An Economic Analysis of

Utah’s Direct Selling Industry

Utah’s established direct selling industry anchored over 38,000

well-paying jobs and added signicantly to state and local tax

revenues as part of its 2020 statewide economic impacts.

August 2022

411 East South Temple Street

Salt Lake City, Utah 84111

801-585-5618

I

gardner.utah.edu

Levi Pace, Ph.D.

Senior Research Economist

Table of Contents

Analysis in Brief .......................................1

Section 1: Utah Economic Impacts ......................2

Section 2: Industry Employment and Wages .............5

Section 3: Sales at Home and Abroad ...................9

Section 4: Sales Representatives ...................... 11

Section 5: Conventions ............................... 14

Section 6: Research Methods ......................... 16

Figures

Figure 1: Economic Impacts of Utah’s Direct Selling

Industry, 2020 ......................................... 2

Figure 2: Utah Indirect and Induced Employment

Impacts by Sector, 2020 ................................ 3

Figure 3: Direct Selling and Industries With Similar

Employment, 2020 ..................................... 5

Figure 4: Utah Direct Selling Companies by

Segment, 2020 ........................................ 5

Figure 5: Average Annual Wages per Employee, 2020 ..... 5

Figure 6: Utah Direct Selling Companies by Size, 2020 ..... 6

Figure 7: Utah Direct Selling Employment by

Sector, 2020 ........................................... 6

Figure 8: Direct Selling Employment and Wages by

County, 2020 .......................................... 7

Figure 9: Employment and Wages of Selected Direct

Selling Suppliers by Type, 2020 ......................... 7

Figure 10: Direct Selling and Other Utah Exports, 2020 .... 9

Figure 11: Attendance at Selected Direct Selling

Conventions in Utah, 2015–2019 ......................14

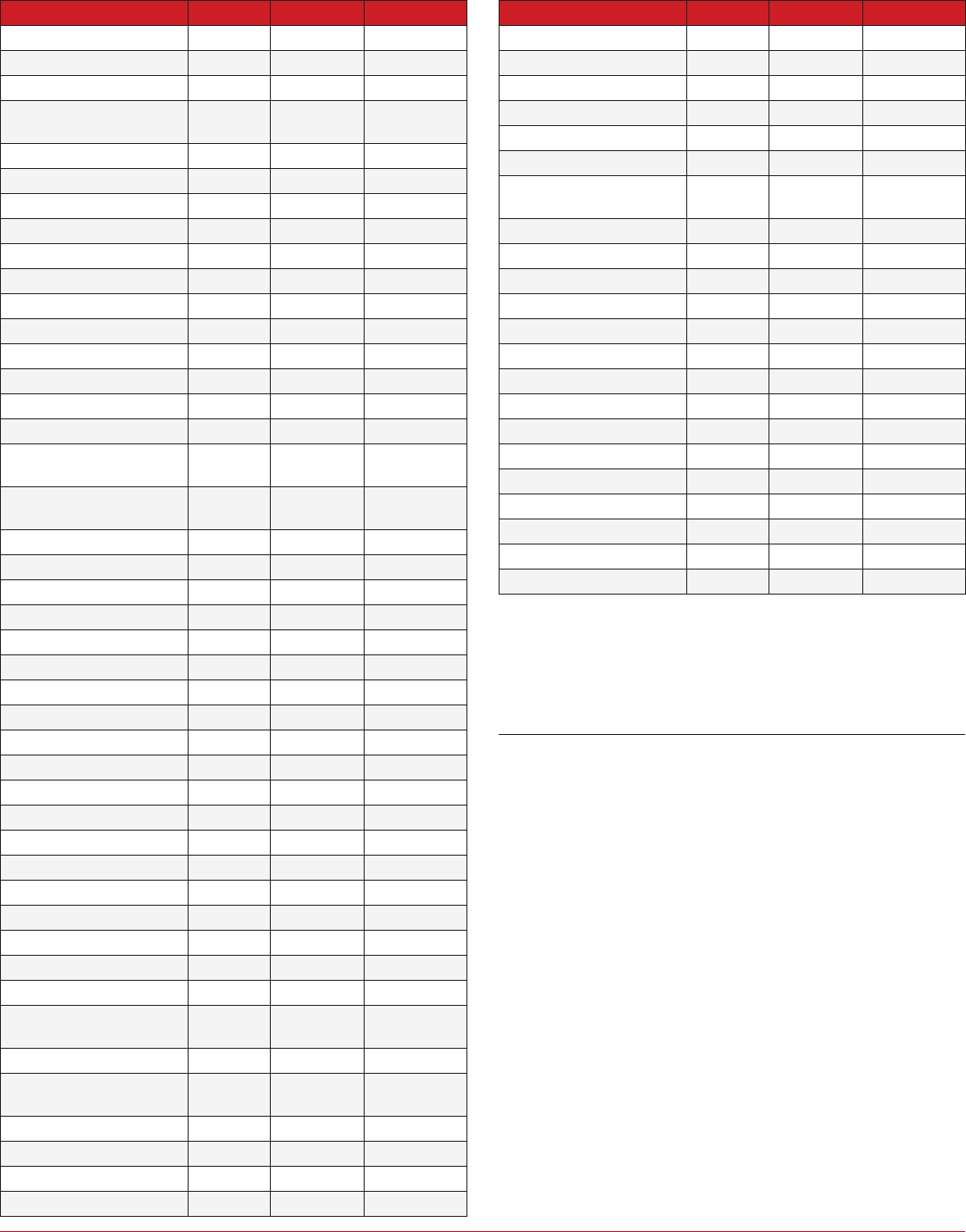

Figure 12: Diagram of Fiscal Impact Calculations ......... 20

Tables

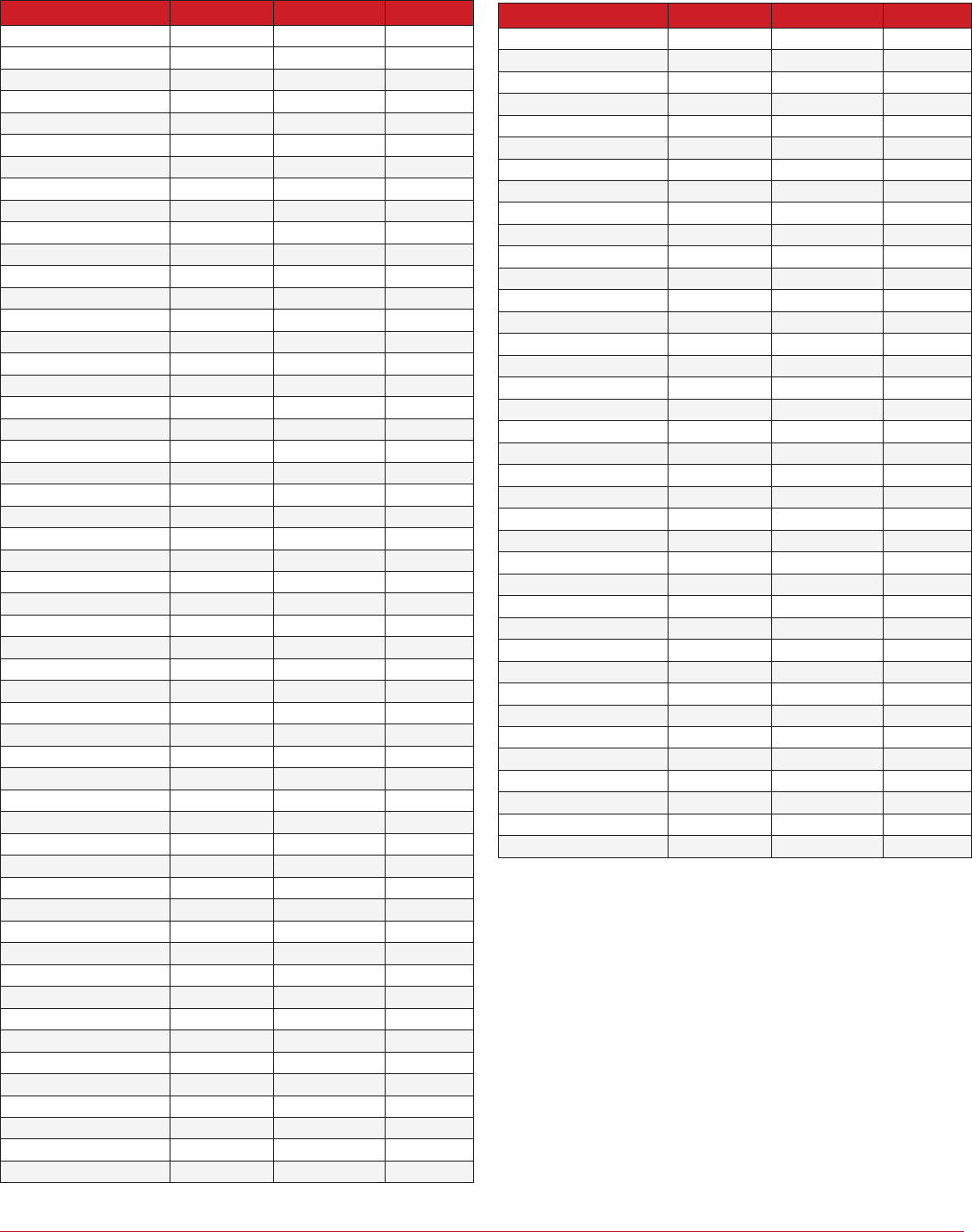

Table 1: Utah Direct Selling Industry Components, 2020 ... 2

Table 2: Utah Direct Selling Industry State and Local

Fiscal Impacts, 2020 .................................... 3

Table 3: Direct Selling State Fiscal Impacts in Utah, 2020 ... 3

Table 4: Direct Selling Local Fiscal Impacts in Utah, 2020 .. 4

Table 5: Utah’s Largest Employers in the Direct Selling

Industry, 2020 ......................................... 6

Table 6: Selected Utah Suppliers to Direct Selling

Companies by County, 2020. . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Table 7: Sales by Destination for Selected Utah Direct

