Inflation Reduction Act of 2022 Fact Sheet

Clean Energy Tax Incentives Relevant to U.S. Real Estate

July 31, 2023

1

President Biden signed the

Inflation Reduction Act of 2022

(IRA) into law on August 16, 2022. The

legislation will invest almost $370 billion over 10 years to tackle the climate crisis.

A number of the IRA’s changes to the federal tax code may help the U.S. real estate sector reduce its

carbon footprint, particularly:

•

A deduction to help make commercial and multifamily buildings more energy efficient (Section 179D);

•

A credit to encourage investments in renewable energy generation, storage, and other “clean

energy” technologies sited at buildings and other facilities (Section 48);

•

A credit to incentivize the installation of EV charging stations (Section 30C); and

•

A credit to incentivize energy-efficient new residential construction, including multifamily (Section

45L).

The Real Estate Roundtable (RER) has encouraged Congress for a number of years to make clean energy

tax incentives more usable for building owners, managers, and financiers—and more impactful to help

meet national GHG reduction goals. Below is our summary of key IRA provisions.

179D Tax Deduction for Energy Efficient Buildings

Amount of Deduction

•

The 179D deduction amount is on a “sliding scale.”

o

Amount increases with higher levels of building efficiency.

o

Minimum efficiency gain eligible for the deduction: 25%, pegged to a minimum deduction

amount of 50 cents per building ft

2

.

o

Each percentage point increase in building efficiency correlates to a 2-cent increase in the

deduction amount.

