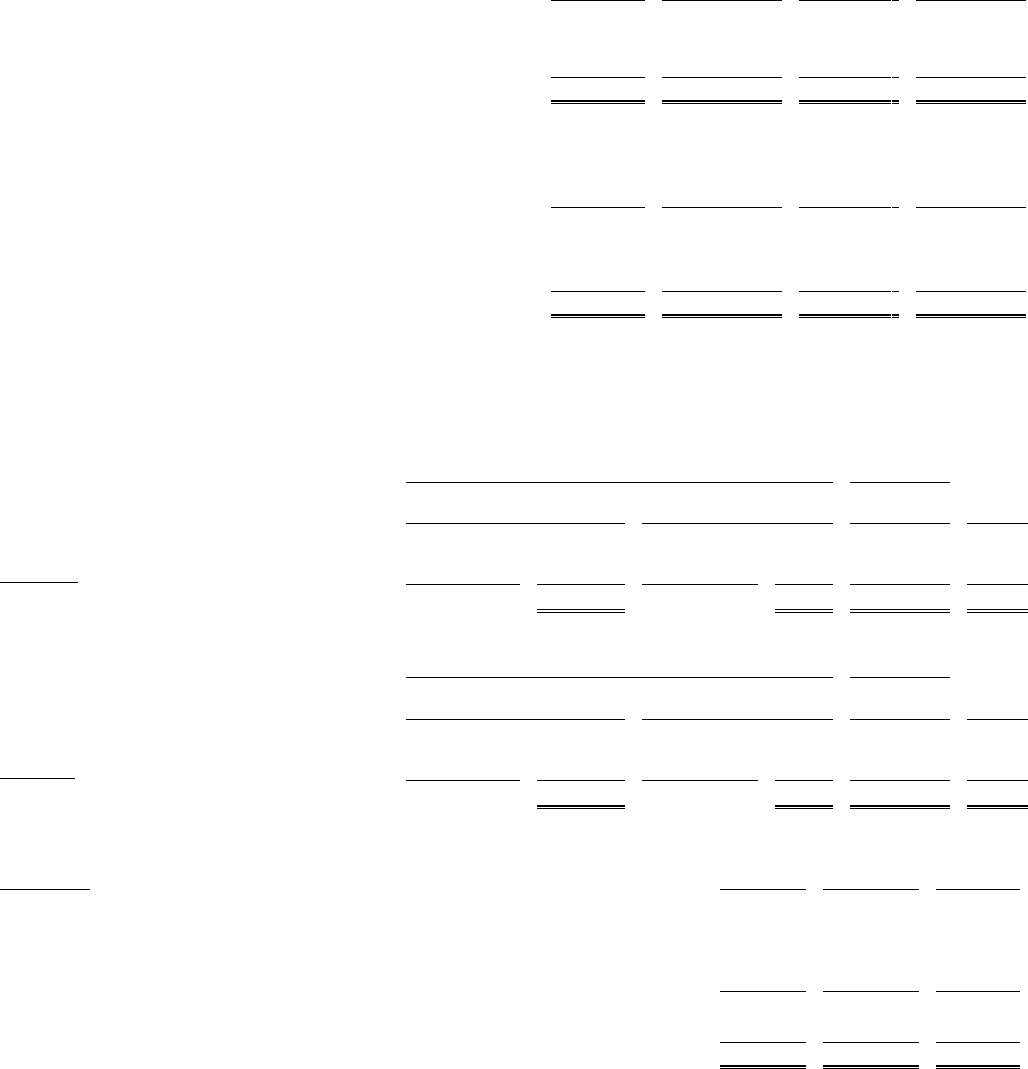

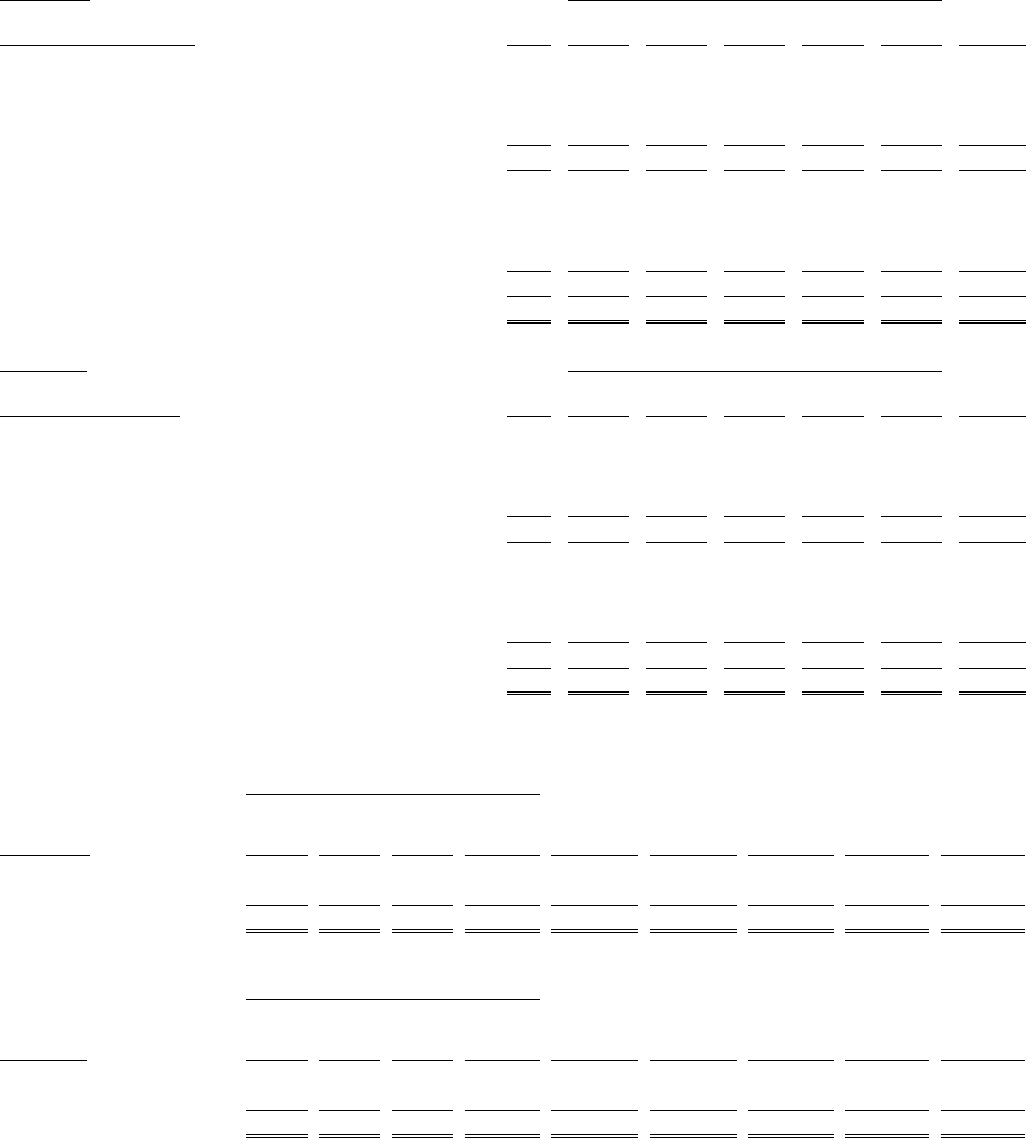

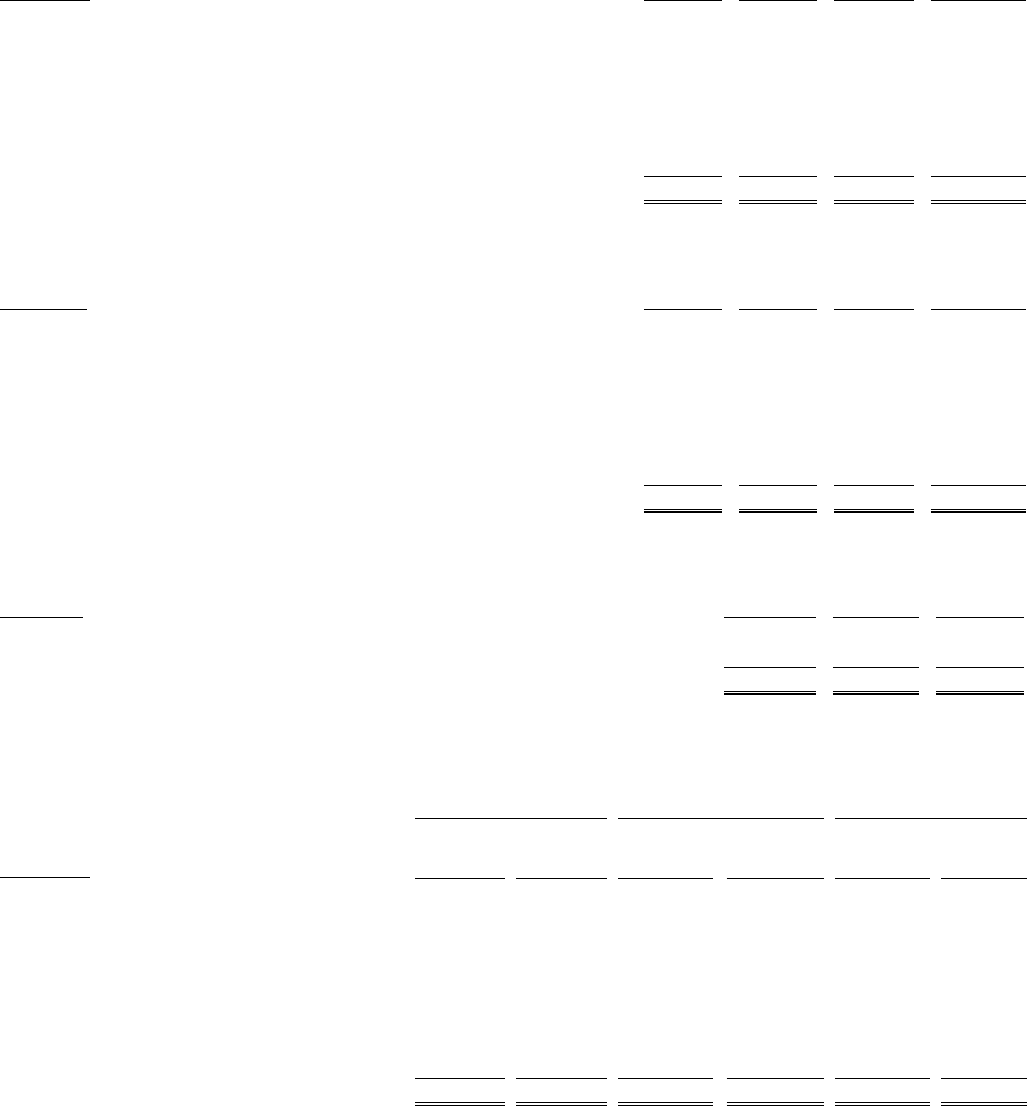

Cisco 2023 Annual Report4

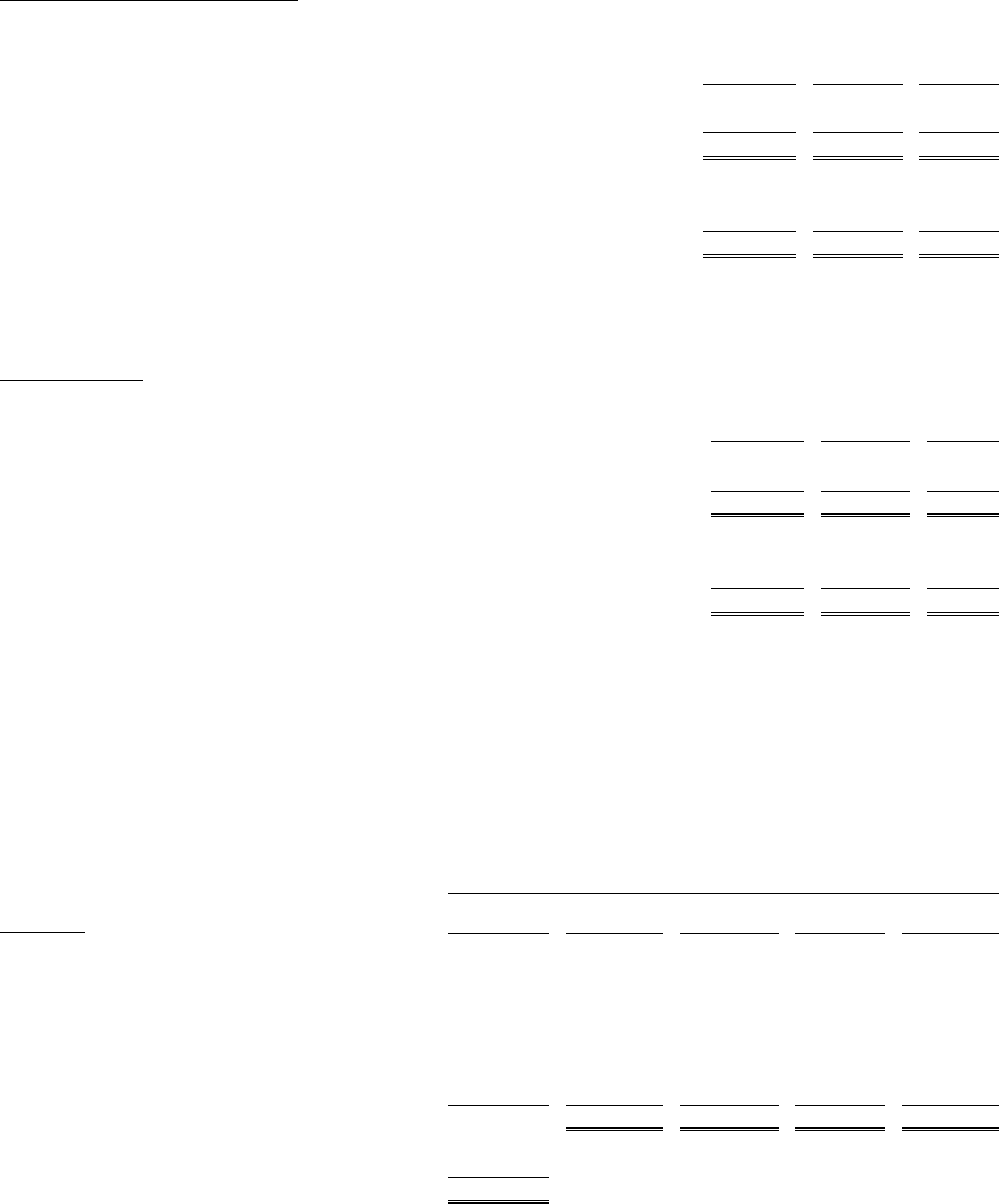

*

Amounts may not sum and percentages may not recalculate due to rounding

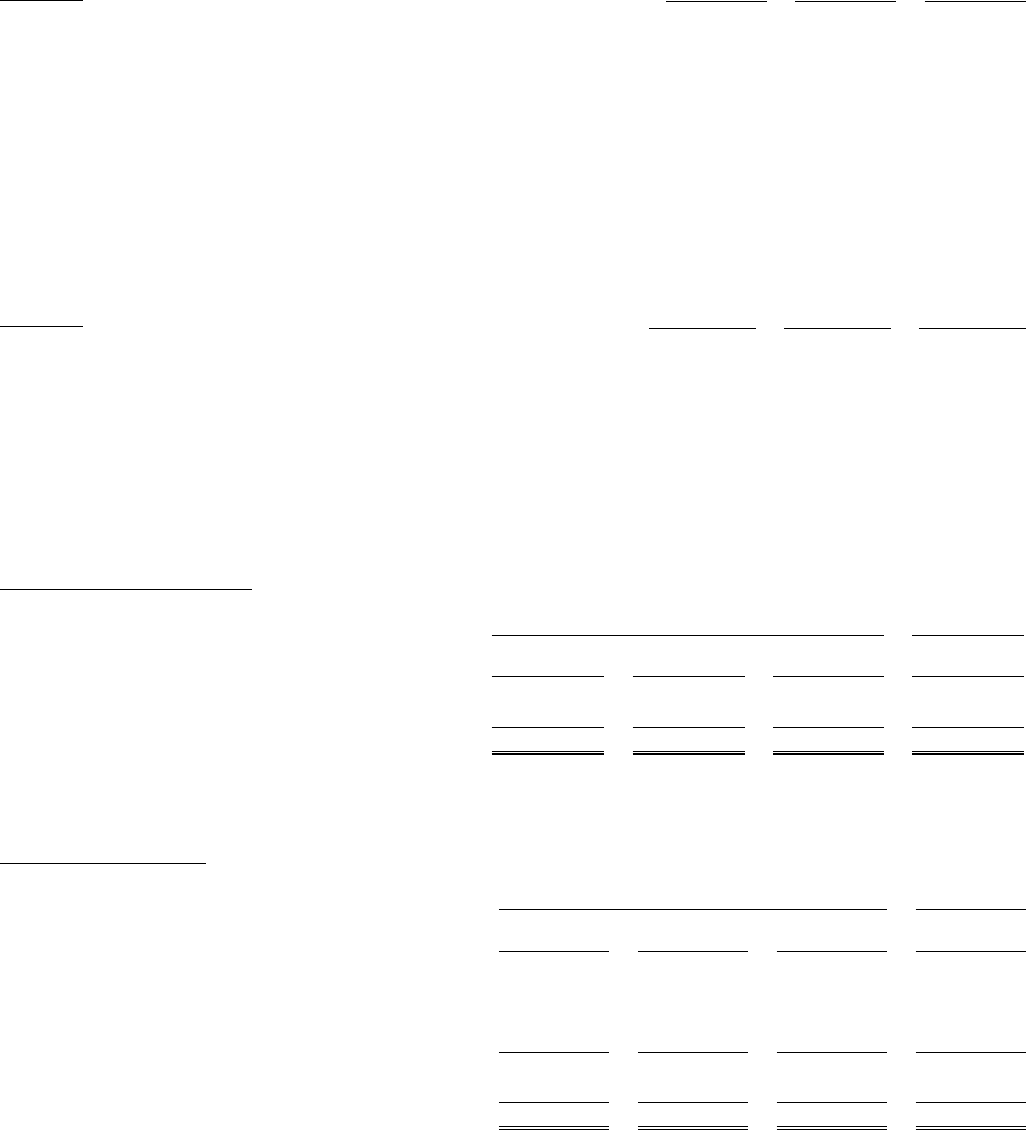

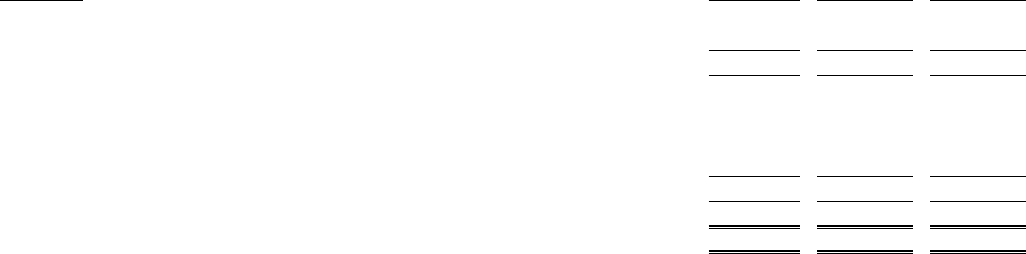

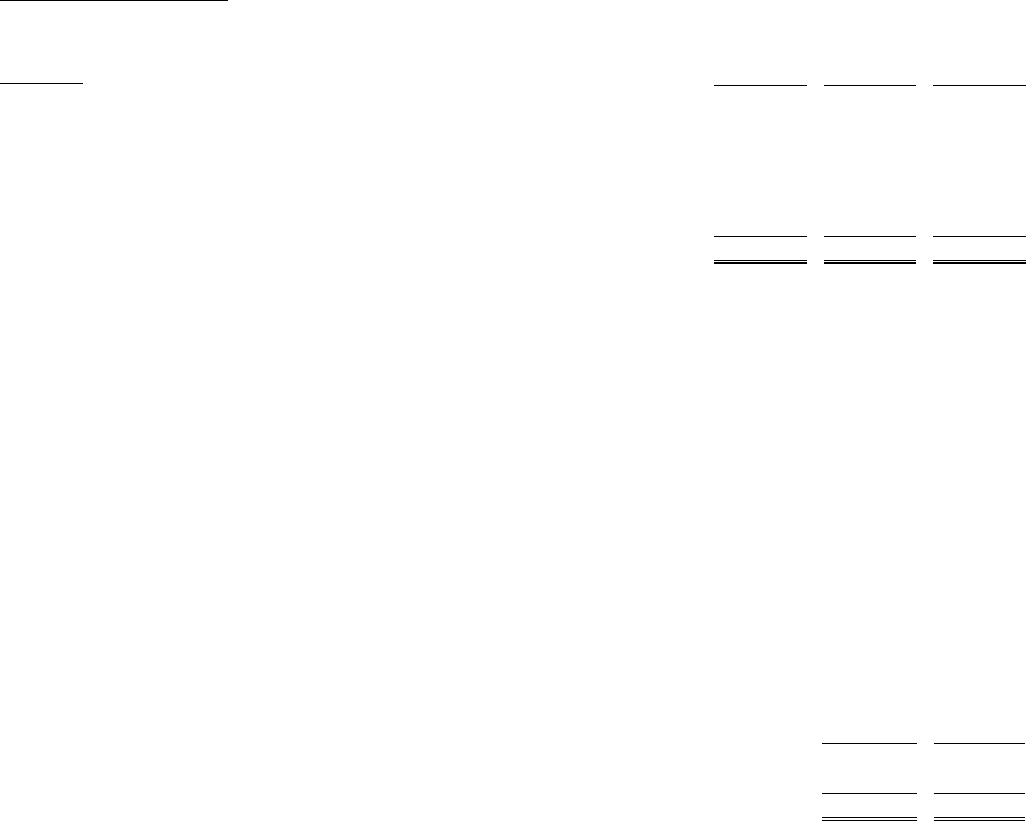

By product category and services*

2021 2022 2023

64.0%

25.8%

62.5%

27.1%

62.7%

26.4%

2021 2022 2023

64.0%

25.8%

62.5%

27.1%

62.7%

26.4%

2021 2022 2023

64.0%

25.8%

62.5%

27.1%

62.7%

26.4%

51%

Secure, Agile

Networks

9%

Internet for