Selling Companies, 2020 ............................... 9

Table 8: Sales Representatives for Selected Utah

Direct Selling Companies, 2020 .......................11

Table 9: Demographics of People Involved in Direct

Selling, 2020 .......................................... 12

Table 10: Selected Conventions Direct Selling Companies

Held in Utah, 2015–2019 ..............................14

Table 11: Annual Attendance at Selected Direct Selling

Conventions in Utah, 2015–2019 ......................14

Table 12: Non-Local Visitor Spending From Selected

Direct Selling Conventions in Utah, 2015–2019 ........15

Table 13: Utah Direct Selling Companies .................17

Table 14: Selected Utah Suppliers to Direct Selling

Companies ...........................................18

gardner.utah.edu

I

August 2022

INFORMED DECISIONS

TM

1

An Economic Analysis of Utah’s Direct Selling Industry

Analysis in Brief

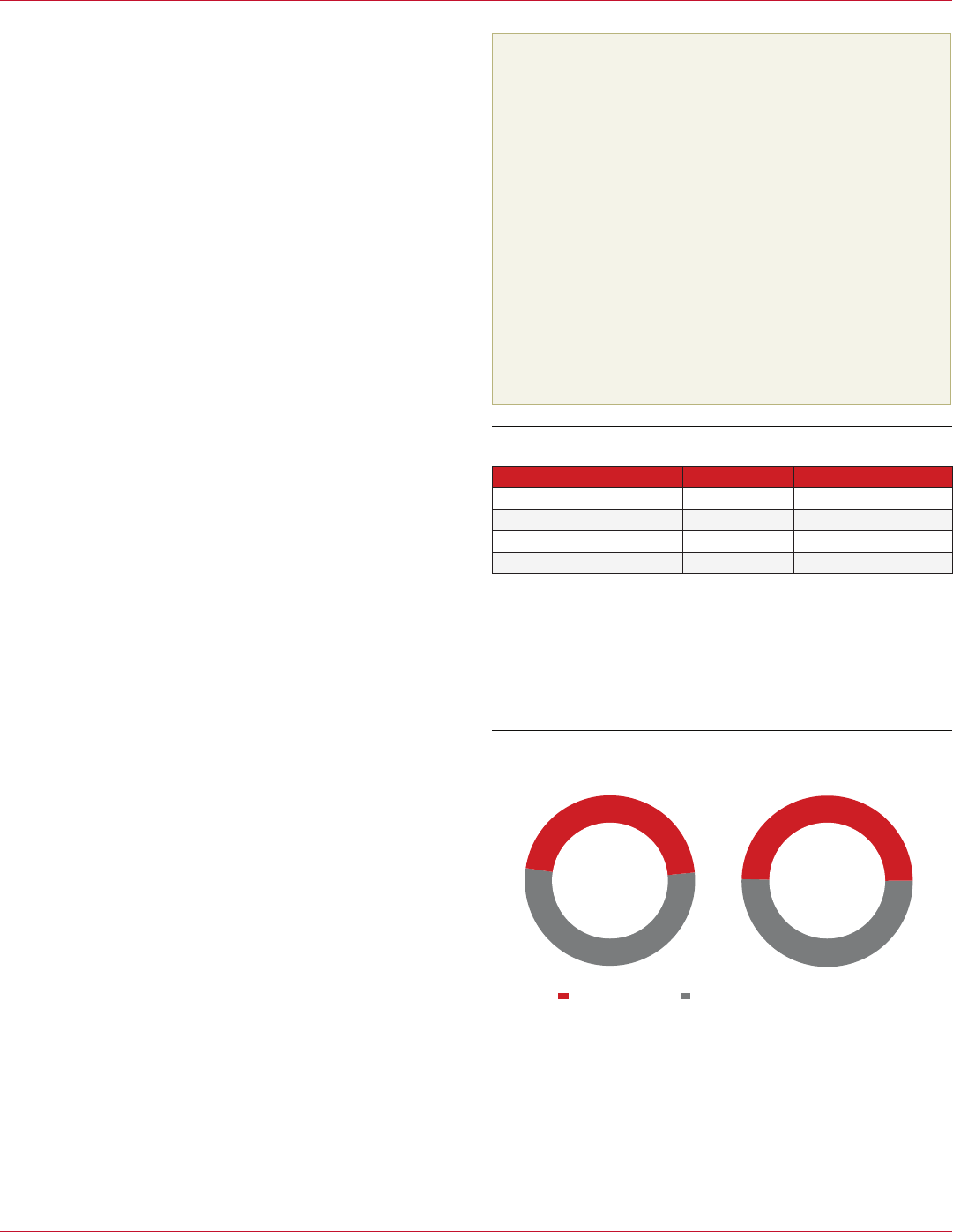

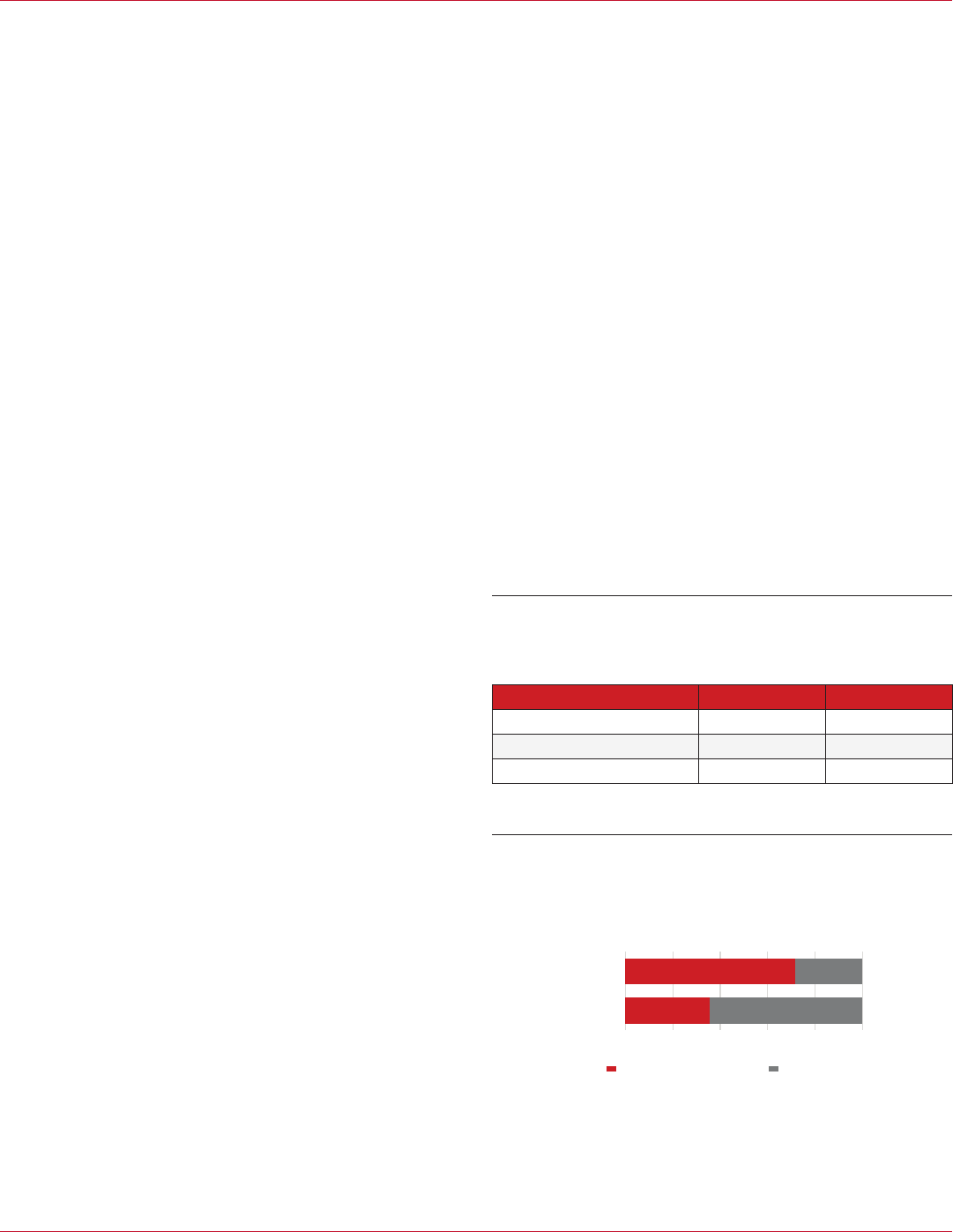

Economic Impacts of Utah’s Direct Selling Industry, 2020

Note: Percentages equal Utah’s total economic impacts from the direct selling industry

divided by total statewide employment and earnings for all industries. Besides the

in-state operations of direct selling companies and selected suppliers, 2020 impacts

incorporate average annual economic activity from direct selling conventions held

between 2015 and 2019.

Source: Kem C. Gardner Policy Institute analysis of data from the Utah Department of

Workforce Services using REMI PI+ economic model

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

Other Industries

Direct Selling Industry

71.7% 28.3%

35.6% 64.4%

0% 20% 40% 60% 80% 100%

Total Utah

Commodity Exports

Utah Non-Gold

Commodity Exports

Direct Selling Industry Other Industries

Direct impacts

(Direct selling)

Indirect and induced impacts

(Beyond the direct selling industry)

100.0%

($8.8 Billion)

100.0%

($17.7 Billion)

17,487

20,751

$1.329.9

$1,347.4

38,238 jobs

1.8% of Utah

employment

$2,677.3 million

2.2% of Utah

earnings

15 (16%)

4 (4%)

6 (7%)

9 (10%)

18 (20%)

51 (56%)

0 10 20 30 40 50 60

Other Products

Food & Beverages

Essential Oils

Services

Beauty & Fashion

Health & Wellness

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

0 5,000 10,000 15,000 20,000 25,000

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

$200.0

State Local

$127.1

$64.3

Tax Revenues

Revenues

$191.4

$38.1

$8.5

Government

Operating Expenditures

$46.6

$89.0

$55.8

Net State and

Local Revenue

$144.7

225,155 (71.2%) 90,961(28.8%)

0 100,000 200,000 300,000

Domestic (U.S.) International

316,116

(100.0%)

Exports from Utah Direct Selling Companies, 2020

(Share of Statewide Exports for 10 Direct Selling Companies,

Which Reported a Combined $6.3 Billion in Exports)

Note: Commodities exclude services. Statewide gold exports were $8.9 billion. Trade data

not available for 81 of Utah’s 91 direct selling companies.

Source: Dorsey & Whitney LLP; U.S. Census Bureau, USA Trade Online

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

Other Industries

Direct Selling Industry

71.7% 28.3%

35.6% 64.4%

0% 20% 40% 60% 80% 100%

Total Utah

Commodity Exports

Utah Non-Gold

Commodity Exports

Direct Selling Industry Other Industries

Direct impacts

(Direct selling)

Indirect and induced impacts

(Beyond the direct selling industry)

100.0%

($8.8 Billion)

100.0%

($17.7 Billion)

17,487

20,751

$1.329.9

$1,347.4

38,238 jobs

1.8% of Utah

employment

$2,677.3 million

2.2% of Utah

earnings

15 (16%)

4 (4%)

6 (7%)

9 (10%)

18 (20%)

51 (56%)

0 10 20 30 40 50 60

Other Products

Food & Beverages

Essential Oils

Services

Beauty & Fashion

Health & Wellness

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

0 5,000 10,000 15,000 20,000 25,000

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

$200.0

State Local

$127.1

$64.3

Tax Revenues

Revenues

$191.4

$38.1

$8.5

Government

Operating Expenditures

$46.6

$89.0

$55.8

Net State and

Local Revenue

$144.7

225,155 (71.2%) 90,961(28.8%)

0 100,000 200,000 300,000

Domestic (U.S.) International

316,116

(100.0%)

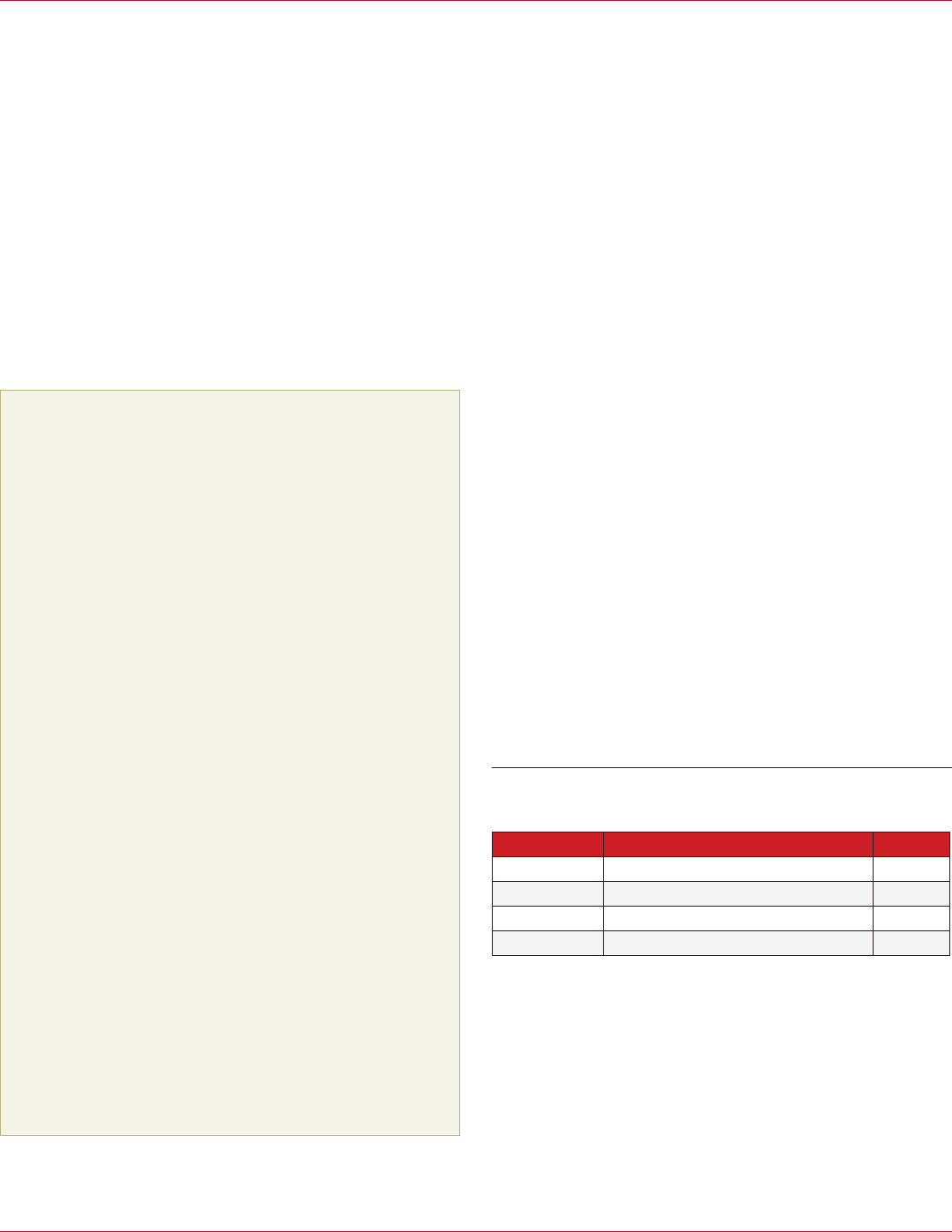

Largest Utah Employers in Direct Selling Industry, 2020

(Companies with at Least 100 Employees)

100 to 249 Jobs 250 to 749 Jobs 750 Jobs or More

ASEA Global 4Life Research doTERRA

LifeVantage Aptive Environmental Nu Skin

Modere Blue Raven Solar USANA Health Sci.