Inflation Reduction Act of 2022 Fact Sheet

Clean Energy Tax Incentives Relevant to U.S. Real Estate

July 31, 2023

2

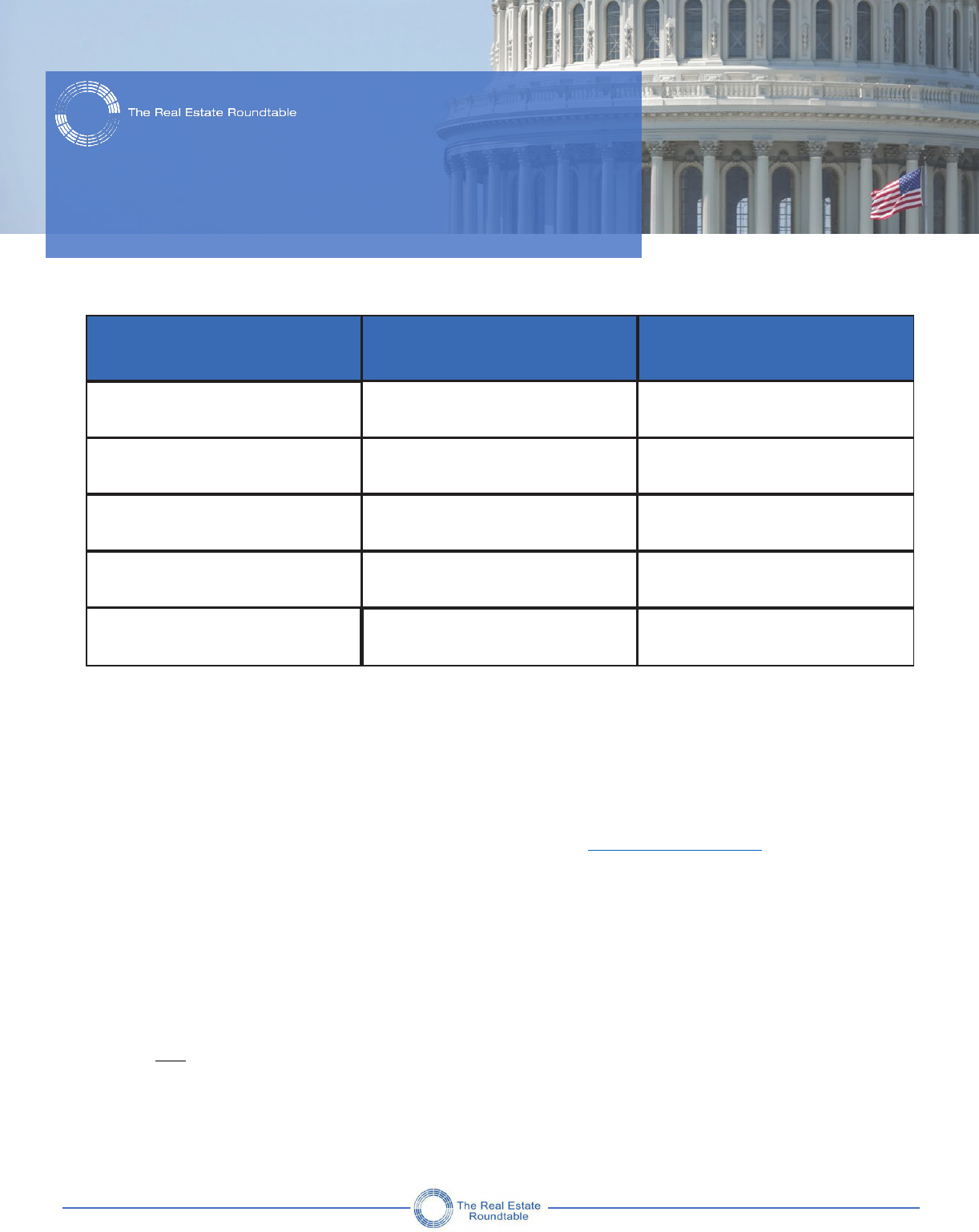

Efficiency Gain Over

Baseline

Deduction Amount

Base Rate

Labor Standards “Bonus

Rate”

25%

(minimum)

50 cents per

ft

2

$2.50 per

ft

2

30%

60 cents per

ft

2

$3.00 per

ft

2

35%

70 cents per

ft

2

$3.50 per

ft

2

40%

80 cents per

ft

2

$4.00 per

ft

2

50%

(maximum)

$1.00 per

ft

2

$5.00 per

ft

2

•

179D deduction amount increases five times if the building project meets labor standards that: (1)

pay “prevailing wages” to laborers that “install” equipment; and (2) satisfy “apprenticeship” hiring

requirements.

o

IRA’s general approach: Projects meeting labor standards are eligible for “Bonus”

incentives that are five times more than “Base” incentives.

o

See prevailing wage and apprenticeship guidance (published by the IRS on Nov. 30,

2022)

179D is a “deduction” – not a “credit.”

• 179D effectively works as a form of “accelerated depreciation” for energy efficient building

“property” – as long as the property achieves the “efficiency gain” performance standard

along the sliding scale in the table above.

• 179D is not a tax “credit” and does not reduce a company’s tax liability dollar-for-dollar.

Inflation Reduction Act of 2022 Fact Sheet

Clean Energy Tax Incentives Relevant to U.S. Real Estate

July 31, 2023

3

Eligible Energy Efficient “Property”

•

Projects to achieve whole-building efficiency gains through installations of any combination of:

o

Interior lighting (not “exterior”)

o

HVAC and hot water systems

o

Envelope (roof, windows, insulation)

Timing

•

IRA sliding scale amounts apply to energy efficient property “placed in service” after December 31,

2022.

•

No sunset for this deduction. 179D became a permanent part of the tax code in December 2022.

Eligible Building Types

•

Any building within the scope of the ASHRAE 90.1 energy standard – which covers commercial

buildings, and larger multifamily buildings with four floors or more (not “low-rise” multifamily).

General 179D Baseline for New Construction

•

New construction must model at least 25% more efficient over the ASHRAE 90.1 baseline to

qualify for an incentive on the sliding scale.

•

The 2007 version of ASHRAE 90.1 provides 179D’s general baseline for equipment “placed in

service” up to Dec. 31, 2026 (see IRS guidance published on Dec. 23, 2020).

•

The 2019 version of ASHRAE 90.1 will provide 179D’s general baseline for equipment “placed in

service” on or after Jan. 1, 2027.

Retrofits—Section 179D(f) “Alternative Deduction”

•

Retrofit baseline: The building’s own specific level of pre-retrofit site energy usage intensity (EUI).

o

Post-retrofit site EUI reductions of at least 25% are measured against the pre-retrofit baseline

to determine the “sliding scale” incentive amount.

•

A building must be five years or older to qualify for 179D(f)’s retrofit path.

•

Project must be set forth in a “qualified retrofit plan” certified by a professional

engineer or registered architect.

o

No requirement that the government review or approve the qualified retrofit plan.

Inflation Reduction Act of 2022 Fact Sheet

Clean Energy Tax Incentives Relevant to U.S. Real Estate

July 31, 2023

4

•

Taxpayer must wait to claim the retrofit deduction at least one year after the equipment

is in service and the project results in anticipated site EUI reductions of at least 25%.

o

Taxpayer cannot claim the retrofit deduction in the year it buys or installs equipment.

o

Architect/engineer must make a “final certification” of site EUI at least one year

after the retrofit plan is implemented to show the requisite level of efficiency

gain.