theFuture

7%

Collaboration

7%

End-to-End

Security

1%

Optimized

Application

Experiences

24%

Services

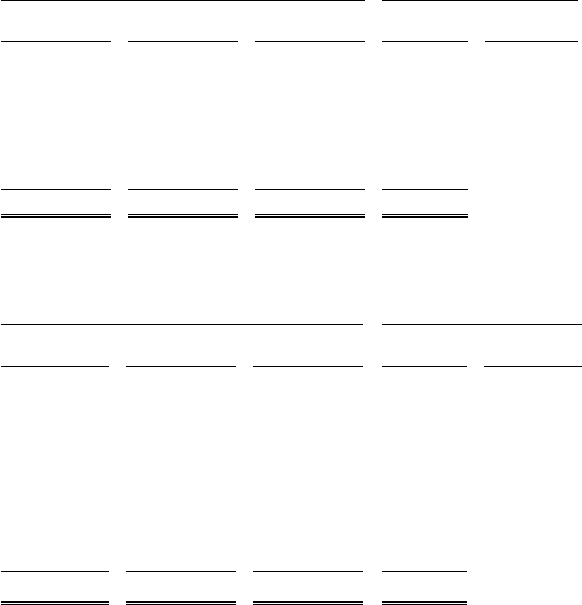

Gross margin

Operating margin

FY23 Revenue

By geographical segment*

59%

Americas

27%

EMEA

15%

APJC

$15.5

2021

$13.2

2022

$19.9

2023

($B)

Revenue trend*

(%)

Margin

Product revenue

Services revenue

$49.8

2021 2022 2023

$36.0

$13.8

$38.0

$13.5

$43.1

$13.9

$51.6

2021 2022 2023

$36.0

$13.8

$38.0

$13.5

$43.1

$13.9

$57.0

($B)

Operating cash flow

Fiscal 2023 financial highlights

2021 2022 2023

$36.0

$13.8

38.0%

13.5%

43.1%

13.9%

All amounts on an annual basis.