Plunder Design Nature's Sunshine Young Living

SupraNaturals NewAge

Thrive Life Paparazzi Accessories

Unicity International Stampin' Up

Xyngular Younique

Zyia Active

Note: Disclosure limitations prevent the reporting of exact employment counts by

company. In addition, Utah employment at direct selling companies does not include

independent sales representatives.

Source: Utah Department of Workforce Services, FirmFind

Utah’s established direct selling industry anchored over

38,000 well-paying jobs and added signicantly to state and

local tax revenues as part of its 2020 statewide economic

impacts. Direct selling companies market and distribute

products through independent sales representatives and their

personal networks. Utah is a global hub for the direct selling

business model. The industry comprises 91 direct selling

companies and 66 key suppliers. Ten of these direct selling

companies with Utah headquarters provided more than $10.3

billion in goods and services to their customers around the

world, 6.1% of industry sales from all states and countries.

Key Findings

• Economic Impacts—The direct selling industry employed

17,487 Utah residents, and industry activity indirectly

supported another 20,751 jobs.

• High Wages—At $63,652 per employee, direct selling

companies paid their Utah employees an average of 18.4%

more than companies in other industries in 2020.

• Exports—International sales of $6.3 billion from selected

direct selling companies in Utah made up 71.7% of the

state’s non-gold commodity exports in 2020.

• Entrepreneurship—In 2020, 10 large direct selling

companies had 21,457 independent sales representatives

in Utah, predominantly women. Their median self-

employment earnings (before expenses) ranged from $70

to $3,000 per year.

• Business Travelers—Out-of-state visitors who attended

direct selling conventions in Utah spent an estimated $41.6

million annually from 2015 to 2019.

August 2022

I

gardner.utah.edu INFORMED DECISIONS

TM

2

A few metrics outline the direct selling industry’s economic

footprint in Utah. In 2020, direct selling companies and

suppliers with headquarters and other oces in the state

provided 17,487 jobs (see Table 1).

1

Economy-wide impacts

from the spending of direct selling companies and their

suppliers and workers included $2.7 billion in earnings, 2.2%

of the state total for all residents, and $182.8 million in annual

state and local tax revenue. Of 91 direct selling companies,

10 responded to a survey for this study and indicated they

collectively provide a self-employment opportunity for more

than 21,000 independent sales representatives in Utah.

2

Before the COVID-19 pandemic, out-of-state visitors spent an

estimated $41.6 million per year while attending direct selling

conventions in Utah. Section 6 lists companies included in the

direct selling industry denition for Utah.

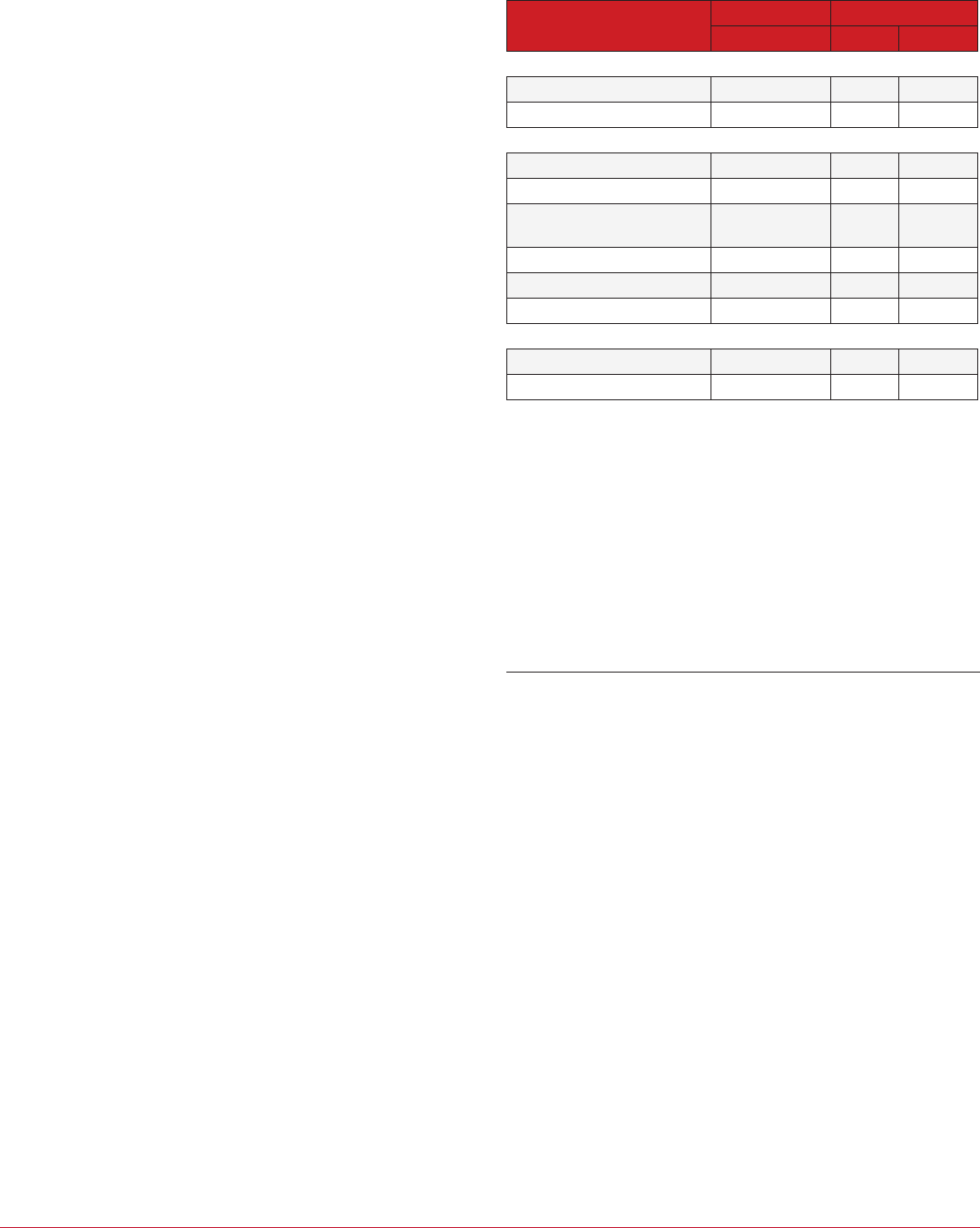

Statewide Economic Impacts: Over 38,000 Jobs Connected

to Direct Selling Industry

In 2020, direct selling companies generated 38,238 Utah

jobs and $2.7 billion in statewide earnings (see Figure 1).

This signicant economic activity constituted 1.8% of Utah

employment in all sectors and 2.2% of its residents’ earnings.

Direct impacts within the direct selling industry were 17,487

jobs and $1.3 billion in earnings.

3

As indirect and induced eects

rippled through interconnected industries and populations,

each direct selling job supported another 1.2 Utah jobs on

average, which added 20,751 jobs to the industry’s employment

impacts. Retail made up nearly one-fourth of direct selling total

employment impacts, followed by manufacturing, construction

and business services (see Figure 2).

4

In each of 13 Utah industries,

at least 1,000 jobs came from direct selling activity in the state.

The economic impacts in this section are based on Utah

employment and wages generated by 157 companies in the

direct selling industry in 2020. Section 2 provides an analysis of

91 direct selling companies and 66 direct selling suppliers. Direct

impacts for this analysis also include estimates of spending

by visitors who attended direct selling conventions, which

were based on historical averages since pandemic measures

limited in-person meetings in 2020 (see Section 5). One

element of the indirect and induced eects Gardner Institute

researchers modeled is the income earned by independent

sales representatives for companies surveyed in this study.

5

Section 1: Utah Economic Impacts

Table 1: Utah Direct Selling Industry Components, 2020

Component Companies Employment (Jobs)

Direct Selling Companies 91 11,678

Selected Suppliers 66 5,312

Convention Visitation NA 497

Total 157 17,487

Note: Of 91 direct selling companies, 10 rms with 6,143 jobs participated in a detailed

survey for this study. Employment at direct selling companies does not include

independent sales representatives. Direct selling companies have many suppliers besides

the 66 within the industry. Economic modeling provides employment estimates but not

company counts for in-state business activity from the spending of out-of-state visitors to

Utah direct selling conventions.

Source: Kem C. Gardner Policy Institute industry denition with input from the Utah

Direct Selling Coalition and Dorsey & Whitney LLP

Figure 1: Economic Impacts of Utah’s Direct Selling

Industry, 2020

Note: Percentages equal Utah’s total economic impacts from the direct selling industry

divided by total statewide employment and earnings for all industries. Besides the

in-state operations of direct selling companies and selected suppliers, 2020 impacts

incorporate average annual economic activity from direct selling conventions held

between 2015 and 2019.

Source: Kem C. Gardner Policy Institute analysis of data from the Utah Department of

Workforce Services using REMI PI+ economic model

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

Other Industries

Direct Selling Industry

71.7% 28.3%

35.6% 64.4%

0% 20% 40% 60% 80% 100%

Total Utah

Commodity Exports

Utah Non-Gold

Commodity Exports

Direct Selling Industry Other Industries

Direct impacts

(Direct selling)

Indirect and induced impacts

(Beyond the direct selling industry)

100.0%

($8.8 Billion)

100.0%

($17.7 Billion)

17,487

20,751

$1.329.9

$1,347.4

38,238 jobs

1.8% of Utah

employment

$2,677.3 million

2.2% of Utah

earnings

15 (16%)

4 (4%)

6 (7%)

9 (10%)

18 (20%)

51 (56%)

0 10 20 30 40 50 60

Other Products

Food & Beverages

Essential Oils

Services

Beauty & Fashion

Health & Wellness

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

0 5,000 10,000 15,000 20,000 25,000

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

$200.0

State Local

$127.1

$64.3

Tax Revenues

Revenues

$191.4

$38.1

$8.5

Government

Operating Expenditures

$46.6

$89.0

$55.8

Net State and

Local Revenue

$144.7

225,155 (71.2%) 90,961(28.8%)

0 100,000 200,000 300,000

Domestic (U.S.) International

316,116

(100.0%)

What is Direct Selling?

Direct selling is unique among retail channels because

of the way in which products and services are marketed

to customers. Instead of relying on traditional retail

outlets or online marketplaces, direct selling companies

maintain a sales force of independent entrepreneurs.

Companies market a wide variety of goods and services,

such as nutritional supplements, essential oils, cosmetics,

sportswear, jewelry, cookware, housewares, energy, and

insurance. Sales representatives of direct selling companies

may market products or services through one-to-one

communication, in-home demonstrations, or social media

sharing. With U.S. roots in the late nineteenth century, the

industry now serves markets around the world.

