For tax assistance or to request this document in an alternate format, visit http://dor.wa.gov or call 360-705-6705. Teletype (TTY) users

may call 360-705-6718.

REV 41 0100 (6/25/19)

Renewable Energy System Cost Recovery

Annual Incentive Payment Application

Fiscal year: July 1, 20 - June 30, 20 .

First, contact the utility serving your property to confirm it is participating in this

program and to receive its application procedures for this incentive payment.

Due to your light and power business by August 1.

DOR Account ID:

Light and Power Company Account No:

Applicant Name:

Mailing Address:

City: State: Zip Code:

Telephone No:

Address of Renewable Energy System:

(If different from address above)

City: State: Zip Code:

Date of the letter from the Department of Revenue certifying that your renewable energy system is eligible for the

incentive payment. (Please attach a copy of the letter and certification form.)

Amount of kilowatt-hours generated by the renewable energy system for fiscal year ending June 30, 20 .

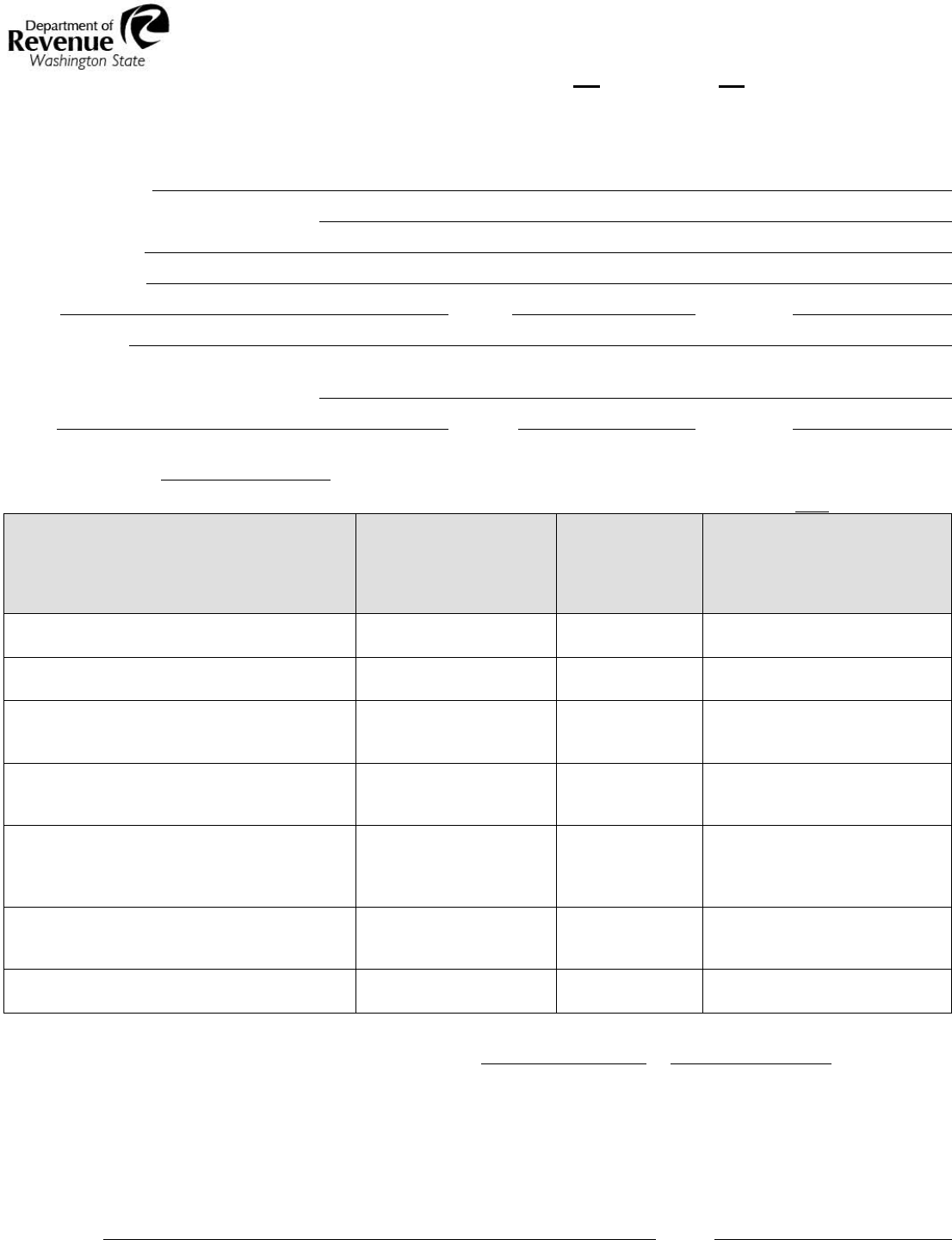

Customer-generated power

applicable rates

Base rate (0.15)

multiplied by

applicable factor,

equals incentive

payment rate

Kilowatt-hours

generated

Incentive payment amount

equals incentive payment

rate multiplied by kilowatt-

hours generated

Total may not exceed $5,000

Solar modules manufactured in Washington

Factor: 2.4 (two and four-tenths)

$0.36

Stirling converter manufactured in Washington

Factor: 2.4 (two and four-tenths)

$0.36

Solar or wind generating equipment with an

inverter manufactured in Washington

Factor: 1.2 (one and two-tenths)

$0.18

Both solar modules and inverter

manufactured in Washington

Factor: (2.4 + 1.2) = 3.6 (three and six-tenths)

$0.54

Anaerobic digester or other solar equipment

or wind generator equipped with blades

manufactured in Washington

Factor: 1.0 (one)

$0.15

Wind generator equipped with both blades

and inverter manufactured in Washington

Factor: (1.0 + 1.2) = 2.2 (two and two-tenths)

$0.33

All other electricity produced by wind

Factor: 0.8 (eight-tenths)

$0.12

I acknowledge that my renewable energy system:

Has been operable throughout the fiscal period, from to .

(date) (date)

Will have reasonable access for my light and power business, allowing them to read my electric production

meter in order to calculate the kilowatt-hours generated during the prior fiscal year beginning July 1 and ending

on June 30.

I understand that this information is provided to the Department of Revenue in determining whether the light and power

business correctly calculates its credit allowed for customer incentive payments and that my statements are true,

complete, and correct to the best of my knowledge and belief under penalty of perjury.

Signature:

Date:

Print This Form

Reset This Form