Fiscal 2023 financial highlights

Cisco 2023 Annual Report 5

R. Scott Herren

EVP and Chief Financial Officer

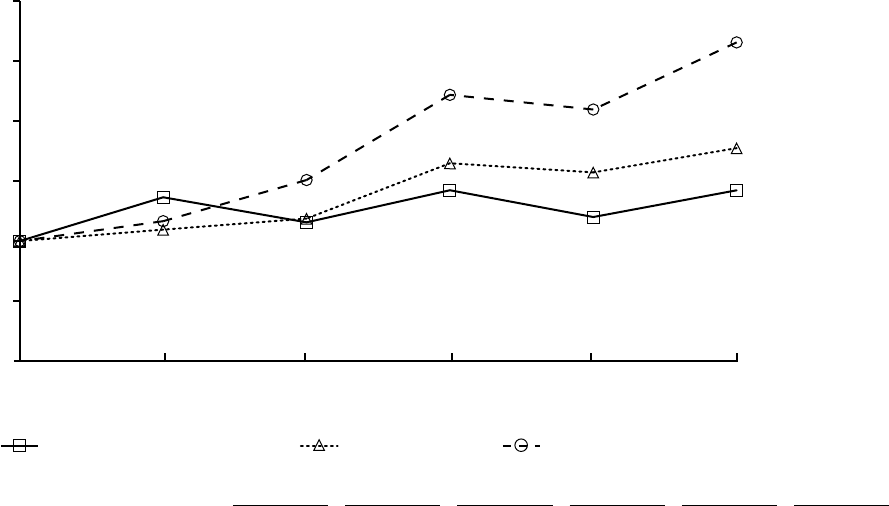

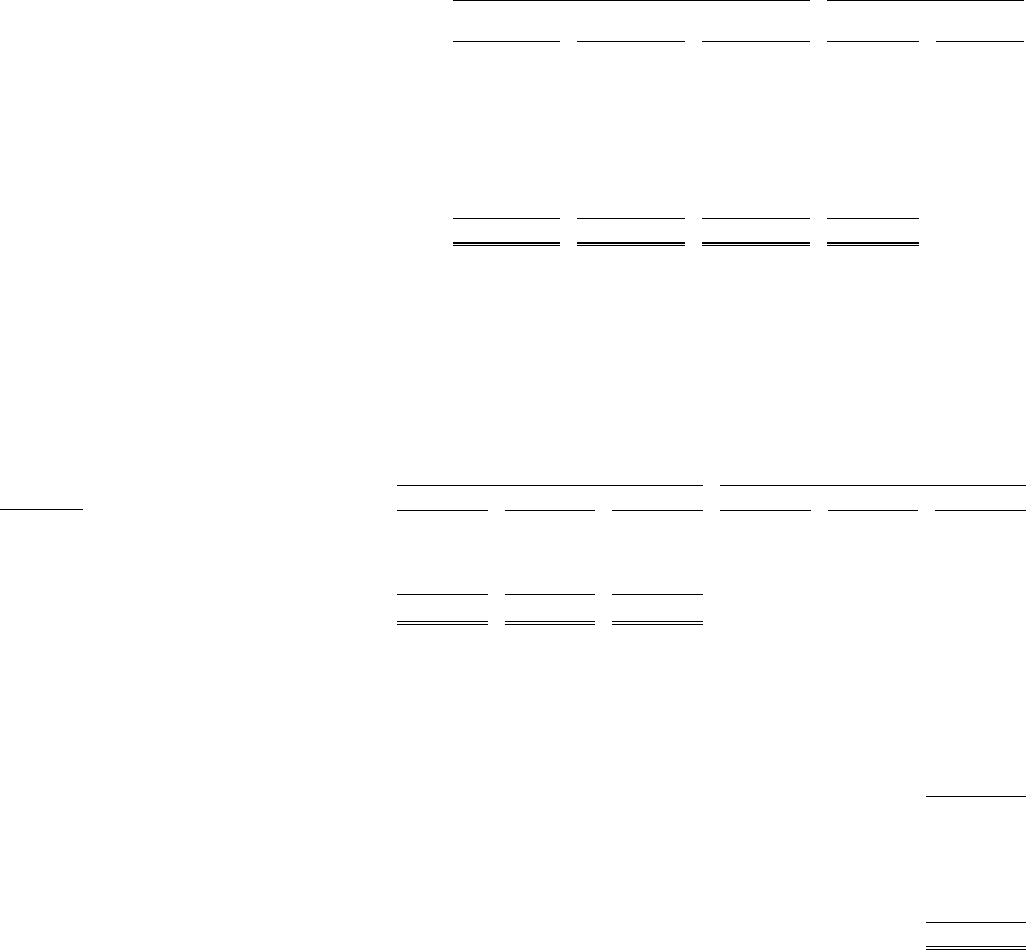

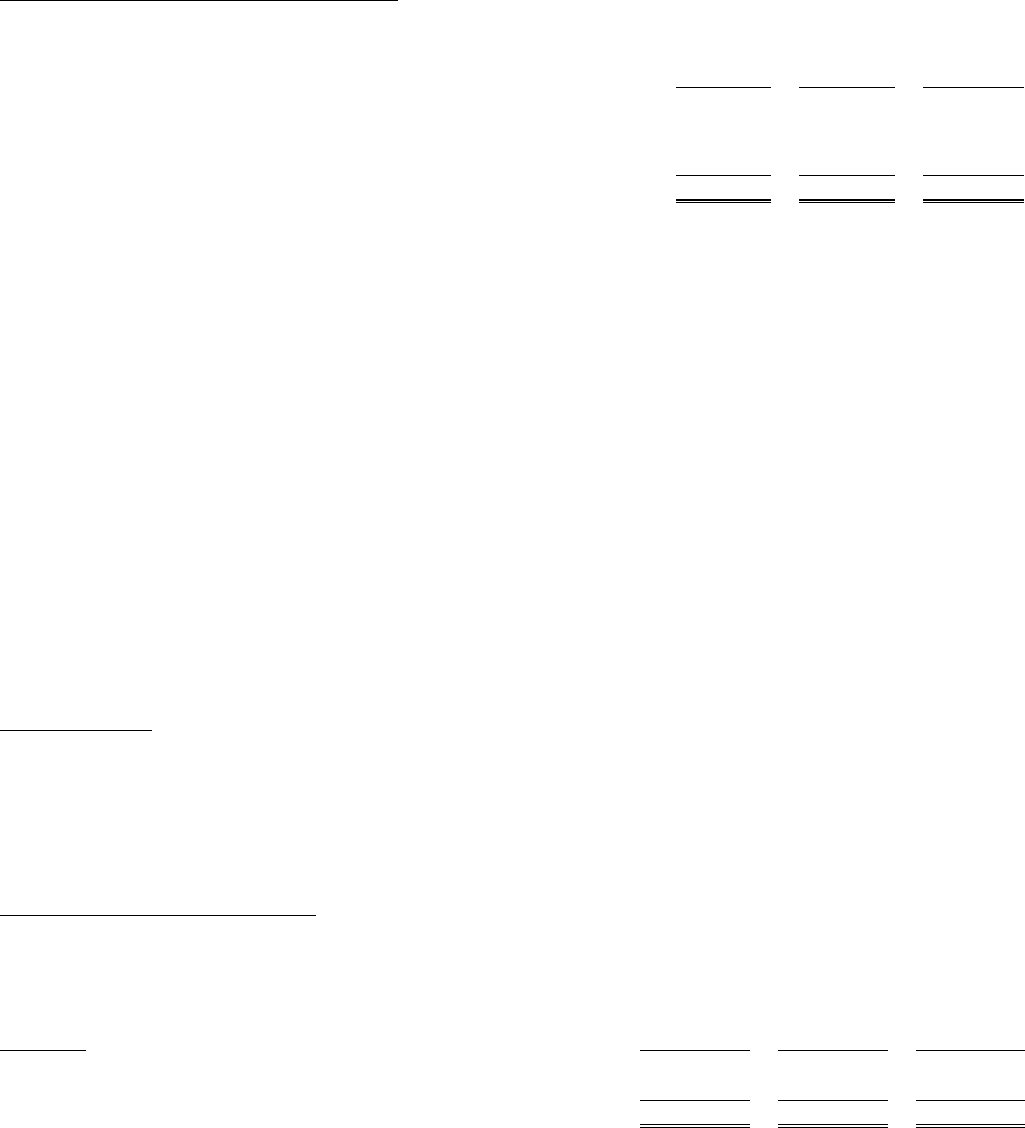

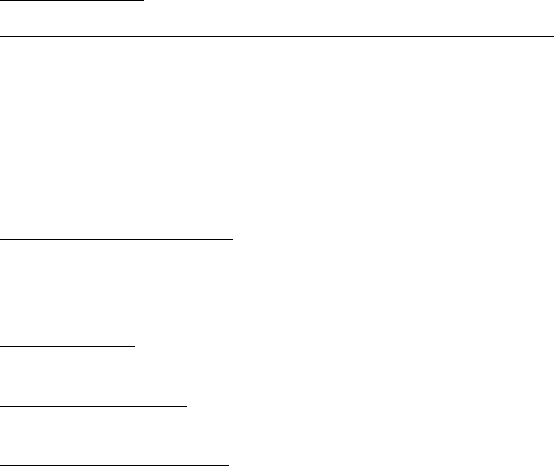

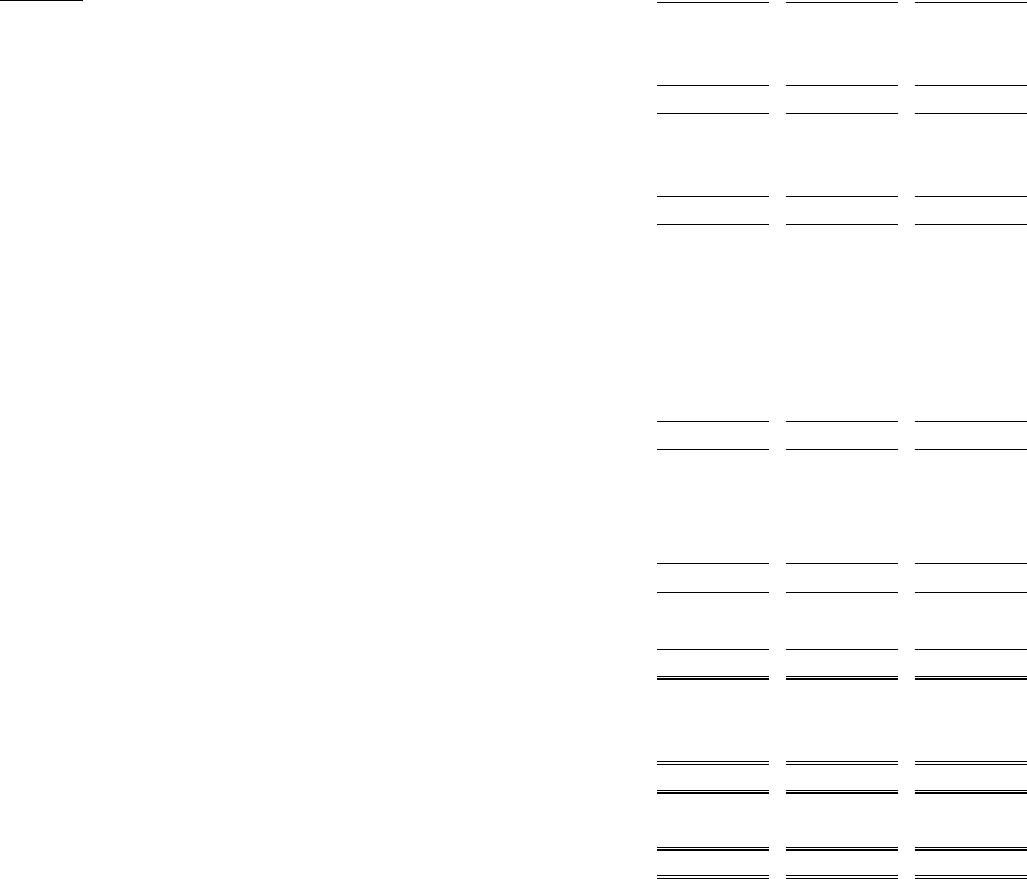

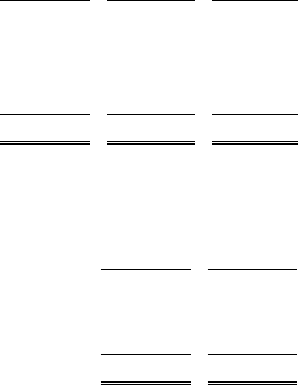

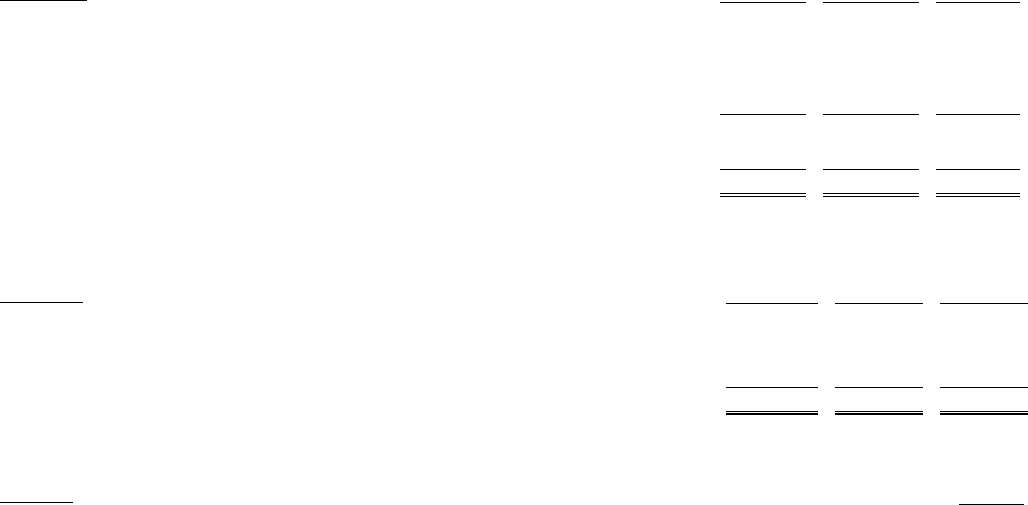

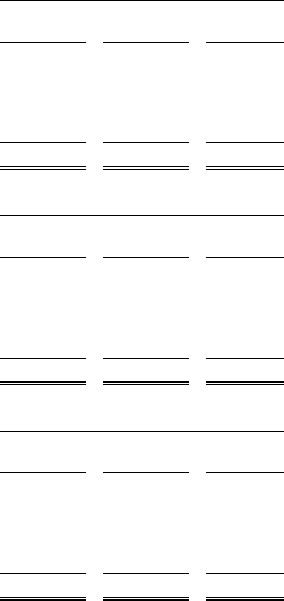

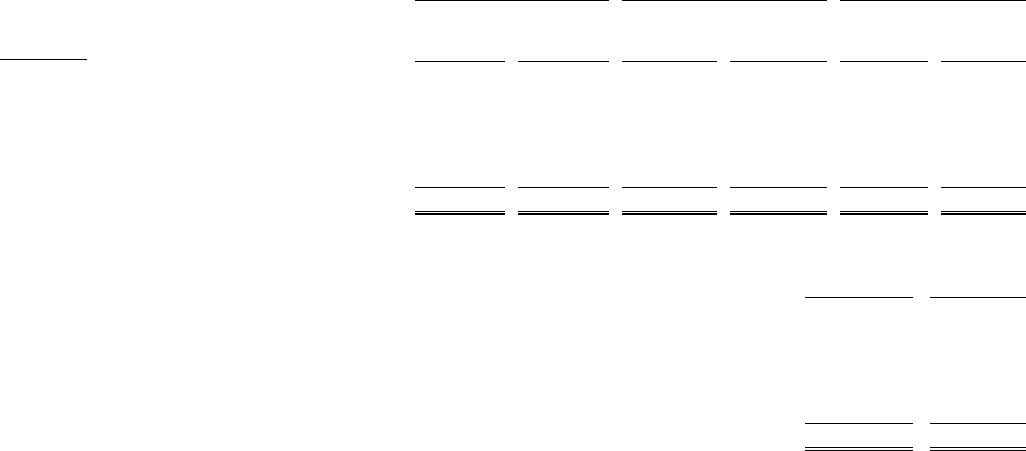

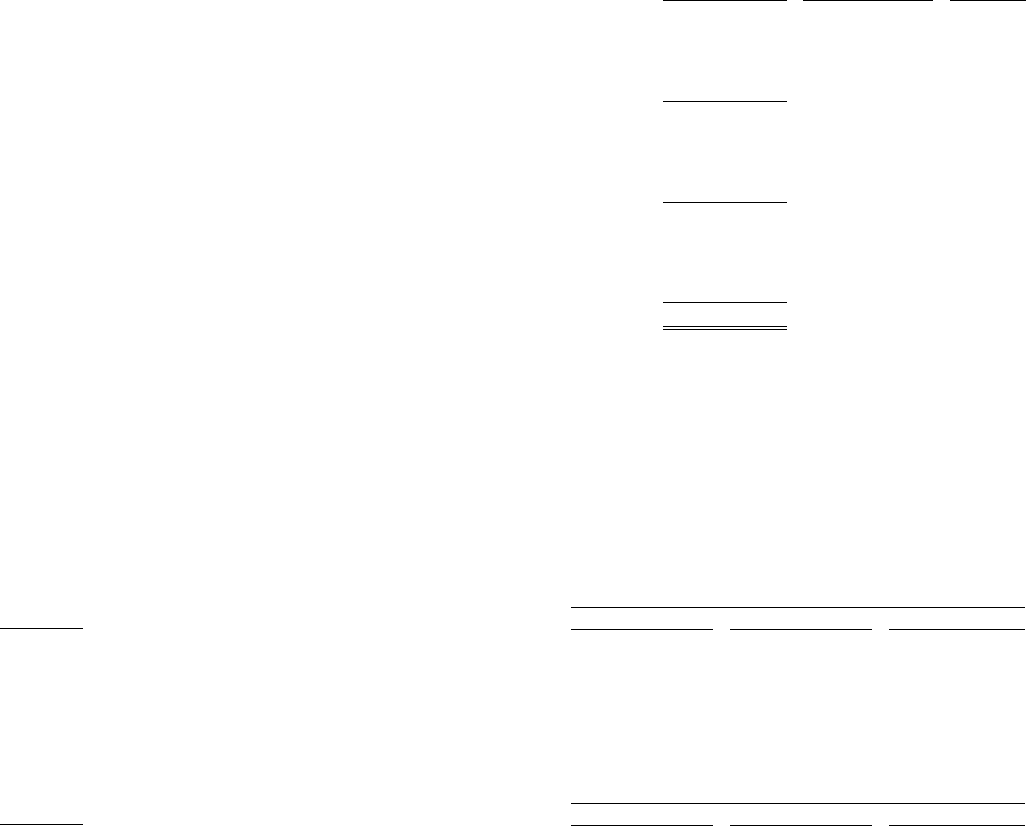

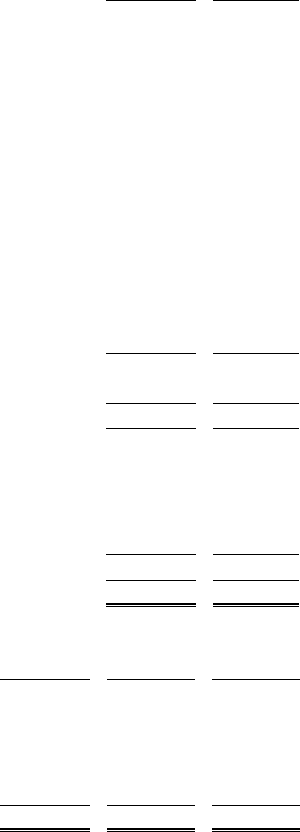

Total stockholder return

$265.46

$177.38

$142.29

202320222021202020192018

Cisco Systems, Inc. S&P 500 S&P Information Technology

Comparison of 5-year cumulative

total return**

among Cisco Systems, Inc., the S&P

500 Index, and the S&P Information

Technology Index

This graph shows a 5-year comparison of

the cumulative total stockholder return on

Cisco common stock with the cumulative

total returns of the S&P 500 Index and

the S&P Information Technology Index.