6

gardner.utah.edu

I

August 2022

INFORMED DECISIONS

TM

3

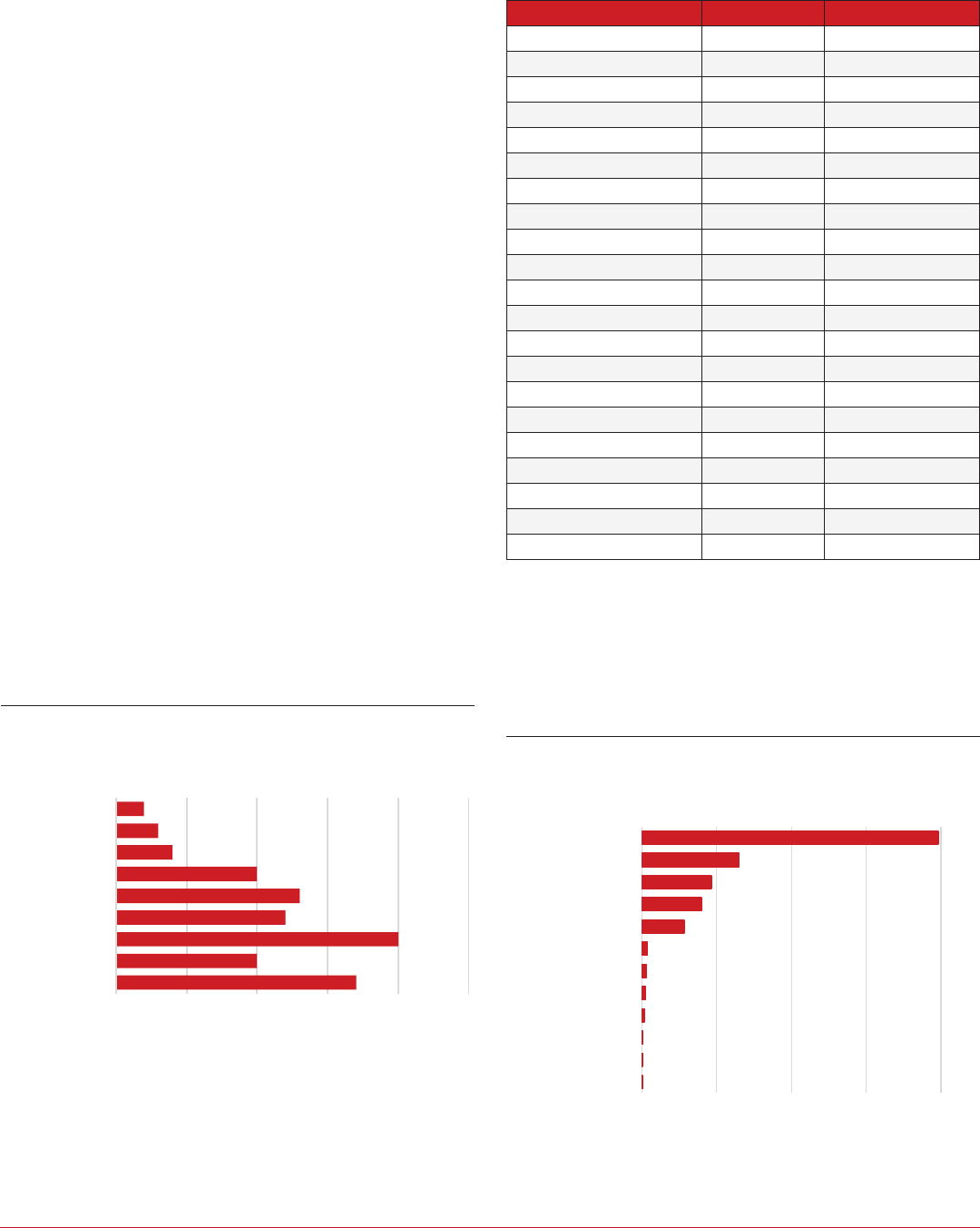

Figure 2: Utah Direct Selling Economic Impacts by

Sector, 2020

(Jobs Generated by the Direct Selling Industry)

Note: Total employment impact of 38,238 jobs includes direct selling companies, selected

suppliers and in-state industry conventions (17,487 jobs), as well as indirect and induced

impacts outside the direct selling industry (20,751 jobs).

Source: Kem C. Gardner Policy Institute analysis of data from the Utah Department of

Workforce Services using REMI PI+ economic model

17 (19%)

10 (11%)

20 (22%)

12 (13%)

13 (14%)

10 (11%)

4 (4%)

3 (3%)

2 (2%)

0 5 10 15 20 25

Less than 5

5 to 9

10 to 19

20 to 49

50 to 99

100 to 249

250 to 499

500 to 1,499

1,500 and above

Companies

Jobs

14,925

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

20,077

20,925

0 5,000 10,000 15,000 20,000 25,000

Misc. Store Retail

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

Arts & Sports

Agriculture

$53,891

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

All Industries

Other Industries

Direct Selling Industry

177

490

1,063

1,258

1,563

1,842

2,023

2,219

2,359

2,434

2,571

2,994

3,418

4,715

9,112

0 2,000 4,000 6,000 8,000 10,000

Natural resources

Information services

Other services

Finance & insurance

Government

Real estate

Professional services

Leisure & hospitality

Wholesale trade

Health & education

Transport. & utilities

Business services

Construction

Manufacturing

Retail trade

2

2

20

51

69

88

104

843

1,200

1,400

1,946

5,953

0 1,500 3,000 4,500 6,000

Real estate

Other services

Finance & insurance

Professional services

Construction

Health & education

Information services

Business services

Transport. & utilities

Wholesale trade

Manufacturing

Retail trade

$540.7

(67.4%)

8,614

(73.8%)

$223.7

(27.9%)

2,357

(20.2%)

$38.2

(4.8%)

707

(6.1%)

0% 20% 40% 60% 80% 100%

Wages

($ Millions)

Employment

(Jobs)

Utah Salt Lake Other Counties

$155.1

(55.6%)

3,497

(65.8%)

36

(54.5%)

$86.2

(30.9%)

1,136

(21.4%)

21

(31.8%)

$37.6

(13.5%)

679

(12.8%)

9

(13.6%)

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Wages

($ Millions)

Employment

(Jobs)

Number of

Companies

Manufacturing Services Ingredients

66

(100.0%)

5,312

(100.0%)

$278.9

(100.0%)

4,336

(6.9%)

21,682

(6.9%)

40,695

(64.4%)

203,473

(64.4%)

18,192

(28.8%)

90,961

(28.8%)

0.0% 20.0% 40.0% 60.0% 80.0% 100.0%

Average

Annual

Five-Year

Total

Utah Other States (U.S.) International

316,116

(100.0%)

63,223

(100.0%)

Economic Impact Terms

Employment is a measure of the average number of full-time

and part-time jobs held by employees and self-employed

workers. Companies report their employment to the Utah

Department of Workforce Services by place of work, not by

place of residence.

Wages represent the amount companies pay their employ-

ees on an hourly or salary basis. Employee benets and

self-employment income are not included in wages; these

forms of worker income are part of personal income.

Earnings consist of employee compensation and propri-

etors’ income from self-employment. Employee compen-

sation is the sum of wage and salary disbursements, and

supplements to wages and salaries (employee benets).

Economic impacts refer to the economic activity in a geo-

graphic region generated by a given source—in this case,

the direct selling industry. The Gardner Institute estimated

four components: direct impacts, which involve employee

compensation and other spending by companies in Utah's

direct selling industry; indirect impacts, which include the

relevant portion of spending at companies that provide

inputs to companies in the direct selling industry; induced

impacts, which include the household spending of direct

selling industry employees and the relevant portion of

spending by workers at companies that are part of the indi-

rect impacts; and scal impacts, which include tax revenue

and government expenditures associated with the com-

bined direct, indirect, and induced impacts.

Fiscal Impacts: Direct Selling Companies Generate $191.4

Million in State and Local Tax Revenue

Taxable economic activity connected to direct selling

companies helps fund state and local governments, including

schools. The Gardner Institute estimated government revenues

generated by the direct selling industry’s economic impacts

in Utah; in 2020, government entities received an estimated

$191.4 million in tax revenues from the economic activity

associated with the 38,238 jobs that the industry created or

indirectly sustained (see Table 2).

7

These revenues far exceeded

government expenses, estimated at $46.6 million, for services

to residents whose jobs depended on direct selling companies.

The net scal impact was a $144.7 million annual ow.

At the state level, 2020 net tax revenue from direct selling

industry activity in Utah was $89.0 million (see Table 3). An

estimated 91.3% of $127.1 million in state revenue came

from sales ($57.2 million) and personal income taxes ($58.8

million). Those who paid these taxes included direct selling

employees, independent sales representatives and workers in

other industries supported by the direct selling industry. The

remaining 8.7% ($11.1 million) of state revenue came from

corporate income taxes paid by direct selling companies and

other companies that were part of the industry’s indirect and

induced impacts.

Table 2: Utah Direct Selling Industry State and Local Fiscal

Impacts, 2020

(Millions of Dollars)

Category State Local Total

Tax revenues $127.1 $64.3 $191.4

Government operating expenditures $38.1 $8.5 $46.6

Net state and local revenue $89.0 $55.8 $144.7

Note: Totals may not match exactly due to rounding. These impacts include total revenues

and operating expenditures from Tables 2 and 3.

Source: Kem C. Gardner Policy Institute scal impact modelling

Table 3: Direct Selling State Fiscal Impacts in Utah, 2020

(Millions of Dollars)

Impact Amount

Sales tax revenues $57.2

Personal income tax revenues $58.8

Corporate income tax revenues $11.1

Total State Revenues $127.1

Non-Education expenditures $13.4

Public education expenditures $13.7

Higher education expenditures $11.0

Total state operating expenditures $38.1

Net state revenue $89.0

Note: Totals may not match exactly due to rounding.

Source: Kem C. Gardner Policy Institute scal impact modeling

August 2022

I

gardner.utah.edu INFORMED DECISIONS

TM

4

Government expenditures fund services for the population

of adults and children who live in Utah because of work

opportunities that direct selling companies generate. Public

and higher education expenditures reached a combined total

of $24.7 million, which was nearly two-thirds of total state

operating expenditures related to the direct selling industry

in 2020. Non-education expenditures, on the other hand,

amounted to $13.4 million.

As for local governments, the net scal impact of Utah’s

direct selling industry was $55.8 million in 2020 (see Table

4). This included an estimated $64.3 million in tax revenues

and $8.5 million in operating expenditures for counties

and school districts. Most local tax revenues came from

property taxes, which amounted to $53.9 million. The local

portion of sales tax collections was $10.3 million. As for local

government expenditures, public K–12 education spending

were an estimated $5.1 million, and other county expenditures

amounted to $3.4 million.

Table 4: Direct Selling Local Fiscal Impacts in Utah, 2020

(Millions of Dollars)

Impact Amount

Property tax revenues $53.9

Sales tax revenues $10.3

Total local revenues $64.3

Non-Education expenditures $3.4

Public education expenditures $5.1

Total local operating expenditures $8.5

Net local revenue $55.8

Note: Totals may not match exactly due to rounding. Local revenues and operating

expenditures include counties and school districts. Cities and towns are not included.

Source: Kem C. Gardner Policy Institute scal impact modeling

gardner.utah.edu

I

August 2022

INFORMED DECISIONS

TM

5

The direct selling industry provided 17,487 Utah jobs in

2020, with an average wage ($63,652) above the state’s average

(53,891). In 2020, direct selling companies staed 11,678 jobs

at large and small businesses.

8

Suppliers to these companies

include manufacturers and service providers in and beyond the

industry’s center in Utah County and Salt Lake County. Selected

suppliers provided 5,312 additional jobs. Besides employment

at direct selling companies and selected suppliers, visitor

spending from direct selling conventions accounts for nearly

497 jobs in the industry. Utah industries with employment

levels similar to the direct selling industry include agriculture,

accommodation, military and publishing (see Figure 3). Section

6 describes the direct selling industry denition and identies

the companies included.

In 2020, 91 direct selling companies and 66 suppliers directly

provided 16,990 Utah jobs and paid employees $1,081.5 million

annually.

9

The average wage per job was $63,652 industry-

wide, which was 18.4% above the statewide average of $53,782

for all other industries (see Figure 4). Compensation at Utah

direct selling companies and suppliers also included employer

benets estimated at $13,766 per job, on average. Wages and

benets add to $77,418 per job and total compensation of

$1,315.3 million for all employees in the industry. These wage

data do not reect employment for direct selling conventions.