The graph tracks the performance of

a $100 investment in Cisco’s common

stock and in each of the indexes (with the

reinvestment of all dividends). Stockholder

returns over the indicated period are

based on historical data and should not be

considered indicative of future stockholder

returns.

**

$100 invested on 7/28/18 in stock or

index, including reinvestment of dividends.

Fiscal year ending July 29, 2023.

Total stockholder return

Primary uses of cash in FY23

Dividends paid

per share

Share repurchases and

diluted share count

($) (Millions)

Dividends paid per share

Capital allocation

Share repurchases and

diluted share count

$M

$1.46

$1.50

$1.54

59

4,254 4,236

64

146

20232022

2021

202220212020

4,192

Absolute number of

shares repurchased

Diluted share count

Dividends paid per share

Capital allocation

Share repurchases and

diluted share count

$B

$M

$1.42

$1.46

$1.50

64

4,236

146

88

202220212020

202320222021

4,105

Absolute number of

shares repurchased

Diluted share count

4,192

“We had a very strong

fiscal year with record

results. We executed well,

delivering strong top line

growth, profitability, and

cash flow. We continued

to make progress on our

business model shift to more

recurring revenue which

provides greater visibility and

predictability, while making

strategic investments in

innovation to drive growth.

We are committed to

expanding operating leverage

and increasing shareholder

returns over the long term.”

Capital allocation

49%

Dividends

33%

Share repurchases

9%

Repayment of debt

7%

Capital

expenditures

2%

Acquisitions,

net

Cisco 2023 Annual Report6

Cisco strategy

As our customers add billions of new

connections to their enterprises, and as

more applications move to a multicloud

environment, the network becomes even

more critical. Our customers are navigating

change at an unprecedented pace. In this

dynamic environment, we believe their

priorities are to transform infrastructure,

secure the enterprise, power hybrid work,

reimagine applications, and drive toward

sustainability.

Secure, Agile

Networks

Build networking

solutions with

built-in simplicity,

security, agility

and automation

that can be

consumed as a

service

Optimized

Application

Experiences

Enable greater

speed, agility

and scale of

cloud-native

applications

Hybrid

Work

Deliver highly

secure access, a

safer workplace

and collaboration

experiences

for the hybrid

workforce

Internet for

the Future

Transform

connectivity

by efficiently

meeting the

ever-growing

demand for

low-latency and

higher speeds

End-to-End

Security

Build simple,

integrated, and

high efficacy

end-to-end

security solutions,

delivered on-

premise or in the

cloud

Capabilities

at the Edge

Develop new

capabilities for a

distributed world

while enhancing

the developer

experience

and extending

enterprise and

carrier networks

Our strategy is to securely connect everything. We are

committed to driving a trusted customer experience through

our innovation, solutions, choice, and people.

We are continuing to incorporate Artificial Intelligence (AI)

and Machine Learning (ML) across our portfolio to enable

further innovation and to empower our customers to drive

increased productivity and better user experiences.

We are investing in new opportunities in AI, launching new

technologies across our product portfolios designed to boost

productivity, enhance policy management and simplify tasks.

Increasingly, our offerings are crossing multiple product

categories. As our core networking offerings evolve,

we expect we will add more common software features

across our core networking platforms. We are increasing

the amount of software offerings that we provide and the

proportion of subscription software offerings. We are also

focused on the entire customer lifecycle to drive expansion

and renewals. We are also accelerating our efforts to enable

the delivery of network functionality as a service, as our

customers increasingly want to consume technologies in

flexible ways.

To execute on our strategy and address our customer

priorities, we are focusing on the following strategic pillars:

Secure, Agile Networks; Optimized Application Experiences;

Hybrid Work; Internet for the Future; End-to-End Security

and Capabilities at the Edge.

7Cisco 2023 Annual Report

Chuck Robbins

Chair and Chief

Executive Officer

Liz Centoni

EVP, Chief Strategy

Officer, and General

Manager, Applications

Eyal Dagan

EVP, Common

Hardware Group

Jonathan Davidson

EVP and General Manager,

Cisco Networking

Maria Poveromo

SVP and Chief

Communications Officer

R. Scott Herren

EVP and Chief

Financial Officer

Carrie Palin

SVP and Chief

Marketing Officer

Jeff Sharritts

EVP and Chief

Customer and Partner

Officer

Francine Katsoudas

EVP and Chief People,

Policy & Purpose

Officer

Maria Martinez

EVP and Chief

Operating Officer

Jeetu Patel

EVP and General

Manager, Security &

Collaboration

Dev Stahlkopf

EVP, Chief Legal Officer

and Chief Compliance

Officer

Mark Patterson

SVP, Chief of Staff

to the Chairand CEO

Leadership

Cisco’s executive leadership team

Leadership@Cisco

Learn more about Cisco’s executive

leadership team at https://newsroom.

cisco.com/c/r/newsroom/en/us/

executives.html

Diverse leadership

At Cisco, diversity, inclusion, and

collaboration are fundamental to

who we are, how we create the best

teams, and how we drive success. A

diverse workplace creates a vibrant

culture where everyone is welcomed,

respected, valued, and heard.

Cisco has signed the CEO Action

for Diversity and Inclusion™ Pledge.

We are delivering on this pledge by

accelerating full-spectrum diversity—

including gender identity, age,

race, ethnicity, sexual orientation,

disability status, nationality, religion,

military status, background,

culture, experience, strengths and

perspectives. It starts at the top in that

46% of our executive leadership team

(ELT) are women and 54% are diverse

in terms of gender or ethnicity,

making Cisco an industry leader in

ELT diversity.

54%

diverse

based on

gender or

ethnicity

Cisco 2023 Annual Report8

Cisco’s Board of Directors recognizes that being a sustainable

business is essential for success and in fiscal 2023 created

a new Environmental, Social and Public Policy Committee.

This committee will enhance oversight of Cisco’s initiatives,

policies, programs, and strategies tied to environmental

sustainability and other key corporate social responsibility

and public policy matters.

Stockholder

engagement

At Cisco, we recognize the importance

of regular and transparent communication

with our stockholders. Each year, we

continually engage with a significant

portion of stockholders that includes our

top institutional investors.

In fiscal 2023, our Board of Directors,

Executive Leadership and Investor

Relations team met with investors

representing approximately 40% of our

shares outstanding, including 79% of

our 30 largest stockholders.

We engaged with these stockholders

on a variety of topics, including our

business and long-term strategy,

corporate governance and risk

management practices, board leadership

and refreshment, diversity, corporate

responsibility initiatives (including

environmental, social, and governance

topics), executive compensation

program, and other matters of

stockholder interest.

Risk management

approach

We believe that risk is inherent

in innovation and the pursuit of

long-term growth opportunities.

Cisco’s management is responsible

for day-to-day risk management

Corporate

governance

activities. The Board of Directors, acting

directly and through its committees, is

responsible for the oversight of Cisco’s

risk management. With the oversight

of the Board of Directors, Cisco has

implemented practices, processes, and

programs designed to help manage the

risks to which we are exposed in our

business and to align risk-taking with our

efforts to increase stockholder value.

Policies

and practices

We have adopted corporate governance

policies, guidelines, and practices that

are consistent with our commitment to

transparency and best-in-class practices,

as well as to ensure compliance with the

rules and regulations of the SEC, the listing

requirements of Nasdaq, and applicable

corporate governance requirements.

●

Stockholder proxy access

●

Annual election of all directors (since IPO)

●

Majority voting (since 2007)

●

Robust Lead Independent

Director role

●

Stockholder right to call a

special meeting (since IPO)

●

No poison pill

●

Recoupment/clawback policy

●

Stock ownership guidelines for

directors and executive officers

●

Stockholder recommendations for

director candidate to the Board

●

Stockholder right to act by

written consent (since IPO)

Risk oversight

Audit Committee

The Audit Committee, which

oversees financial and risk

management policies, and

programs related to cybersecurity

and data protection, currency,

interest rate, equity, and insurance

risk, receives regular reports on

enterprise risk management (ERM)

from the chair of the ERM operating

committee and receives regular

reports on cybersecurity from

senior management on a quarterly

basis and a detailed presentation

from our Chief Security and Trust

Officer two or more times per year.

Other committees

Other board committees oversee

certain categories of risk associated

with their respective areas

of responsibility.

Board of Directors

The Board of Directors regularly

discusses many core subjects with

executive management, including

strategy, operations, information

systems, finance, legal and public

policy matters, in which risk

oversight is an inherent element.

Management

Cisco’s management has

implemented an ERM program,

managed by Cisco’s internal audit

function, that is designed to work

across the business to identify,

evaluate, govern, and manage risks

and Cisco’s response to those risks.

Cisco’s internal audit function

manages the enterprise ERM

program and performs an annual

risk assessment that is used by the

ERM program. The structure of the

ERM program includes both an ERM

operating committee that focuses

on risk management-related

topics and an ERM executive

committee consisting of members

of management.

The ERM operating committee

conducts global risk reviews and

provides regular updates to the

ERM executive committee.

Corporate governance

9Cisco 2023 Annual Report

Executive

compensation

Consistent with our business model

transformation to meet the evolving needs

of our customers and increasing the amount

of subscription offerings that we provide, we

incorporated a product annualized recurring

revenue (ARR) performance metric into our

fiscal 2023 executive compensation program to

better align our program with our transforming

business model. Additionally, our pay-for-

performance philosophy underscores our

commitment to sound compensation and

governance practices.

Given the importance of ESG matters to Cisco’s

strategy, for fiscal 2023, we continued to

incorporate a team performance factor into

our variable cash incentive plan, the Executive

Incentive Plan, which was scored based on

the executive leadership team’s joint execution

with respect to our overall ESG strategy,

including specific goals on environmental and

social matters.

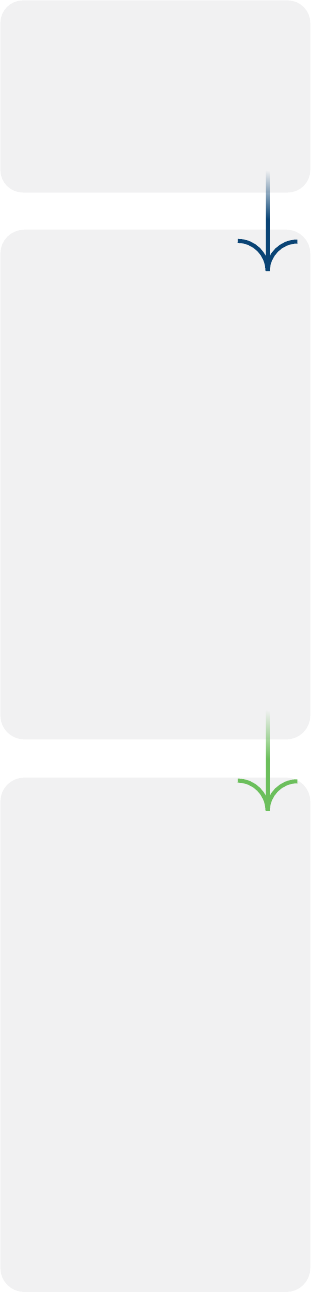

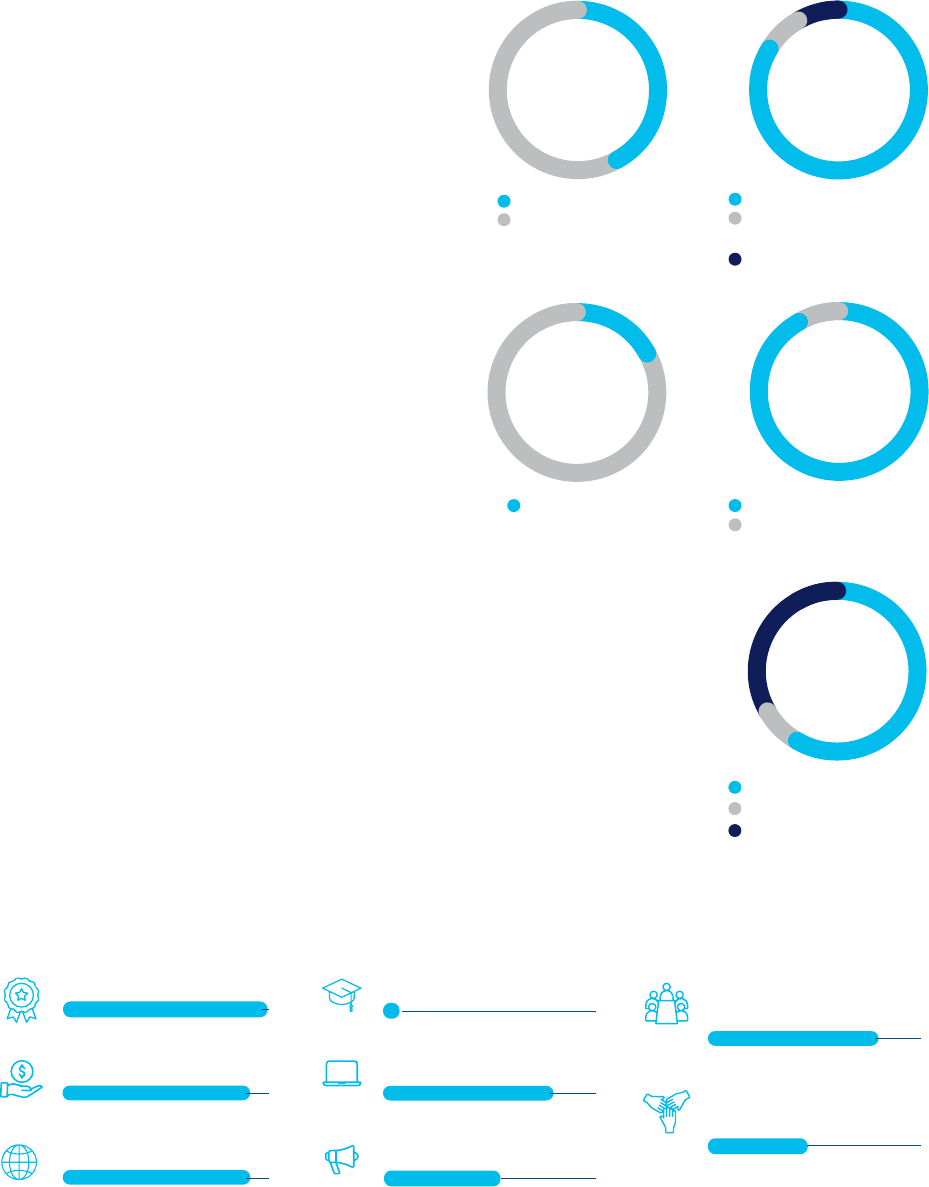

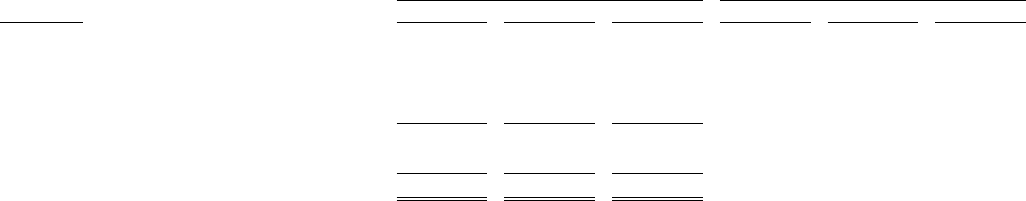

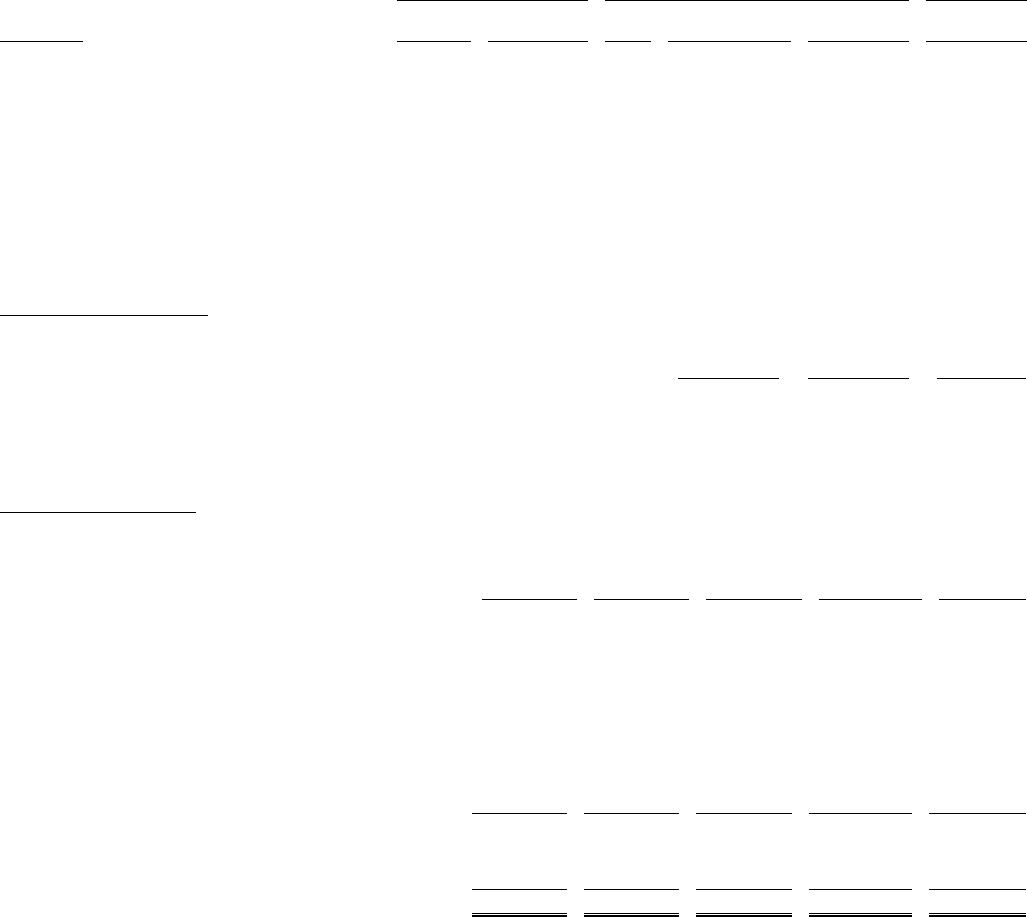

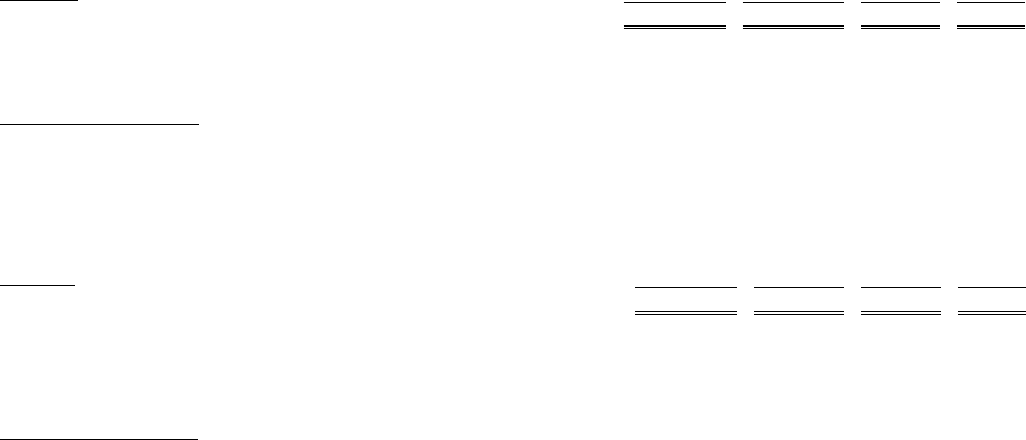

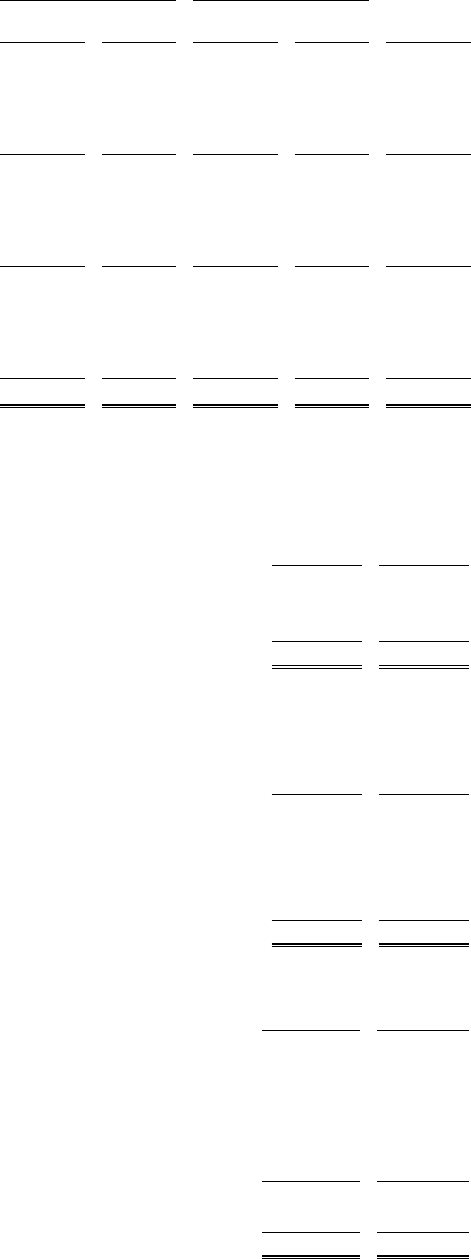

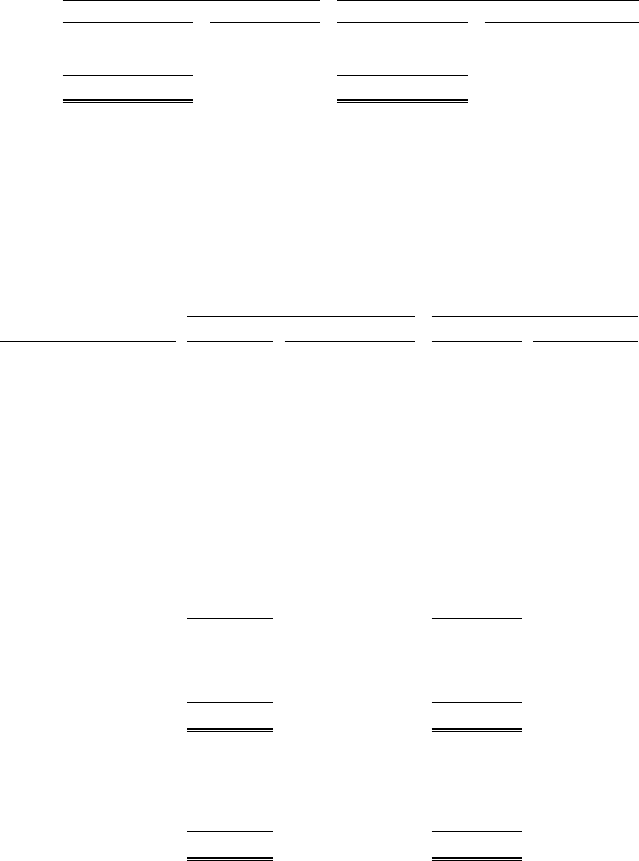

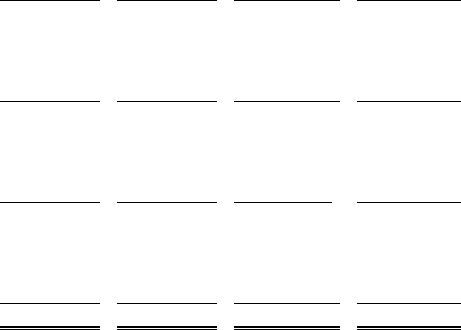

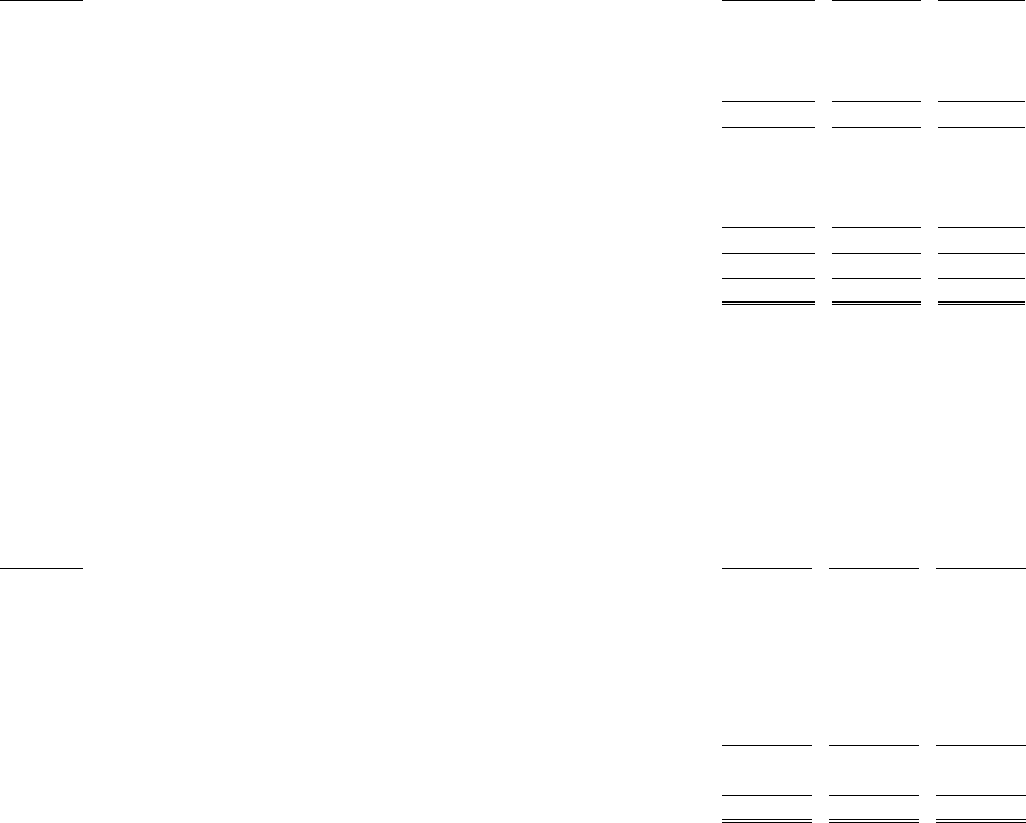

These charts summarize the major elements

of target total direct compensation for our CEO

and our other named executive officers (NEOs

1

)

as a group for fiscal 2023 and demonstrate our

continued pay-for-performance philosophy.

1 As dened in our Proxy Statement for our 2023

Annual Meeting of Stockholders

Independent compensation

committee

Independent compensation

consultant

Comprehensive annual

compensation program

riskassessment

Annual compensation peer

group review

Caps on incentive

compensation

Performance on specific

initiatives considered in

the variable cash incentive

program for executive

officers

No employment,

severance, or change in

control agreements for our

executive officers

Stock ownership

guidelines

Recoupment/clawback

policy

Limited perquisites

No single-trigger vesting of

equity award grants

No stock option repricing

or cash-out of underwater

equity awards

No supplemental executive

retirement plan or

executive-defined benefit

pension plan

No golden parachute tax

gross-ups

Broad anti-pledging and

anti-hedging policies

We apply leading executive compensation

practices

Our executive

compensation program

rewards performance

Compensation philosophy is

designed to attract and retain,

motivate performance, and

reward achievement

Performance measures are aligned

with stockholderinterests

Majority of annual total direct

compensation is performance-based

No dividends or dividend

equivalents are paid or settled on

unvested awards

CEO

NEOs

other

than CEO

CEO

NEOs

other

than CEO

67%

Performance-based

equity incentive awards

57%

Performance-based

equity incentive awards

23%

Time-based equity

incentive awards

32%

Time-based equity

incentive awards

8%

Variable cash

incentive awards

7%

Variable cash

incentive awards

3%

Base salary

5%

Base salary

Amounts may not sum due to rounding.