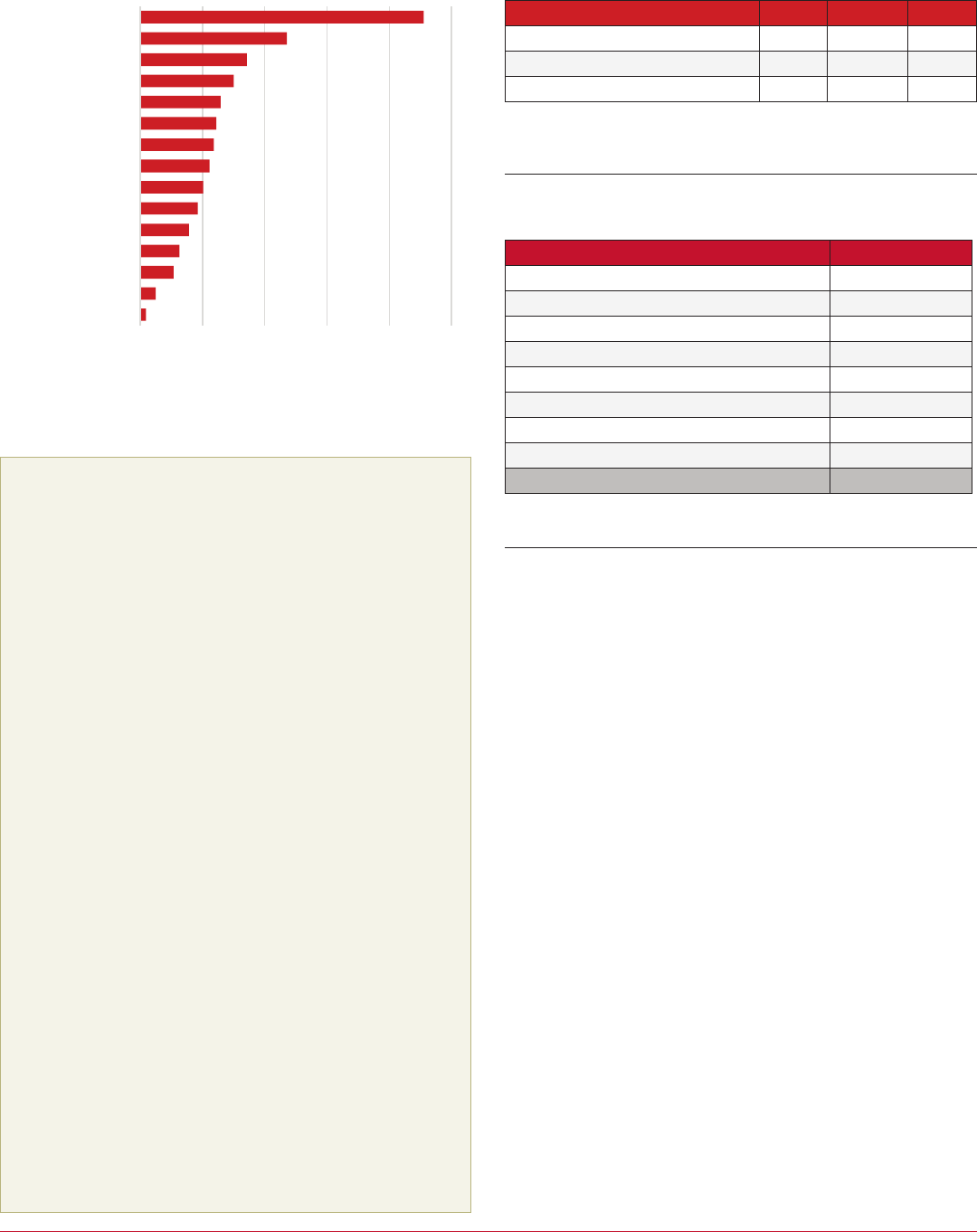

Direct Selling Company Segmentation by Product

and Employment

Among the goods and services that Utah direct selling

companies provide, the “health and wellness” segment is the

most dominant. In the ve-category classication system

shown in Figure 5, 56% of Utah direct selling companies have

health and wellness oerings, which include things such as

vitamins, nutritional supplements and weight-loss products.

The second-largest segment, “beauty and fashion,” represents

20% of companies and includes skin care, hair care and apparel

products. The share of companies providing “services” or

“essential oils” are 10% and 7%, respectively. Services include

nancial services, pest control and cyber risk management.

“Food and beverage” companies and other tangible product

sellers round out the industry. “Other products” includes solar

panels and windows, home organization and décor items,

technology devices, cleaning products, craft supplies, and

stationery. Of the 91 total companies, nine participate in two or

more segments.

In 2020, 91 direct selling companies provided 11,678 Utah

jobs and paid their employees a cumulative $802.6 million

annually. At direct selling companies (not including suppliers

in the industry), the average wage per job was $68,727, which

Section 2: Industry Employment and Wages

Figure 3: Direct Selling and Industries With Similar

Employment, 2020

(Utah Jobs)

Note: Includes industries within 3,500 jobs of direct selling, ranking from 36th to 46th by

employment among 92 disaggregated industries. Agriculture includes crop and animal

activity, but not support activities for agriculture. Arts and sports include performing arts,

spectator sports, and related industries. The publishing industry includes print formats

and software, but not internet publishing. Metal product manufacturing involves

fabricated products, not primary metals. The building and garden industry includes

building material and garden equipment and supplies. Miscellaneous retail includes

brick-and-mortar orists; oce supplies, stationery and gift stores; used merchandise; pet

supplies; art dealers; and manufactured home dealers.

Source: U.S. Bureau of Economic Analysis, Interactive Data Table SAEMP25N Total

Full-Time and Part-Time Employment by NAICS Industry

17 (19%)

10 (11%)

20 (22%)

12 (13%)

13 (14%)

10 (11%)

4 (4%)

3 (3%)

2 (2%)

0 5 10 15 20 25

Less than 5

5 to 9

10 to 19

20 to 49

50 to 99

100 to 249

250 to 499

500 to 1,499

1,500 and above

Companies

Jobs

14,925

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

20,077

20,925

0 5,000 10,000 15,000 20,000 25,000

Misc. Store Retail

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

Arts & Sports

Agriculture

$53,891

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

All Industries

Other Industries

Direct Selling Industry

177

490

1,063

1,258

1,563

1,842

2,023

2,219

2,359

2,434

2,571

2,994

3,418

4,715

9,112

0 2,000 4,000 6,000 8,000 10,000

Natural resources

Information services

Other services

Finance & insurance

Government

Real estate

Professional services

Leisure & hospitality

Wholesale trade

Health & education

Transport. & utilities

Business services

Construction

Manufacturing

Retail trade

2

2

20

51

69

88

104

843

1,200

1,400

1,946

5,953

0 1,500 3,000 4,500 6,000

Real estate

Other services

Finance & insurance

Professional services

Construction

Health & education

Information services

Business services

Transport. & utilities

Wholesale trade

Manufacturing

Retail trade

$540.7

(67.4%)

8,614

(73.8%)

$223.7

(27.9%)

2,357

(20.2%)

$38.2

(4.8%)

707

(6.1%)

0% 20% 40% 60% 80% 100%

Wages

($ Millions)

Employment

(Jobs)

Utah Salt Lake Other Counties

$155.1

(55.6%)

3,497

(65.8%)

36

(54.5%)

$86.2

(30.9%)

1,136

(21.4%)

21

(31.8%)

$37.6

(13.5%)

679

(12.8%)

9

(13.6%)

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Wages

($ Millions)

Employment

(Jobs)

Number of

Companies

Manufacturing Services Ingredients

66

(100.0%)

5,312

(100.0%)

$278.9

(100.0%)

4,336

(6.9%)

21,682

(6.9%)

40,695

(64.4%)

203,473

(64.4%)

18,192

(28.8%)

90,961

(28.8%)

0.0% 20.0% 40.0% 60.0% 80.0% 100.0%

Average

Annual

Five-Year

Total

Utah Other States (U.S.) International

316,116

(100.0%)

63,223

(100.0%)

Figure 4: Average Annual Wages per Employee, 2020

Note: Employee wages do not include benets or income from self-employment.

Source: Utah Department of Workforce Services, information request

17 (19%)

10 (11%)

20 (22%)

12 (13%)

13 (14%)

10 (11%)

4 (4%)

3 (3%)

2 (2%)

0 5 10 15 20 25

Less than 5

5 to 9

10 to 19

20 to 49

50 to 99

100 to 249

250 to 499

500 to 1,499

1,500 and above

Companies

Jobs

14,925

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

20,077

20,925

0 5,000 10,000 15,000 20,000 25,000

Misc. Store Retail

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

Arts & Sports

Agriculture

$53,891

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

All Industries

Other Industries

Direct Selling Industry

177

490

1,063

1,258

1,563

1,842

2,023

2,219

2,359

2,434

2,571

2,994

3,418

4,715

9,112

0 2,000 4,000 6,000 8,000 10,000

Natural resources

Information services

Other services

Finance & insurance

Government

Real estate

Professional services

Leisure & hospitality

Wholesale trade

Health & education

Transport. & utilities

Business services

Construction

Manufacturing

Retail trade

2

2

20

51

69

88

104

843

1,200

1,400

1,946

5,953

0 1,500 3,000 4,500 6,000

Real estate

Other services

Finance & insurance

Professional services

Construction

Health & education

Information services

Business services

Transport. & utilities

Wholesale trade

Manufacturing

Retail trade

$540.7

(67.4%)

8,614

(73.8%)

$223.7

(27.9%)

2,357

(20.2%)

$38.2

(4.8%)

707

(6.1%)

0% 20% 40% 60% 80% 100%

Wages

($ Millions)

Employment

(Jobs)

Utah Salt Lake Other Counties

$155.1

(55.6%)

3,497

(65.8%)

36

(54.5%)

$86.2

(30.9%)

1,136

(21.4%)

21

(31.8%)

$37.6

(13.5%)

679

(12.8%)

9

(13.6%)

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Wages

($ Millions)

Employment

(Jobs)

Number of

Companies

Manufacturing Services Ingredients

66

(100.0%)

5,312

(100.0%)

$278.9

(100.0%)

4,336

(6.9%)

21,682

(6.9%)

40,695

(64.4%)

203,473

(64.4%)

18,192

(28.8%)

90,961

(28.8%)

0.0% 20.0% 40.0% 60.0% 80.0% 100.0%

Average

Annual

Five-Year

Total

Utah Other States (U.S.) International

316,116

(100.0%)

63,223

(100.0%)

Figure 5: Utah Direct Selling Companies by Segment, 2020

(Number of Companies; Share of 91 Companies)

Note: Other products include home improvement, household, craft, and other tangible

goods. Shares add to more than 100% because nine of these companies belong in two or

more categories.

Source: Kem C. Gardner Policy Institute analysis of data from Dorsey & Whitney LLP

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

Other Industries

Direct Selling Industry

71.7% 28.3%

35.6% 64.4%

0% 20% 40% 60% 80% 100%

Total Utah

Commodity Exports

Utah Non-Gold

Commodity Exports

Direct Selling Industry Other Industries

Direct impacts

(Direct selling)

Indirect and induced impacts

(Beyond the direct selling industry)

100.0%

($8.8 Billion)

100.0%

($17.7 Billion)

17,487

20,751

$1.329.9

$1,347.4

38,238 jobs

1.8% of Utah

employment

$2,677.3 million

2.2% of Utah

earnings

15 (16%)

4 (4%)

6 (7%)

9 (10%)

18 (20%)

51 (56%)

0 10 20 30 40 50 60

Other Products

Food & Beverages

Essential Oils

Services

Beauty & Fashion

Health & Wellness

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

0 5,000 10,000 15,000 20,000 25,000

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

$200.0

State Local

$127.1

$64.3

Tax Revenues

Revenues

$191.4

$38.1

$8.5

Government

Operating Expenditures

$46.6

$89.0

$55.8

Net State and

Local Revenue

$144.7

225,155 (71.2%) 90,961(28.8%)

0 100,000 200,000 300,000

Domestic (U.S.) International

316,116

(100.0%)

August 2022

I

gardner.utah.edu INFORMED DECISIONS

TM

6

was 27.8% above the statewide average of $53,778 for all other

companies. Compensation at Utah direct selling companies

also included employer benets estimated at $13,766 per

job, on average. Wages and benets added to $77,418 per job

and total compensation of $963.2 million for all direct selling

company employees.