Corporate governance

10 Cisco 2023 Annual Report

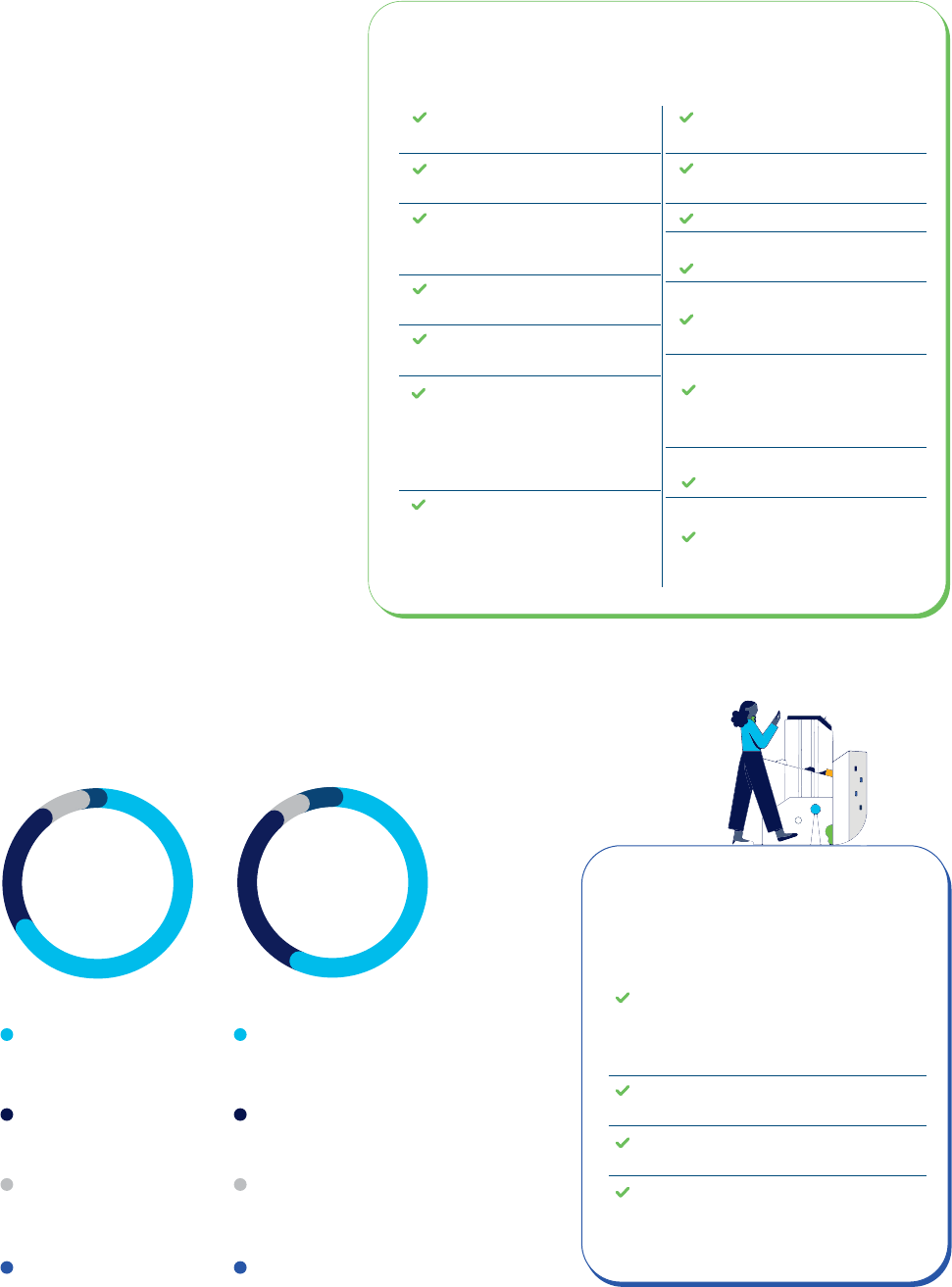

Board of Directors

Cisco’s Board of Directors is composed of skilled and

diverse directors who are committed to strong corporate

governance structures and practices that help Cisco build

long-term stockholder value. The Board believes strongly

in the value of an independent board of directors and has

established a Lead Independent Director role with broad

authority and responsibility. Independent board members

have consistently comprised over 75% of the members of the

Board of Directors and all members of our Board committees,

including the Audit Committee, the Compensation and

Management Development Committee and the Nomination

and Governance Committee are independent.

M. Michele Burns, 65

Independent Director

Former Chair and CEO, Mercer LLC

Wesley G. Bush, 62

Independent Director

Former Chair and CEO,

Northrop Grumman Corporation

John D. Harris II, 62

Independent Director

Former Vice President of Business

Development, Raytheon Company

Charles H. Robbins, 57

Chair and Chief Executive Officer

Michael D. Capellas, 69

Lead Independent Director

Founder and CEO, Capellas Strategic Partners

Dr. Kristina M. Johnson, 66

Independent Director

Former President, The Ohio State University

Mark Garrett, 65

Independent Director

Former CFO, Adobe Systems Incorporated

Roderick C. McGeary, 73

Independent Director

Former Vice Chair, Consulting, KPMG LLP

Dr. Lisa T. Su, 53

Independent Director

Chair, President and CEO,

Advanced Micro Devices, Inc.

Marianna Tessel, 55

Independent Director

Executive Vice President and General

Manager, Small Business and

Self–Employed Group, Intuit Inc.

Director

Since

AU

C

AQ

ESPPNG

Committees

Board skills and attributes

Leadership

Sales and marketing

Academia

Technology

Financial experience

Public company board

experience

Global business

2022

2003

2019

2006

2018

2021

2012

2003

2023

2015

2020

2021

Sarah Rae Murphy, 40

Independent Director

Former Chief Procurement Officer and Senior

Vice President of Global Sourcing, United Airlines

Daniel H. Schulman, 65

Independent Director

Former President and Chief Executive Ocer,

PayPal Holdings, Inc.

Environmental, Social and Public

Policy Committee

ESPP

Audit CommitteeAU

Compensation and Management

Development Committee

C

Acquisition CommitteeAQ

Nomination and Governance CommitteeNG

Chair

Member

Key to

Committees

Corporate governance

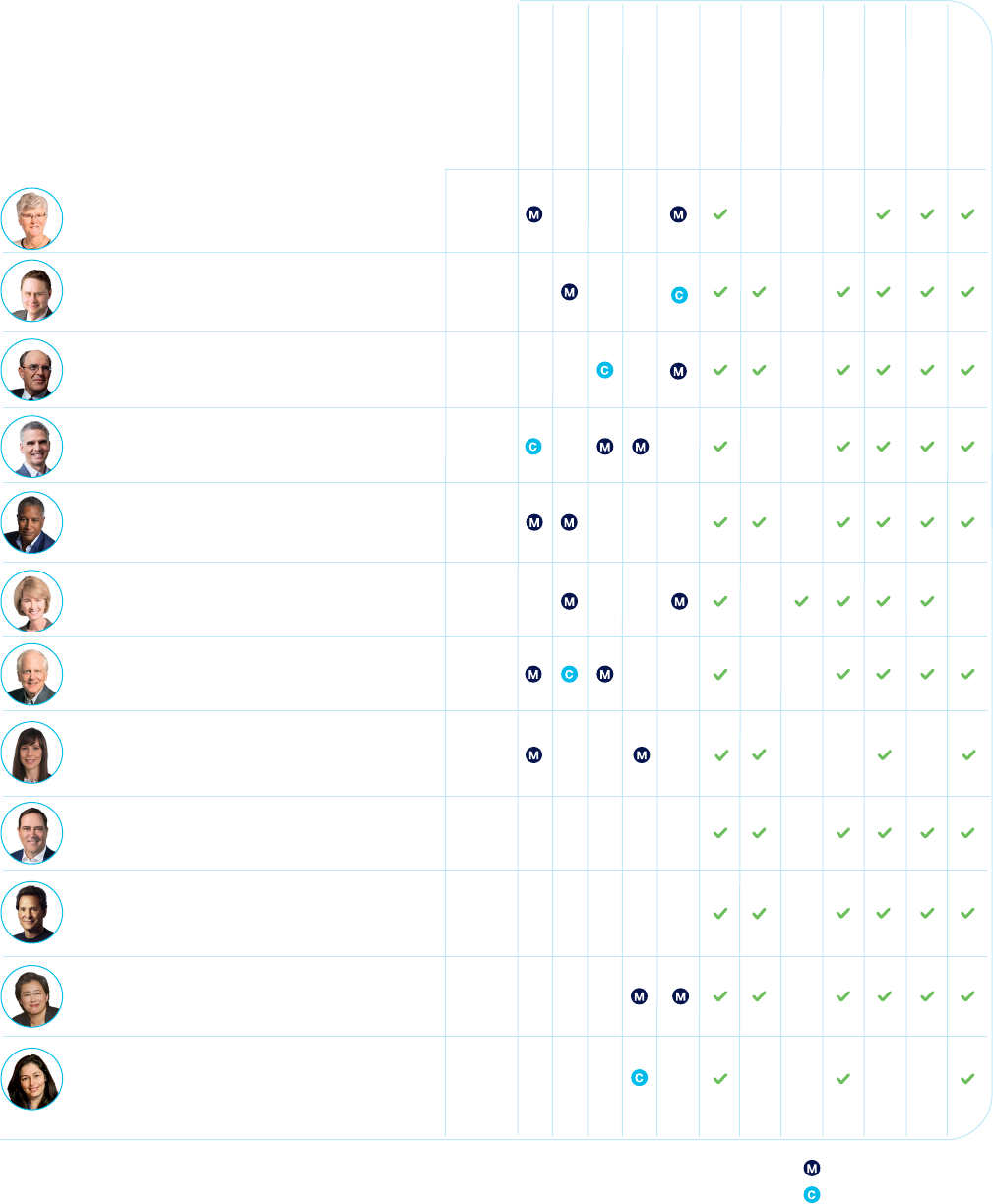

Leadership

12

Financial experience

11

Global business

11

Public company

board experience

10

Gender/ethnic/racial/

sexualorientation diversity

6

42% Women

58% Men

83% White

8% African American or

Black and Native American

8% Asian

17% LGBTQ+

11 Independent

1 Non-Independent

7 Director 0-5 years

1 Director 6-8 years

4 Director 9+ years

The role of the Board of

Directors in strategy

One of the Board’s key responsibilities is

overseeing management’s formulation and

execution of Cisco’s strategy. Throughout the

year, our CEO, the executive leadership team,

and other leaders from across the company

provide detailed business and strategy updates

to the Board. During these reviews, the Board

engages with the executive leadership team and

other business leaders regarding various topics,

including business strategy and initiatives, capital

allocation, portfolio updates, the competitive

landscape, talent and culture (including inclusion

and diversity), other matters affecting our long-

term strategy (including our environmental

impact and human rights implications of Cisco

product development and sales), and regulatory

developments. Additionally, on an annual basis,

the Board reviews and approves Cisco’s financial

plan. The Lead Independent Director also chairs

regularly scheduled executive sessions of the

independent directors, without Cisco management

present, during which Cisco’s strategy is reviewed

and other topics are discussed.

Board snapshot

Board Skills and Attributes

11Cisco 2023 Annual Report

Director

tenure

Race/ethnicity

diversity

* Percentages may not total 100% due to rounding.

Gender

diversity

Sexual

orientation

diversity

Board

governance

structure

Academia

1

Technology

10

Sales and marketing

7

Cisco 2023 Annual Report12

Our purpose

For decades, Cisco has been evolving and expanding

the way it positively impacts people and the planet, and

we are driven by our Corporate Purpose: to Power an

Inclusive Future for All. We believe that technology, when

thoughtfully and strategically applied, can help address

inequities; bring positive, lasting change to people’s lives

and communities; and benefit the planet. To help fulfill our

Purpose, we leverage our technology and catalyze our

networks, partners, and people to make a positive impact

in communities worldwide and for the planet. We know we

can achieve so much more when we work in partnership

with those aligned with our values and purpose.

The upcoming fiscal 2023 Purpose Report, which will

be published in December 2023, will describe our latest

impact, goals, and progress on our Purpose journey.

Purpose governance

andmanagement

Cisco’s People, Policy, and Purpose organization leads

our social investment programs and champions our

commitment to environmental, social, and governance

(ESG) performance and transparency. Within this

organization is a core reporting team which engages with

stakeholders, leads ESG materiality assessments

1

for all

our voluntary reporting, and stewards reporting activities.

Our reporting is aligned with standards set by the Global

Reporting Initiative, Sustainability Accounting Standards

Board, the Task Force on Climate-related Financial

Disclosures, and the UN Sustainable Development Goals.

1 ESG materiality, as referred to in this Report, and our ESG materiality assessment process are dierent from "materiality" in the context of Securities and

Exchange Commission (SEC) disclosure obligations. Issues deemed material for purposes of our ESG reporting and for purposes of determining our ESG

strategy may not be considered material for SEC reporting purposes, nor does inclusion of information in our ESG reporting indicate that the topic or

information is material to Cisco's business or operating results.

“We are driven by our Purpose to harness

the power of connectivity for our customers,

employees, and communities around

the world.”

Francine Katsoudas

EVP and Chief People,

Policy & Purpose Officer

Cisco 2023 Annual Report

Our purpose

13

Purpose governance and management

Board of Directors

Environmental, Social, and Public Policy

Committee

Oversees the Company’s initiatives, policies, programs, and

strategies concerning environmental sustainability and other key

corporate social responsibility and public policy matters.

People, Policy,and

Purpose Organization

Business Functions and

Cross-Functional Groups

Governance, Risk,

and Controls

Champions Cisco’s company-wide

commitment to ESG performance and

transparency

Conduct due diligence and implement

policies and programs for specific

focus areas

Champion Enterprise Risk Management (ERM)

efforts across the business to identify, assess,

and manage risks

ESG Topics

*

Environmental Social

Governance

●

Climate change

and GHGs

●

Circular economy

●

Operational waste

●

Environmental regeneration

and protection

●

Water

●

Inclusion and diversity

●

Talent

●

Human rights and working conditions

in the supply chain

●

Employee wellbeing

●

Employee health and safety

and labor rights

●

Digital inclusion

●

Community impact

●

Critical human needs and disaster relief

●

Economic empowerment

●

Corporate governance

●

Data security and privacy

●

Business ethics

●

Innovation and responsible

technology

* These ESG focus areas are the topics identied in our FY23 ESG materiality assessment. The topics found to be of greater importance are noted in bold.

Other Board

Committees

●

Acquisition

●

Audit

●

Compensation and Management Development

●

Nomination and Governance

Powering an inclusive

future for all

Cisco’s Purpose to Power an Inclusive Future for

All is increasingly a differentiator for our business.

We can do good for the world and do good for

business when we combine our technology, our

people, and our broader networks. We pursue our

Purpose by closing the digital divide, empowering

the future of work, fighting for equality and social

justice, and building a regenerative planet. Our

ESG programs and disclosures deliver value to

our stakeholders, including our stockholders,

customers, partners, suppliers, employees, our

global communities, and the environment.

Power

Since our founding in 1984, Cisco has helped power the

world’s connectivity and accelerate the transition to the

digital age. Our software and solutions protect the data

of millions of users within public sector organizations and

businesses of all sizes. At Cisco, we cultivate trust and hold

ourselves to the highest standards of business conduct.

This requires applying leading security and privacy,

and human rights principles to the design, sourcing,

manufacturing, and sale of our solutions, and working

to integrate a human rights perspective across Cisco’s

global business. Cisco works to instill trust by operating

with transparency, fairness, accountability, and integrity in

every aspect of our business — from the integrity of our

solutions and networks, to our cyber-resilience strategies

that we openly share with organizations around the world,

to our financial transparency and high standards of fair and

responsible conduct.