Utah’s direct selling companies vary signicantly in size (see

Figure 6). In 2020, nearly one-fth (17 of 91 companies) were

small businesses with fewer than ve employees, and 79% of the

industry (72 companies) had fewer than 100 employees. The ve

largest direct sellers in Utah each provided at least 500 jobs.

Principal Utah employers in the direct selling industry include

21 direct selling companies with at least 100 employees (see Table

5). The companies were founded between 1972 and 2017. In

2020, nine of them provided 100 to 249 in-state jobs. The largest

two employers, doTERRA and Young Living, each provided more

than 1,500 jobs, and the three companies rounding out the top

ve were Nu Skin, USANA Health Sciences, and Nature’s Sunshine.

Note that the Utah Department of Workforce Services does not

release exact employment for individual companies.

Most of Utah’s direct selling companies identify as retail or

wholesale trade companies (see Figure 7). In 2020, half of the

industry’s employment, 5,953 jobs, was in the retail trade sector—

commonly classied as nonstore retailers, although a portion was

in e-commerce or miscellaneous retail sales.

10

On the other hand,

over one-tenth of industry employment came from companies in

wholesale trade––primarily classied as pharmaceutical, which

includes vitamins, other nutraceuticals and certain cosmetic

products. Besides retail and wholesale trade, most of the

remaining employment at direct selling companies was either

Figure 6: Utah Direct Selling Companies by Size, 2020

(Companies Grouped by Number of Jobs)

Note: Employment at direct selling companies does not include independent sales

representatives (direct sellers). The category “20 to 49” includes Activz, which has 21 to 53

employees. Additionally, seven larger companies may belong in either of two

employment ranges: Nature’s Sunshine, Aptive Environmental, Blue Raven Solar, NewAge,

4Life Research USA , Stampin' Up, and Younique (see Table 5 for their employment).

Source: Utah Department of Workforce Services, FIrmFind

17 (19%)

10 (11%)

20 (22%)

12 (13%)

13 (14%)

10 (11%)

4 (4%)

3 (3%)

2 (2%)

0 5 10 15 20

25

Less than 5

5 to 9

10 to 19

20 to 49

50 to 99

100 to 249

250 to 499

500 to 1,499

1,500 and above

Companies

Jobs

14,925

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

20,077

20,925

0 5,000 10,000 15,000 20,000 25,000

Misc. Store Retail

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

Arts & Sports

Agriculture

$53,891

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

All Industries

Other Industries

Direct Selling Industry

177

490

1,063

1,258

1,563

1,842

2,023

2,219

2,359

2,434

2,571

2,994

3,418

4,715

9,112

0 2,000 4,000 6,000 8,000 10,000

Natural resources

Information services

Other services

Finance & insurance

Government

Real estate

Professional services

Leisure & hospitality

Wholesale trade

Health & education

Transport. & utilities

Business services

Construction

Manufacturing

Retail trade

2

2

20

51

69

88

104

843

1,200

1,400

1,946

5,953

0 1,500 3,000 4,500 6,000

Real estate

Other services

Finance & insurance

Professional services

Construction

Health & education

Information services

Business services

Transport. & utilities

Wholesale trade

Manufacturing

Retail trade

$540.7

(67.4%)

8,614

(73.8%)

$223.7

(27.9%)

2,357

(20.2%)

$38.2

(4.8%)

707

(6.1%)

0% 20% 40% 60% 80% 100%

Wages

($ Millions)

Employment

(Jobs)

Utah Salt Lake Other Counties

$155.1

(55.6%)

3,497

(65.8%)

36

(54.5%)

$86.2

(30.9%)

1,136

(21.4%)

21

(31.8%)

$37.6

(13.5%)

679

(12.8%)

9

(13.6%)

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Wages

($ Millions)

Employment

(Jobs)

Number of

Companies

Manufacturing Services Ingredients

66

(100.0%)

5,312

(100.0%)

$278.9

(100.0%)

4,336

(6.9%)

21,682

(6.9%)

40,695

(64.4%)

203,473

(64.4%)

18,192

(28.8%)

90,961

(28.8%)

0.0% 20.0% 40.0% 60.0% 80.0% 100.0%

Average

Annual

Five-Year

Total

Utah Other States (U.S.) International

316,116

(100.0%)

63,223

(100.0%)

Table 5: Utah’s Largest Employers Among Direct Selling

Companies, 2020

(Companies with at Least 100 Employees)

Company Jobs

1

Year Established

2

doTERRA 2,265 to 3,526 2008

Young Living 1,505 to 3,007 1993

Nu Skin 606 to 1,260 1984

USANA Health Sciences 520 to 1,048 1992

Nature’s Sunshine 370 to 797 1972

Stampin' Up 300 to 598 1988

Younique 300 to 598 2012

Aptive Environmental 270 to 548 2015

Paparazzi Accessories 250 to 499 2011

4Life Research USA 205 to 405 1998

Blue Raven Solar 170 to 397 2014

NewAge

3

161 to 371 2016

ASEA Global 100 to 249 2010

LifeVantage 100 to 249 2003

Modere 100 to 249 1987

Plunder Design 100 to 249 2014

SupraNaturals 100 to 249 2004

Thrive Life 100 to 249 2005

Unicity International 100 to 249 2005

Xyngular 100 to 249 2009

Zyia Active 100 to 249 2017

Note:

1. Disclosure limitations prevent the reporting of exact employment counts by company.

In addition, Utah employment at direct selling companies does not include

independent sales representatives (direct sellers).

2. Companies have reorganized and renamed themselves over the years. Some had

signicant precursors before the founding year given.

3. In July 2020, NewAge acquired ARIIX, which accounts for 50 to 99 of the jobs at

NewAge.

Source: Utah Department of Workforce Services and company websites

17 (19%)

10 (11%)

20 (22%)

12 (13%)

13 (14%)

10 (11%)

4 (4%)

3 (3%)

2 (2%)

0 5 10 15 20 25

Less than 5

5 to 9

10 to 19

20 to 49

50 to 99

100 to 249

250 to 499

500 to 1,499

1,500 and above

Companies

Jobs

14,925

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

20,077

20,925

0 5,000 10,000 15,000 20,000 25,000

Misc. Store Retail

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

Arts & Sports

Agriculture

$53,891

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

All Industries

Other Industries

Direct Selling Industry

177

490

1,063

1,258

1,563

1,842

2,023

2,219

2,359

2,434

2,571

2,994

3,418

4,715

9,112

0 2,000 4,000 6,000 8,000 10,000

Natural resources

Information services

Other services

Finance & insurance

Government

Real estate

Professional services

Leisure & hospitality

Wholesale trade

Health & education

Transport. & utilities

Business services

Construction

Manufacturing

Retail trade

2

2

20

51

69

88

104

843

1,200

1,400

1,946

5,953

0 1,500 3,000 4,500 6,000

Real estate

Other services

Finance & insurance

Professional services

Construction

Health & education

Information services

Business services

Transport. & utilities

Wholesale trade

Manufacturing

Retail trade

$540.7

(67.4%)

8,614

(73.8%)

$223.7

(27.9%)

2,357

(20.2%)

$38.2

(4.8%)

707

(6.1%)

0% 20% 40% 60% 80% 100%

Wages

($ Millions)

Employment

(Jobs)

Utah Salt Lake Other Counties

$155.1

(55.6%)

3,497

(65.8%)

36

(54.5%)

$86.2

(30.9%)

1,136

(21.4%)

21

(31.8%)

$37.6

(13.5%)

679

(12.8%)

9

(13.6%)

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Wages

($ Millions)

Employment

(Jobs)

Number of

Companies

Manufacturing Services Ingredients

66

(100.0%)

5,312

(100.0%)

$278.9

(100.0%)

4,336

(6.9%)

21,682

(6.9%)

40,695

(64.4%)

203,473

(64.4%)

18,192

(28.8%)

90,961

(28.8%)

0.0% 20.0% 40.0% 60.0% 80.0% 100.0%

Average

Annual

Five-Year

Total

Utah Other States (U.S.) International

316,116

(100.0%)

63,223

(100.0%)

Figure 7: Utah Direct Selling Company Employment by

Sector, 2020

(Jobs)

Note: Employment does not include suppliers to direct selling companies or industry

conventions. Sectors follow the North American Industry Classication System (NAICS).

Other industries include natural resources, real estate and other services.

Source: Utah Department of Workforce Services, information request

gardner.utah.edu

I

August 2022

INFORMED DECISIONS

TM

7

in manufacturing (1,946 jobs primarily under pharmaceutical

manufacturing), transportation and utilities (1,200 jobs primarily

under warehousing and storage), or business services (843 jobs

primarily under pest control or telemarketing).

Direct selling companies are located in ve counties, with

a noticeable concentration in Utah County. Several of these

91 companies may have multiple establishments, which

are commonly located at dierent addresses from their

respective company headquarters. Of 114 in-state direct selling

establishments operating in 2020, 55% were in Utah County,

34% were in Salt Lake County, and the remaining 11% were in

Washington, Davis, Kane, Weber and Duchesne counties.

Based on average employment, Utah County’s 63 direct selling

establishments were larger than those in other counties. While

direct selling headquarters and other establishments coalesce

in the Wasatch Front, their Utah suppliers and the companies

sustained by the industry’s economic impacts are more widely

distributed across the state. Over 8,600 direct selling jobs were

in Utah County, nearly three-fourths (73.8%) of the industry’s

statewide total (see Figure 8). Salt Lake County was home to

more than 2,350 direct selling jobs, and the remaining 707 jobs

were in Washington, Davis, Kane, Weber and Duchesne counties.

More than two-thirds of the statewide employee wages from

direct selling companies, or $540.7 million, went to people

working in Utah County. Salt Lake County followed with

17 (19%)

10 (11%)

20 (22%)

12 (13%)

13 (14%)

10 (11%)

4 (4%)

3 (3%)

2 (2%)

0 5 10 15 20 25

Less than 5

5 to 9

10 to 19

20 to 49

50 to 99

100 to 249

250 to 499

500 to 1,499

1,500 and above

Companies

Jobs

14,925

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

20,077

20,925

0 5,000 10,000 15,000 20,000 25,000

Misc. Store Retail

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

Arts & Sports

Agriculture

$53,891

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

All Industries

Other Industries

Direct Selling Industry

177

490

1,063

1,258

1,563

1,842

2,023

2,219

2,359

2,434

2,571

2,994

3,418

4,715

9,112

0 2,000 4,000 6,000 8,000 10,000

Natural resources

Information services

Other services

Finance & insurance

Government

Real estate

Professional services

Leisure & hospitality

Wholesale trade

Health & education

Transport. & utilities

Business services

Construction

Manufacturing

Retail trade

2

2

20

51

69

88

104

843

1,200

1,400

1,946

5,953

0 1,500 3,000 4,500 6,000

Real estate

Other services

Finance & insurance

Professional services

Construction

Health & education

Information services

Business services

Transport. & utilities

Wholesale trade

Manufacturing

Retail trade

$540.7

(67.4%)

8,614

(73.8%)

$223.7

(27.9%)

2,357

(20.2%)

$38.2

(4.8%)

707

(6.1%)

0% 20% 40% 60% 80% 100%

Wages

($ Millions)

Employment

(Jobs)

Utah Salt Lake Other Counties

$155.1

(55.6%)

3,497

(65.8%)

36

(54.5%)

$86.2

(30.9%)

1,136

(21.4%)

21

(31.8%)

$37.6

(13.5%)

679

(12.8%)

9

(13.6%)

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Wages

($ Millions)

Employment

(Jobs)

Number of

Companies

Manufacturing Services Ingredients

66

(100.0%)

5,312

(100.0%)

$278.9

(100.0%)

4,336

(6.9%)

21,682

(6.9%)

40,695

(64.4%)

203,473

(64.4%)

18,192

(28.8%)

90,961

(28.8%)

0.0% 20.0% 40.0% 60.0% 80.0% 100.0%

Average

Annual

Five-Year

Total

Utah Other States (U.S.) International

316,116

(100.0%)

63,223

(100.0%)

Figure 8: Direct Selling Company Employment and Wages

by County, 2020

Note: Other counties include Davis, Washington, Duchesne, Kane, Tooele and Weber, each

with one to four direct selling establishments. Disclosure limitations prevent the reporting

of exact employment counts for these counties. Totals are 11,678 jobs and $802.6 million

in wages.

Source: Utah Department of Workforce Services, FirmFind and information request

wages of $223.7 million from direct selling companies, 27.9%

of the state’s total, which was well above its 20.2% share of

employment and reected relatively well-paying jobs. Finally,

companies in Washington, Davis, Kane, Weber and Duchesne

counties paid a cumulative $38.2 million to direct selling

company employees, 6.1% of the statewide total.

Suppliers Include Utah Manufacturers and Service

Providers in Eight Counties

A large number of Utah workers and companies earn income

by supplying inputs to direct selling companies. The Gardner

Institute analyzed the employment, wages and locations of

66 noteworthy suppliers in eight counties.

11

The rm Dorsey

& Whitney selected these in-state suppliers from Utah’s direct

sales industry by compiling and corroborating responses from

individuals in the industry. The guiding principle for inclusion

was that a company’s primary line of business be supplying

inputs to direct selling companies. This list of suppliers is not

intended to be comprehensive of all Utah suppliers that make

large or small, occasional or frequent sales to Utah’s direct

selling companies.

12

See Section 6 for further details.

The 66 Utah suppliers to direct selling companies identied

for this study are manufacturers, service providers or ingredient

suppliers (see Figure 9).

13

Manufacturers for direct selling

companies provided 3,497 Utah jobs in 2020, nearly two-thirds

of the supplier total of 5,312 full-time and part-time jobs. In

the same year, service providers paid $86.2 million in wages,

nearly one-third of the supplier total. Companies that provided

ingredients to direct selling companies accounted for 12.8% to

13.6% of suppliers’ company count, employment and wages.

In 2020, the 66 selected suppliers in the direct selling industry

paid employees an aggregate $278.9 million annually. Among

these suppliers (not including direct selling companies in the

industry), the average wage per job was $52,497, which was

within 3% of the average of $53,896 for all other employment

in the state. Compensation at Utah direct selling suppliers also

included employer benets estimated at $13,801 per job, on

average. Wages and benets added to $66,298 per job and

$352.2 million in total compensation for supplier employees.

17 (19%)

10 (11%)

20 (22%)

12 (13%)

13 (14%)

10 (11%)

4 (4%)

3 (3%)

2 (2%)

0 5 10 15 20 25

Less than 5

5 to 9

10 to 19

20 to 49

50 to 99

100 to 249

250 to 499

500 to 1,499

1,500 and above

Companies

Jobs

14,925

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

20,077

20,925

0 5,000 10,000 15,000 20,000 25,000

Misc. Store Retail

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

Arts & Sports

Agriculture

$53,891

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

All Industries

Other Industries

Direct Selling Industry

177

490

1,063

1,258

1,563

1,842

2,023

2,219

2,359

2,434

2,571

2,994

3,418

4,715

9,112

0 2,000 4,000 6,000 8,000 10,000

Natural resources

Information services

Other services

Finance & insurance

Government

Real estate

Professional services

Leisure & hospitality

Wholesale trade

Health & education

Transport. & utilities

Business services

Construction

Manufacturing

Retail trade

2

2

20

51

69

88

104

843

1,200

1,400

1,946

5,953

0 1,500 3,000 4,500 6,000

Real estate

Other services

Finance & insurance

Professional services

Construction

Health & education

Information services

Business services

Transport. & utilities

Wholesale trade

Manufacturing

Retail trade

$540.7

(67.4%)

8,614

(73.8%)

$223.7

(27.9%)

2,357

(20.2%)

$38.2

(4.8%)

707

(6.1%)

0% 20% 40% 60% 80% 100%

Wages

($ Millions)

Employment

(Jobs)

Utah Salt Lake Other Counties

$155.1

(55.6%)

3,497

(65.8%)

36

(54.5%)

$86.2

(30.9%)

1,136

(21.4%)

21

(31.8%)

$37.6

(13.5%)

679

(12.8%)

9

(13.6%)

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Wages

($ Millions)

Employment

(Jobs)

Number of

Companies

Manufacturing Services Ingredients

66

(100.0%)

5,312

(100.0%)

$278.9

(100.0%)

4,336

(6.9%)

21,682

(6.9%)

40,695

(64.4%)

203,473

(64.4%)

18,192

(28.8%)

90,961

(28.8%)

0.0% 20.0% 40.0% 60.0% 80.0% 100.0%

Average

Annual

Five-Year

Total

Utah Other States (U.S.) International

316,116

(100.0%)

63,223

(100.0%)

Figure 9: Employment and Wages of Selected Direct Selling Suppliers by Type, 2020

Source: Utah Department of Workforce Services, FirmFind and information request

August 2022

I

gardner.utah.edu INFORMED DECISIONS

TM

8

Supplier activity in the direct selling industry is more evenly

distributed statewide than direct selling companies themselves.

While nearly nine out of 10 direct selling establishments were in

the industry’s two leading counties, Utah County and Salt Lake

County, only 69% of supplier establishments were located there

in 2020 (see Table 6). Three other counties, Weber, Davis and

Washington, were home to multiple suppliers to direct selling

companies. Additionally, at least one supplier operated in Cache,

Emery and Millard counties, which feature large rural areas.

Table 6: Selected Utah Suppliers to Direct Selling

Companies by County, 2020

County Establishments Share of Total

Utah 26 36.6%

Salt Lake 23 32.4%

Weber 9 12.7%

Davis 7 9.9%

Washington 3 4.2%

Cache 1 1.4%

Emery 1 1.4%

Millard 1 1.4%

State Total 71 100.0%

Note: These 71 Utah establishments represent 66 companies, three of which had two or

more business locations within the same county, and one had two or more business

locations in dierent counties.

Source: Dorsey & Whitney LLP and Utah Department of Workforce Services

gardner.utah.edu

I

August 2022

INFORMED DECISIONS

TM

9

Exceptional levels of in-state production for domestic and

international markets marked Utah’s role in the direct selling

industry. Utah, a state with under 0.1% of the world’s population,

provided more than 6% of the industry’s global sales in 2020.

While Utah produces just under 1% of U.S. GDP, it provided at

least 10% of direct selling products bought nationwide. At the

same time, in-state purchases in Utah exceeded the national

average of sales per capita.

A 2021 industry survey of several large companies

headquartered in Utah informs Sections 3 and 4. The survey

supplements a state government dataset on the full set of

companies addressed in Sections 1 and 2, as well as previously

published ndings from national surveys of direct selling

companies. The rm Dorsey & Whitney collected detailed

information on sales and sales representatives from 10 of the

91 direct selling Utah companies.

14

The surveyed companies

operated in one or more industry segments: health and

wellness (10 companies), beauty and fashion (four), and other

products (one).

15

These companies provided more than half

(57.5%) of industry employment statewide in 2020, and their

6,143 employee jobs paid $410.2 million in annual wages. Due

to their importance in the Utah, national and international

direct selling landscape, parts of Section 3 and 4 reference

survey results from companies’ sales and sales representatives.

State Comparisons: Utah Provides More Direct Selling

Products Than It Consumes

Utah is a signicant market for the retail activity of direct

selling companies headquartered either within or outside Utah.

State comparisons suggest Utah consumers have a moderately

high anity for direct selling products and networks. In 2020,

Utah ranked ninth in terms of direct sales per capita.

16

At $215

per adult living in the state, Utah spending exceeded the $155

U.S. average. The nationwide Direct Selling Association, which

represents the industry, surveyed a sample of direct selling

companies and estimated that there were $498.8 million in

Utah retail purchases in 2020.

17

Besides being a market for direct sellers, Utah is an established

industry hub, and a signicant portion of the $40.1 billion in

2020 direct selling nationwide originated in the state.

18

Utah’s

nationwide direct product sales far exceed those from within

the state. While Utah consumers accounted for 1.2% of U.S. retail

sales in the industry, Utah direct selling companies provided

over 10.0% of direct selling nationwide.