Cisco 2023 Annual Report

Our purpose

14

Cisco is committed to making our products and solutions

responsibly, and that commitment extends to our manufacturing

partners and suppliers, and the standards they uphold for labor,

health and safety, environment, and human rights. We are a

founding member of the Responsible Business Alliance (RBA) and

have long adopted the RBA Code of Conduct as our Supplier Code

of Conduct. We assess our suppliers’ conformance to our policies

through risk assessments, audits, and targeted engagements. If

suppliers do not meet our standards, we work with them to improve

and hold them accountable to achieve that improvement. We also

work across the Information and Communications Technology (ICT)

industry to build supplier capacity to support a baseline of human

rights and environmental standards. This work in our supply chain is

a core element of our commitment to our Purpose.

Inclusive

We believe Diversity, Equity & Inclusion (DEI) is a core competency

and lens that we leverage to accelerate and amplify Cisco’s existing

business goals and mission. It is intrinsic to who we are — and who

we intend to be long into the future. We promote inclusivity through

our Conscious Culture and Social Impact Initiatives. Our Conscious

Culture is a set of expectations, principles, and measures that define

Cisco’s values, beliefs, and ethos. Our values and expectations are

laid out in our Code of Business Conduct. Every employee must

certify compliance with the code each year to help uphold integrity in

the workplace and the ethical use of data and resources, and to help

prevent conflicts of interest. Living a Conscious Culture requires us to

act with dignity, respect, fairness, and equity in each of our interactions

with one another, allowing us to become a catalyst for social change.

When people are respected for who they are and encouraged to seek

balance between work and personal life, we believe they are more

productive and successful in their jobs and able to give their best to

their families and communities. In fiscal 2017, we set a goal to achieve

80% employee participation in community impact by 2020. We

achieved that goal and have sustained or exceeded 80% employee

participation since then.

At Cisco, we believe in equal rights, access to opportunity, and

promoting justice and fair treatment. In 2020, we transformed our

longstanding advocacy for social justice into a global, enterprise-wide

commitment to leading bolder action and creating lasting change.

Guided by our Social Justice Beliefs, we designed 12 Actions for

Social Justice to bring together the full power of our technology, our

people, and our ecosystem. We embarked on a five-year journey,

backed by a US$300 million commitment, to explore new ways to

address systemic challenges and create opportunities that can change

the trajectory of entire communities – and power an inclusive future

for all.

Selected company goals

25 million

additional people reached through

Cisco Networking Academy’s digital and

cybersecurity skills training by FY32

1 billion

people positively impacted through

our social impact grants and signature

programs by FY25

Note: Progress against all goals listed by fiscal year (FY) is

measured through the end of the fiscal year.

For more information see our ESG Reporting Hub at

https://www.cisco.com/c/m/en_us/about/csr/esg-hub.html

Diversity highlights

●

At Cisco, 46% of our ELT are women and 54%

are diverse in terms of gender or ethnicity

●

On our Board of Directors, 42% are women,

58% are men, 8% are Asian, 8% are African

American or Black, and Native American, 83%

are White, and 17% are diverse in terms of

sexual orientation

●

In FY22 (data excludes certain acquisitions) our

global employee base was comprised of 29%

women, 71% men, and 0.1% nonbinary, and

our U.S. employee base was comprised of the

following ethnicities: 50.9% White/Caucasian,

34.6% Asian, 6.6% Hispanic/Latino, 5.5%

African American/Black, 1.9% two or more

races (not Hispanic or Latinx), 0.3% American

Indian or Alaska Native, and 0.2% Native

Hawaiian/Other Pacic Islander

71% Men

29% Women

0.1% Nonbinary

Global

employees

based on

FY22 data

Cisco 2023 Annual Report

Our purpose

15

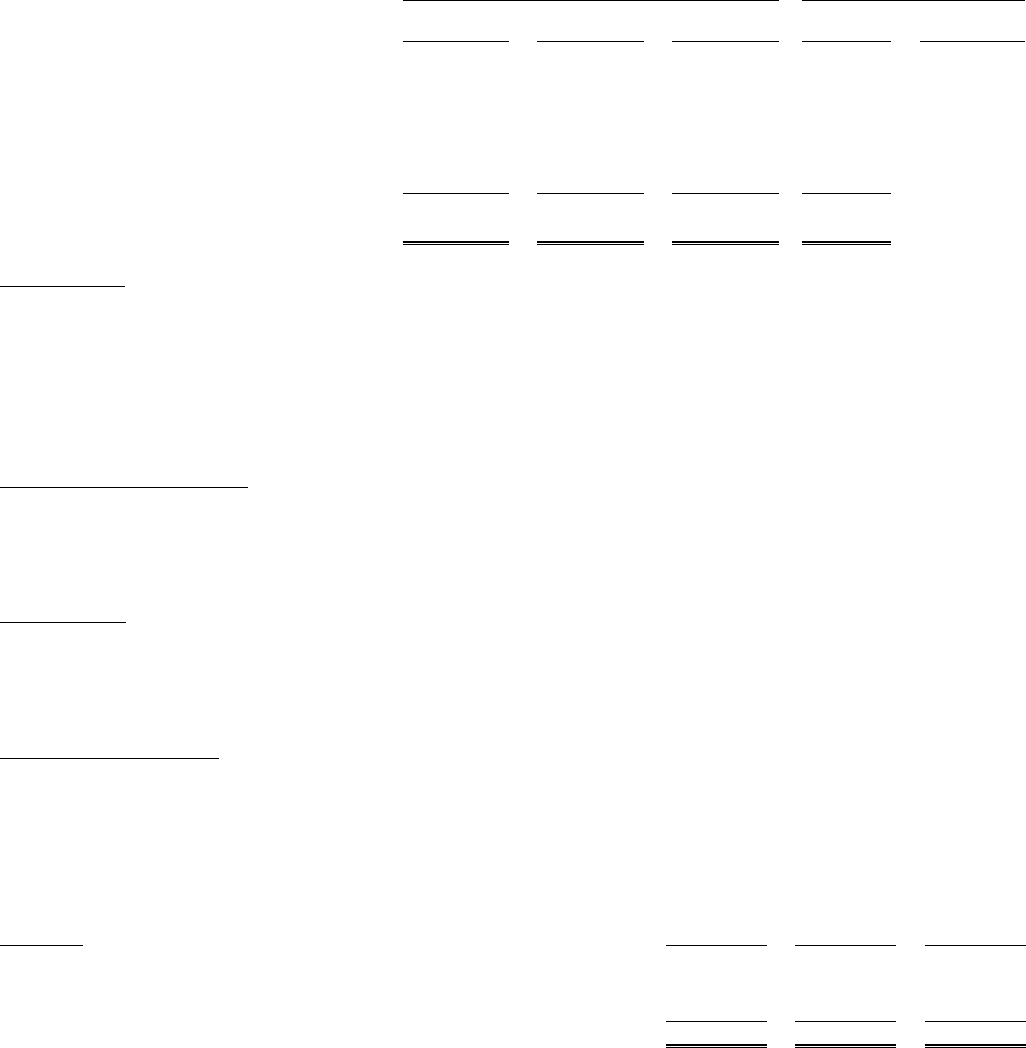

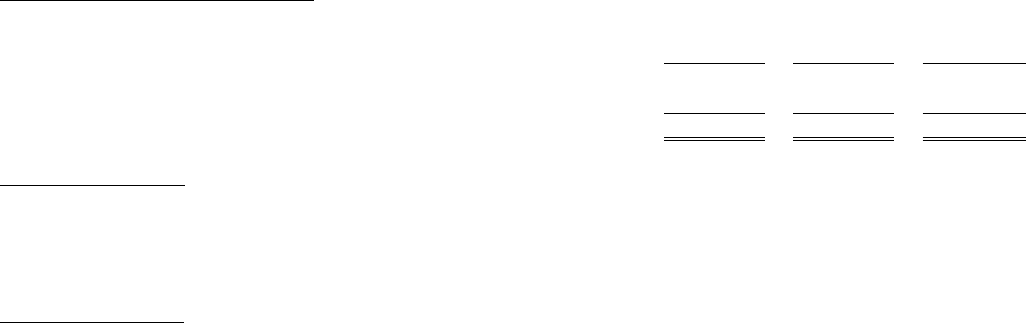

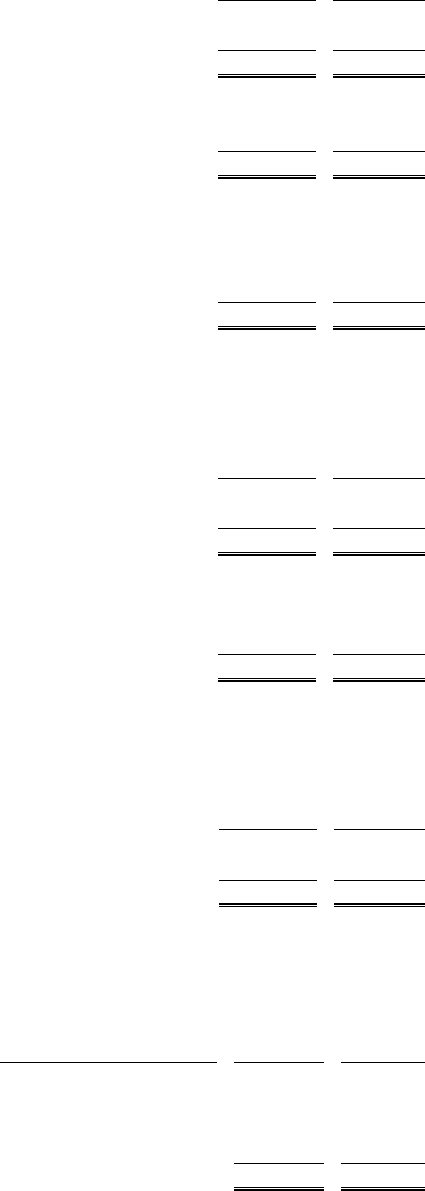

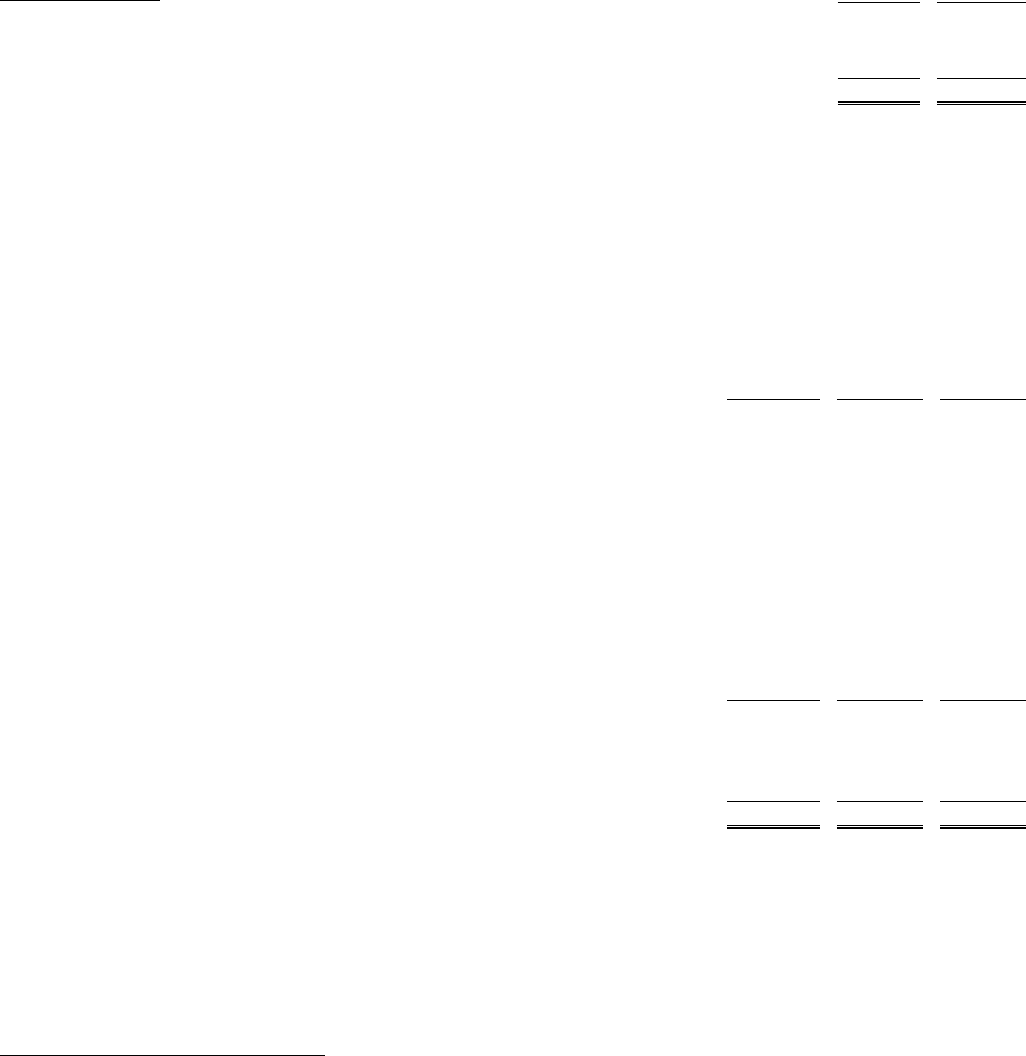

Our science-based

net-zero GHG emissions

goal and near-term targets

Cisco’s 12 Actions initially focused on driving greater impact across

the African American/Black community. Now, we’re building a

strategic framework and holistic services that can be adapted and

scaled across the full spectrum of diversity, including underserved or

vulnerable communities around the world.

Cisco has always been committed to compensating our employees

fairly and equitably. We are a founding signer of the White House

Equal Pay Pledge and the Parity.org pledge, and are a leader in

the charge to make fair pay a reality for all employees through the

Employers for Pay Equity Consortium.

In 2016, Cisco set a goal to positively impact one billion people by

2025 through our social impact grants and signature programs

2

, and

we are well on our way to realizing this goal. We prepare millions of

learners with digital skills through Cisco Networking Academy, one of

the world’s longest running learning and digital skills programs. In fiscal

2023, we celebrated its 25th anniversary, reaching 20.5 million learners

across 190 countries since 1997. As we marked these successes, we

also announced an ambitious next phase goal: to provide digital and

cybersecurity skills training to an additional 25 million people through

Cisco Networking Academy over the next decade.

2 Some of our social impact grantees receive funding from other organizations.

In January 2022 Cisco completed an external limited assurance review

of our progress toward this goal. For more information see the criteria

document and assurance report available at our ESG Reporting Hub at

https://www.cisco.com/c/m/en_us/about/csr/esg-hub.html.

Near-Term Targets

By FY25:

Net-Zero Goal

By 2040:

90% reduction in absolute Scope 1 and 2

GHG emissions

Compared to FY19. We will neutralize any remaining

emissions by removing an equal amount from

the atmosphere.

By FY30:

30% reduction in absolute Scope3

emissions from purchased goods and

services, upstream transportation and

distribution, and use of sold products

Compared to FY19.

You will be able to read more about our progress toward our

net-zero goal and near-term targets in our fiscal 2023 Purpose

Report and ESG Reporting Hub.

Reach net-zero emissions across our

value chain

By reducing our absolute Scope 1, 2, and 3

emissions by at least 90% compared to FY19

and neutralizing any remaining emissions by

removing an equal amount from the atmosphere.

Future

An inclusive future depends on a healthy planet. Our holistic

approach to environmental sustainability includes how we operate

our business, how we help our customers and suppliers make

progress toward their sustainability goals, and how we do our part

to help the world adapt to a changing climate.

Our environmental sustainability strategy focuses on three

priorities: accelerating the transition to clean energy, evolving our

business to circular, and fostering resilient ecosystems.

Accelerating the transition to clean energy

To power the world with renewables, the grid requires updated digital

infrastructure in order to connect diverse, decentralized sources of

clean energy. But even as the world electrifies, we must simultaneously

reduce the amount of energy used by a connected economy. To help

advance these priorities, we will:

●

Improve our product power efficiency

●

Collaborate with our customers, partners, and suppliers to

accelerate the energy transition

●

Continue to increase our use of renewable energy in Cisco’s

operations

One important piece of Cisco’s clean energy strategy is our goal

to reach net-zero greenhouse gas (GHG) emissions across our

value chain by 2040, by prioritizing reductions across all scopes

of emissions. We are proud that Cisco’s 2040 net-zero goal was

approved by the Science Based Targets initiative (SBTi) in 2022, under

its Net-Zero Standard. Cisco was one of the first technology hardware

and equipment companies to have its net-zero goal validated under

the SBTi Net-Zero Standard.

16 Cisco 2023 Annual Report

Our purpose

Evolving our business to circular

The world must transition from a linear economy that extracts

resources and eventually wastes them, to a circular one

which finds new uses for products and their inputs. We aim to

transform our business to extend the useful life of our products

and provide ongoing services. This includes continuing to deploy

business models to extend the value of our products and reduce

environmental impacts.

In fiscal 2023, we continued to work towards our goal of

100% of new Cisco products and packaging incorporating our

Circular Design Principles by fiscal 2025. This included further

embedding circularity into key design tools and the standard

product development process. You will be able to read more

about our progress on this goal and others in our fiscal 2023

Purpose Report and ESG Reporting Hub.

Fostering resilient ecosystems

It is in our shared interest to help humans and nature navigate

a changing climate by investing in regenerative technologies,

workforces, and nature itself. This includes enabling

communities to adapt to climate realities, cultivating skills and

talent for the regenerative economy, and deploying Cisco

technology to protect and restore ecosystems and biodiversity.

Examples include:

●

A multi-year, multi-million-dollar partnership with Mercy Corps,

the global humanitarian nonprofit, to help them develop and

scale technology-enabled climate solutions that can build

resilience in communities that are experiencing devastating

drought conditions in Kenya.

●

An investment from the Cisco Foundation of US$100 million

over ten years in climate solutions that draw down the carbon

already in the atmosphere and/or regenerate depleted

ecosystems. As of the end of fiscal 2023, the Cisco

Foundation had disbursed approximately US$19.8 million

dollars to early-stage solutions that are in diverse stages of

development, from conceptual ideas to solutions that are ready

for commercial deployment and widespread impact.

Selected circular

economy goals

100%

of new Cisco products and

packaging incorporate circular

design principles by FY25

70%

of Cisco component and

manufacturing suppliers (by

spend) achieve a zero-waste

diversion rate at one or more

sites by FY25

50%

of plastic used in our products

(by weight) made of recycled

content by FY25 (the plastics

included in this goal exclude

those contained in commodity

components sourced from

suppliers, e.g., plastic screws,

fans, and cables)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the fiscal year ended July 29, 2023

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from _________ to _________

Commission file number 001-39940

CISCO SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

170 West Tasman Drive

San Jose, California

(Address of principal executive offices)

77-0059951

(IRS Employer

Identification No.)

95134-1706

(Zip Code)

Registrant’s telephone number, including area code: (408) 526-4000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: Trading Symbol(s) Name of each exchange on which registered

Common Stock, par value $0.001 per share CSCO The Nasdaq Stock Market LLC

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Ye s No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Ye s No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or

an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer Accelerated filer

Non-accelerated filer Smaller reporting company

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal

control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that

prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the

filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No

Aggregate market value of registrant’s common stock held by non-affiliates of the registrant, based upon the closing price of a share of the registrant’s

common stock on January 27, 2023 as reported by the Nasdaq Global Select Market on that date: $198.6 billion

Number of shares of the registrant’s common stock outstanding as of September 1, 2023: 4,054,857,783

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to the 2023 Annual Meeting of Stockholders, to be held on December 6, 2023, are

incorporated by reference into Part III of this Annual Report on Form 10-K where indicated.

PART I

Item 1. Business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Item 1A. Risk Factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Item 1B. Unresolved Staff Comments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Item 2. Properties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Item 3. Legal Proceedings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Item 4. Mine Safety Disclosures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of

Equity Securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Item 6. [Reserved] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations . . . . . . . . . . . . . . . 32

Item 7A. Quantitative and Qualitative Disclosures About Market Risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

Item 8. Financial Statements and Supplementary Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure . . . . . . . . . . . . . . . 100

Item 9A. Controls and Procedures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100

Item 9B. Other Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100

PART III

Item 10. Directors, Executive Officers and Corporate Governance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101

Item 11. Executive Compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters . . . . . 101

Item 13. Certain Relationships and Related Transactions, and Director Independence . . . . . . . . . . . . . . . . . . . . . . . . . . 101

Item 14. Principal Accountant Fees and Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101

PART IV

Item 15. Exhibits and Financial Statement Schedules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101

Item 16. Form 10-K Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103

Signatures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104

Business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Risk Factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Unresolved Staff Comments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Properties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Legal Proceedings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Mine Safety Disclosures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of

Equity Securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

[Reserved] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Management’s Discussion and Analysis of Financial Condition and Results of Operations . . . . . . . . . . . . . . .

Quantitative and Qualitative Disclosures About Market Risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Financial Statements and Supplementary Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure . . . . . . . . . . . . . . .

Controls and Procedures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Directors, Executive Officers and Corporate Governance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Executive Compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters . . . . .

Certain Relationships and Related Transactions, and Director Independence . . . . . . . . . . . . . . . . . . . . . . . . . .

Principal Accountant Fees and Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Exhibits and Financial Statement Schedules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form 10-K Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Item 1.

Item 1A.

Item 1B.

Item 2.

Item 3.

Item 4.

Item 5.

Item 6.

Item 7.

Item 7A.

Item 8.

Item 9.

Item 9A.

Item 9B.

Item 9C.

Item 10.

Item 11.

Item 12.

Item 13.

Item 14.

Item 15.

Item 16.

Signatures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

14

29

29

29

29

30

31

32

52

54

100

100

100

100

101

101

101

101

101

101

103

104

1

This Annual Report on Form 10-K, including the “Management’s Discussion and Analysis of Financial Condition and Results

of Operations,” contains forward-looking statements regarding future events and our future results that are subject to the safe

harbors created under the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). All statements other than statements of historical facts are statements that could be deemed

forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about

the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,”

“targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “momentum,” “seeks,” “estimates,” “continues,” “endeavors,”

“strives,” “may,” variations of such words, and similar expressions are intended to identify such forward-looking statements.

In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends

in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are

cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions

that are difficult to predict, including those identified below, under “Item 1A. Risk Factors,” and elsewhere herein. Therefore,

actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no

obligation to revise or update any forward-looking statements for any reason.

PART I

Item 1. Business

General

Cisco designs and sells a broad range of technologies that power the Internet. We are integrating our product portfolios across

networking, security, collaboration, applications and the cloud to create highly secure, intelligent platforms for our customers’

digital businesses. These platforms are designed to help our customers manage more users, devices and things connecting to

their networks. This will enable us to provide customers with a highly secure, intelligent platform for their digital business.

We conduct our business globally and manage our business by geography. Our business is organized into the following three

geographic segments: Americas; Europe, Middle East, and Africa (EMEA); and Asia Pacific, Japan, and China (APJC).

Our products and technologies are grouped into the following categories: Secure, Agile Networks; Internet for the Future;

Collaboration; End-to-End Security; Optimized Application Experiences; and Other Products. In addition to our product offerings,

we provide a broad range of service offerings, including technical support services and advanced services. Increasingly, we are

delivering our technologies through software and services. Our customers include businesses of all sizes, public institutions,

governments, and service providers, including large webscale providers. These customers often look to us as a strategic partner

to help them use information technology (IT) to differentiate themselves and drive positive business outcomes.

We were incorporated in California in 1984 and reincorporated in Delaware in 2021. Our headquarters are in San Jose, California.

The mailing address of our headquarters is 170 West Tasman Drive, San Jose, California 95134-1706, and our telephone number

at that location is (408) 526-4000. Our website is www.cisco.com. Through a link on the Investor Relations section of our

website, we make available the following filings as soon as reasonably practicable after they are electronically filed with or

furnished to the Securities and Exchange Commission (SEC) at sec.gov: our Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or

15(d) of the Exchange Act. All such filings are available free of charge. The information published on our website, or any other

website referenced herein, is not incorporated into this report.

Strategy and Priorities

As our customers add billions of new connections to their enterprises, and as more applications move to a multicloud environment,

the network becomes even more critical. Our customers are navigating change at an unprecedented pace. In this dynamic

environment, we believe their priorities are to transform infrastructure, secure the enterprise, power hybrid work, reimagine

applications, and drive toward sustainability.

Our strategy is to securely connect everything. We are committed to driving a trusted customer experience, through our

innovation, solutions, choice, and people.

2

Customer Priorities

Transform Infrastructure

In an increasingly digital and connected world, where each new connection to the Internet puts more demand on the network,

our customers are looking to modernize and transform their infrastructure in an automated way in order to manage and monitor

each connection in real time. Our strategy to help our customers transform their infrastructure with the network at the core

began with Software-Defined Access (SD-Access) technology, one of our leading enterprise architectures, and continued with

the launch of our Catalyst 9000 series of switches.

We have continued to transform our enterprise access portfolio by bringing together several technologies to form the only

integrated architecture with built-in simplicity, automation and security at the foundation. This architecture is designed to enable

our customers to securely connect their users and devices to applications and data over any network, no matter where they are.

We have introduced several innovations that extend our networking capabilities to wireless and enterprise routing products,

including Software-Defined Wide Area Network (SD-WAN) and Internet of Things (IoT) edge platforms. Our SD-WAN

solutions are designed to provide direct branch to cloud connectivity, enabling the workforce to access their software-as-

a-service (SaaS) applications and workloads in an optimized and highly secure manner. We have continued to expand our

SD-WAN offering, through our Cloud OnRamp integrations with several webscale providers to deliver predictable and highly

secure application experiences.

To further our innovation in this area, we are applying the latest technologies, such as machine learning and advanced analytics,

to operate and enhance network capabilities. These network product offerings are designed to help enable customers to detect

cybersecurity threats, even in encrypted traffic. As such, we have created, in our view, the only network that is designed for

security while also helping to maintain privacy.

Our customers are operating in multicloud environments with private, public and hybrid clouds. For the data center, our strategy

is to deliver multicloud architectures that bring policy and operational consistency, regardless of where applications or data

reside, by extending our Application Centric Infrastructure (ACI) and our hyperconverged offerings. We continue to invest

in our data center portfolio to help meet the growing demand for cloud-delivered technologies. Our Nexus Cloud platform is

designed to help our customers deploy, manage, and operate their data center networks from the cloud.

Our technology strategy for the Internet for the Future is aimed at addressing the broad adoption of multicloud and application

environments. We continue to make significant investments in the development of software, silicon and optics — which we

believe are the building blocks for the Internet for the Future.

We introduced Cisco Silicon One, a single unified silicon architecture, as well as the Cisco 8000 carrier-class router family built

on Cisco Silicon One and our operating system, Cisco IOS XR7. We have also expanded our Cisco Silicon One platform from

a routing focused solution to one which addresses the webscale switching market. By combining our routed optical networking

solution integrating our routers with pluggable optics, we can further help deliver cost savings to our customers.

Secure the Enterprise

With the rapid growth in modern applications, and with more distributed work environments, securing the enterprise has become

more complex and difficult for our customers to manage. We believe every organization requires new or enhanced security

architectures to defend against increasing cyber attacks. Our security strategy is focused on delivering a simple and effective

cyber-security architecture combining network, cloud and endpoint-based solutions that recognizes the critical importance of

data privacy.

We are investing significant resources across our security portfolio focused on cloud-based offerings, artificial intelligence-

driven threat detection and end-to-end security architectures. We unveiled our strategic plan for a global, cloud-delivered,

integrated platform that secures and connects organizations of any shape and size. Cisco Security Cloud is designed to be the

most open, end-to-end, security platform across hybrid multi-cloud environments, while also minimizing the attack surface

and automating security policies across an organization’s environment. This extends to our secure access service edge (SASE)

framework and Zero Trust architecture, where we have developed a cloud-delivered stack. We are also delivering unified

detection and response capabilities with Cisco Extended Detection and Response (XDR), a cloud-based solution, and introduced

new innovations across firewall, multicloud and application security capabilities. To enable a more optimized hybrid work

experience with simple access across any location, device, and application, we have brought to market a security service edge

(SSE) solution. Additionally, we have announced generative AI capabilities as part of our Security Cloud platform to simplify

security operations and increase efficiency.

3

Power Hybrid Work

Over the last several years, the world has shifted to a hybrid work environment, and we believe that our customers are looking

to support a blend of onsite and offsite workers into the future. To enable a hybrid workforce, customers require secure access,

collaboration, and technologies to empower their teams to connect seamlessly and to work from anywhere.

Customers are looking to us to help improve how their people communicate, collaborate and to increase productivity. At Cisco,

we are focused on providing and delivering highly secure collaboration experiences to help our customers create a secure hybrid

work environment.

We believe our collaboration portfolio, which includes our subscription-based Webex conferencing platform, with meetings,

devices, calling and messaging, is at the center of our customers’ strategy for enabling their teams to be more productive and

secure. To help our customers transform their workplaces, we continue to invest to expand our capabilities by introducing

new Webex Calling innovations in the Webex Suite to improve work flexibility, reliability, and quality. We also launched new

devices for hybrid work which we are making interoperable with other vendors’ collaboration offerings to create a seamless

user experience.

Reimagine Applications

In our view, over the next several years, customers will be increasingly writing modern software applications that can run on

any hybrid cloud and will be adding billions of connections to their environments. In a multicloud environment, customers must

reimagine how they design, develop and deploy their applications. They need to be able to build applications quickly, deploy

them nearly anywhere, monitor experiences, and act in real time.