19

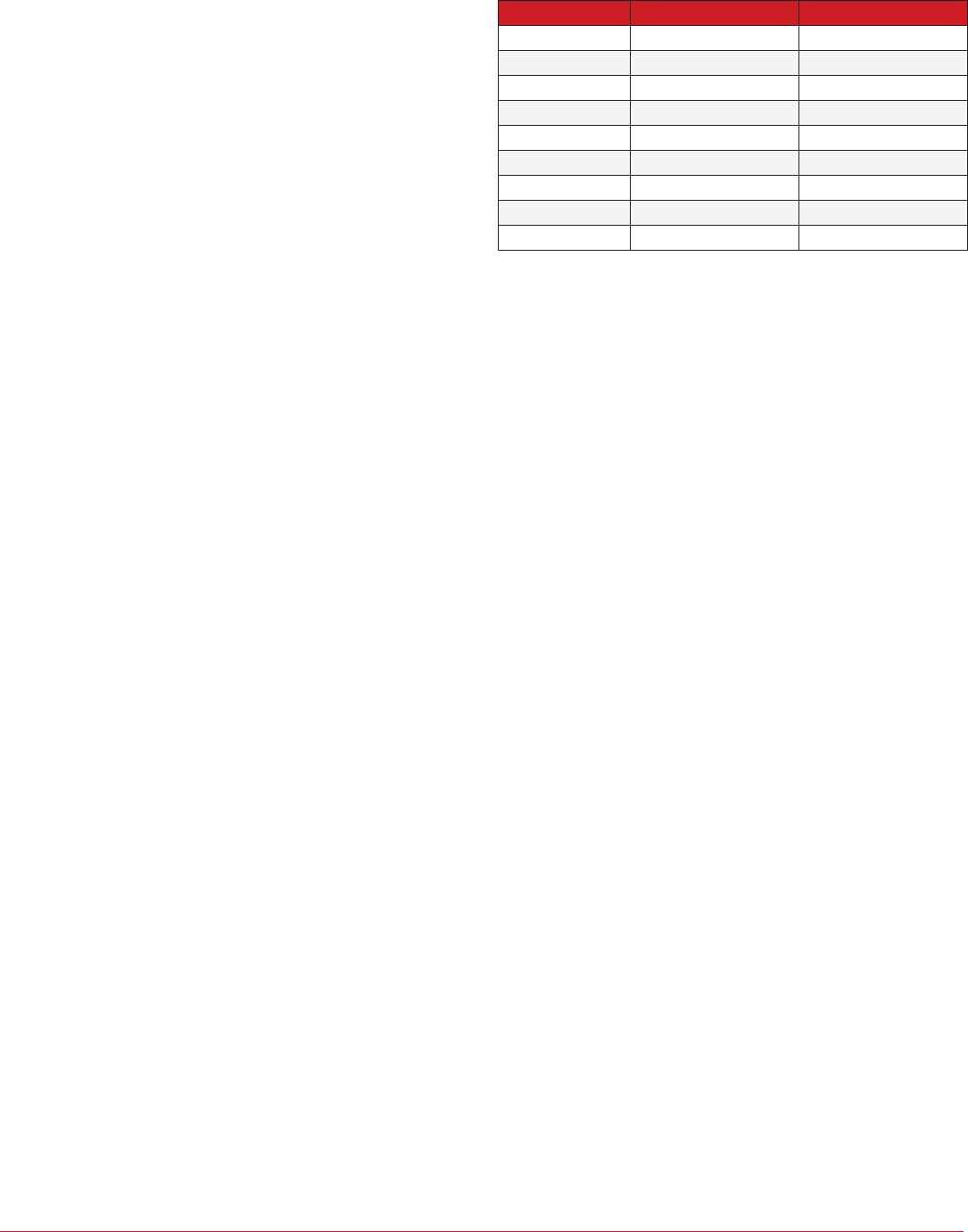

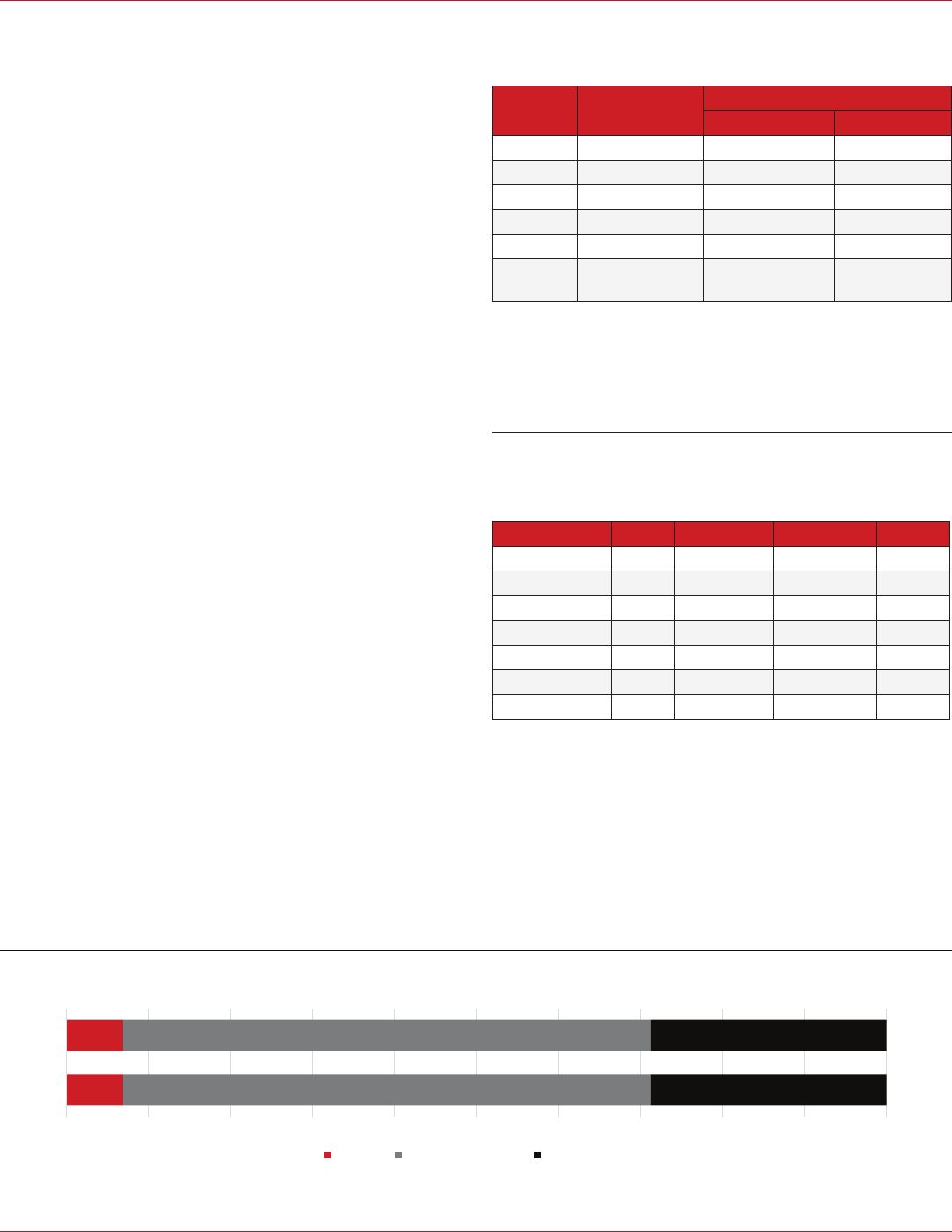

Section 3: Sales at Home and Abroad

Sales From Utah Direct Selling Companies Exceed $10

Billion, Mostly International Exports

Ten large Utah direct selling companies surveyed reported a

total of $10.3 billion in global sales during 2020, 3.0% of total

industry sales from Utah (see Table 7).

20

From a state with 0.04%

of the world’s population, these companies represented 6.1%

of the industry’s global sales of $168.3 billion.

21

Including all

companies in the industry, not just the 10 survey participants,

Utah direct selling companies generated substantially more

than 3.0% of statewide sales in all industries combined, and

more than 6.1% of global sales in the direct selling industry

itself.

22

Of total sales from the 10 companies surveyed, most

were international exports: 61.1% or $6.3 billion. In 2020,

these direct selling exports represented 35.6% of Utah’s total

international exports of $17.7 billion in commodities (see Figure

10).

23

Direct selling companies accounted for 71.7% of Utah’s

$8.8 billion in non-gold commodity exports. The remaining

38.9% of the selected companies’ global sales, $4.0 billion,

were domestic sales in Utah and other states. Total sales ranged

from $0.2 billion to $2.6 billion for individual companies, and

their international shares ranged from 13.3% to 90.6% of total

sales. The extent of out-of-state distribution from this Utah

Table 7: Sales by Destination for Selected Utah Direct

Selling Companies, 2020

(Billions of Dollars)

Destination Sales Share

Domestic (U.S.) $4.0 38.9%

International (Exports) $6.3 61.1%

Total $10.3 100.0%

Note: Data aggregated from the survey responses of 10 companies headquartered in Utah.

Source: Dorsey & Whitney LLP, 2021 direct selling industry survey

Figure 10: Exports from Utah Direct Selling

Companies, 2020

(Share of Statewide Exports for 10 Direct Selling Companies,

Which Reported a Combined $6.3 Billion in Exports)

Note: Commodities exclude services. Statewide gold exports were $8.9 billion.

Trade data not available for 81 of Utah’s 91 direct selling companies.

Source: Dorsey & Whitney LLP; U.S. Census Bureau, USA Trade Online

$53,782

$63,652

$0 $20,000 $40,000 $60,000 $80,000

Other Industries

Direct Selling Industry

71.7% 28.3%

35.6% 64.4%

0% 20% 40% 60% 80% 100%

Total Utah

Commodity Exports

Utah Non-Gold

Commodity Exports

Direct Selling Industry Other Industries

Direct impacts

(Direct selling)

Indirect and induced impacts

(Beyond the direct selling industry)

100.0%

($8.8 Billion)

100.0%

($17.7 Billion)

17,487

20,751

$1.329.9

$1,347.4

38,238 jobs

1.8% of Utah

employment

$2,677.3 million

2.2% of Utah

earnings

15 (16%)

4 (4%)

6 (7%)

9 (10%)

18 (20%)

51 (56%)

0 10 20 30 40 50 60

Other Products

Food & Beverages

Essential Oils

Services

Beauty & Fashion

Health & Wellness

15,497

15,828

16,707

16,784

17,487

18,697

19,543

19,891

0 5,000 10,000 15,000 20,000 25,000

Bldg. & Garden Retail

Metal Product Mfg.

Publishing

Federal Military

Direct Selling

Amusement & Rec.

Food Manufacturing

Accommodation

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

$200.0

State Local

$127.1

$64.3

Tax Revenues

Revenues

$191.4

$38.1

$8.5

Government

Operating Expenditures

$46.6

$89.0

$55.8

Net State and

Local Revenue

$144.7

225,155 (71.2%) 90,961(28.8%)

0 100,000 200,000 300,000

Domestic (U.S.) International

316,116

(100.0%)

August 2022

I

gardner.utah.edu INFORMED DECISIONS

TM

10

industry brings substantial income and employment into the

state. In contrast, in-state sales do not add signicant economic

impacts, although they are associated with economic activity

because resources are used and recirculated within the state.

The $4.0 billion in direct selling from these Utah companies

made up 10.0% of the estimated $40.1 billion in domestic sales

from all companies in the U.S. industry.

24

By the comparison, the

state’s share of nationwide GDP across all industries is just under

1%. This percentage understates Utah’s outsized participation in

the industry by all Utah direct selling companies. For example,

the 10 companies made up only 57.5% of total employment at

all 91 direct selling companies included in this report.

gardner.utah.edu

I

August 2022

INFORMED DECISIONS

TM

11

The direct selling industry’s network of independent

contractors connect with consumers and support product

distribution. These self-employed sales representatives

are more common in Utah than most other states. Typical

incomes, which vary widely by company and individual, are

below $10,000. People involved in direct selling in the U.S. are

disproportionately female, White, and Hispanic or Latino. Many

of these entrepreneurs fall within demographic cross-sections

with below-average incomes, rates of business ownership,

and labor-force participation. As of 2020, nearly 230,000 non-

employee sales representatives and discount buyers in Utah

were involved with direct selling companies. Worldwide, direct

selling companies headquartered in Utah had at least 4.9

million independent sales representatives.

Direct Selling Terms

People involved in direct selling include sales representatives

and discount buyers, each dened below. This nomenclature

for industry participants who are not employees follows

the conventions of the Direct Selling Association (DSA), a

nationwide industry advocate and trade association.

Sales representatives are people who create a business selling

consumer goods or services, either alone or with their

team. They are independent contractors, not employees of

direct selling companies. Sales representatives may also be

called direct sellers, aliates, participants, distributors, or

consultants.

Discount buyers or preferred customers are the terms

the industry uses to describe customers who purchase

products and services at a discount and do not participate

in the business opportunity. Discount buyers have

signed an agreement that makes them eligible to sell to

consumers and sponsor team members. In their responses

to DSA’s Growth and Outlook Survey, companies often do

not distinguish between active sales representatives and

discount buyers eligible to sell who have $0 in current-

year sales.

25

For example, just under one-third of sales

representatives who are independent contractors for a

large Utah company documented any sales in 2020.

Employees at direct selling companies are counted sepa-

rately from self-employed sales representatives or other

people involved in direct selling. Sections 1 and 2 provide

employment measures for the direct selling industry.

Section 4: Sales Representatives

People Involved in Direct Selling: Nearly 230,000

Sales Representatives and Discount Buyers in Utah

Direct selling companies provide opportunities for self-

employed independent contractors throughout the state.

In 2020, besides direct selling employees, an estimated

229,797 people in Utah participated in the industry as sales

representatives (independent contractors operating their own

businesses) or discount buyers (preferred customers who do

not make sales), together 9.9% of the adult population reported

by the U.S. Census Bureau (Direct Selling Association, 2021b).

Utah’s share was well above the national average of 6.5%, and

Utah ranks ninth among all states and DC in this regard.

26

Several large companies headquartered in Utah responded

to a 2021 industry survey conducted for this study. According

to responses, nine Utah direct selling companies created

entrepreneurship opportunities for 21,457 in-state sales

representatives in 2020 (see Table 8), 9.3% of the estimated

statewide total of 229,797 sales representatives and discount

buyers.

27

One company had at least one sales representative

in every county of the state, and more than 100 jobs for sales

representatives in six Utah counties.

28

The vast majority of independent sales representatives who

contract with Utah direct selling companies surveyed lived

and worked outside the state. In 2020, nearly 4.9 million sales

representatives were aliated with nine large Utah companies

that responded to an industry survey.

29

Three-fourths of these

independent direct sellers were outside the U.S., 3.7 million;

one-fourth were in the U.S., 1.2 million sales representatives.

Less than 1% of the global sales force lived and worked in Utah.

Table 8: Sales Representatives for Selected Utah Direct

Selling Companies, 2020

Location Independent Sales Representatives Share

Utah 21,457 0.4%

Other States 1,195,861 24.6%

International 3,634,667 74.9%

Total 4,851,985 100.0%

Note: Sales representatives are independent contractors who are self-employed. Data

represents nine companies with a combined $7.9 billion in global sales. One company

provided Utah and U.S. counts without information on any international sales

representatives the company may have had.

Source: Dorsey & Whitney LLP, 2021 direct selling industry survey

August 2022

I

gardner.utah.edu INFORMED DECISIONS

TM

12

Self-Employment Income as Independent Sales

Representatives Varies

Six Utah direct selling companies with a combined $4.9 billion

in global sales reported the income earned by their in-state sales

representatives.

30

In 2020, their 15,322 sales representatives

earned a collective $94.8 million in documented commissions

and related income. The mean of annual earnings from direct

selling (before expenses) was $6,186 per representative, and

company-specic means ranged from $574 to $10,650 per

representative.

31

Naturally, top performers inuenced these

means: company medians for their sales representatives’ annual

earnings ranged from $70 to $3,000 before expenses. Companies’

income disclosure statements provide further details.

32

A prior nationwide survey noted direct selling income

variability, with 7% of sales representatives reaching

cumulative prots above $10,000, and 47% losing money

by their participation over the years before 2017, after

subtracting expenses.

33

In a position as exible as that of an

independent contractor, the time and eort they devote to

selling varies widely by sales representative. Moreover, many

sales representatives purchase products primarily for personal

use rather than developing their networks and promoting the

goods and services of direct selling companies.

Direct Seller Demographics: Nationwide Participation

Among Women and Racial and Ethnic Groups

Direct selling companies oer exible entrepreneurial

opportunities that attract independent sales representatives

from broad Utah demographic groups, including those with low

incomes and below-average rates of business ownership and