•

179D(f) retrofit deduction amount and cap:

o

Uses the same sliding scale in the table on pg. 1

o

The deduction amount increases with greater efficiency gains proved-out in the retrofit

plan’s “final certification.”

o

The deduction amount is capped at the retrofit plan’s cost (i.e., “aggregate adjusted

basis…of energy efficient building retrofit property placed in service”).

Deduction Reset

•

The 179D deduction can apply to a specific building every 3 years (or every 4 years in the

case of a building owned by a governmental or tribal body, or a non-profit organization).

REITs

•

Includes earnings and profits (E&P) “conformity” accounting fix.

o

179D deduction amount fully reduces E&P in the year that the energy efficiency

components are installed or, in the case of a retrofit, in the year that site EUI

reductions are proven and “certified” (not ratably over a five-year period, as prior

law required).

o

REITs and their shareholders may thus receive a fuller and more immediate financial

benefit by claiming the 179D deduction.

Relationship to Low-Income Housing Tax Credits (LIHTCs)

•

179D Deduction amounts do reduce basis in LIHTC properties

o

Note different treatment for Section 48 tax credit that does not reduce LIHTC

basis.

o

Bipartisan LIHTC reform legislation pending in Congress would not reduce LIHTC

basis under 179D (section 309 of S. 1557/H.R. 3238).

Inflation Reduction Act of 2022 Fact Sheet

Clean Energy Tax Incentives Relevant to U.S. Real Estate

July 31, 2023

5

Section 48 Investment Tax Credit

Types of Projects

•

“Energy Property” covered by prior law: solar to generate electricity for heating or cooling; fiber-

optic solar to illuminate the inside of a structure; “small wind” and microturbines; geothermal used

to produce electricity; geothermal heat pumps to heat or cool a structure; fuel cells; waste recovery;

and combined heat and power.

•

IRA adds: energy storage (including thermal energy storage); dynamic glass; microgrid

controllers; biogas property; linear generators; and “interconnection property” to the electric

grid.

Base and Bonus Rate ITC Credit Amount (see also separate RER chart on “Base and Bonus Rate

Amounts”)

•

6% of the cost of the Energy Property (“Base Rate”).

•

Can scale up to 30% of cost (“Bonus Rate”) if project pays prevailing wages and

meets apprenticeship requirements for the duration of the project’s

“construction.”

o Except for microturbines: 2% “Base Rate” and 10% “Bonus Rate.”

•

“Small solar” and other projects that generate less than one MW of electricity can qualify at

the 30% “Bonus Rate” even if they do not meet wage and apprenticeship standards.

•

Credit amount increased by 2% if project meets “domestic content requirements” (i.e.,

iron, steel, manufactured products are made in the USA). See also IRS Notice 2023-38

(May 12, 2023)

o Boost to 10% if prevailing wage/apprenticeship standards are met.

•

Credit amount increased by 2% if project is located in an “energy community” (i.e.,

Brownfield site, census tract [or immediately adjacent tract] where a coal mine closed

after Dec. 31, 1999, or coal-fired electric plant was retired after Dec. 31, 2009). See also IRS

Notice 2023-29

o Boost to 10% if prevailing wage/apprenticeship standards are met.

Inflation Reduction Act of 2022 Fact Sheet

Clean Energy Tax Incentives Relevant to U.S. Real Estate

July 31, 2023

6

Low-Income Housing and Communities – See also IRS Notice 2023-17 (Feb. 13, 2023)

•

Any credit amounts under Sections 48, 48E, or 45Y do not reduce the basis of buildings supported

by Section 42 LIHTCs.

•

20% credit boost for solar and wind projects, generating less than 5 MW, installed “on” low-income

housing buildings (such as those supported by LIHTCs).

•

10% credit boost for solar and wind projects, generating less than 5 MW, located in census tracts

eligible for New Markets Tax Credits (NMTCs).

•

Section 48 credit increases for low-income housing and communities are competitive. They are

capped at annual capacity limits, require an application to US-DOE, and approval by Treasury/IRS.

Timing and Switch to “Technology Neutral” Tax Credits

•

Generally: Section 48 project construction must commence in 2023 or 2024.

o Except for geothermal heat pumps: Construction must commence through 2034.

o Tax credit starts to scale down for geothermal heat pumps constructed in 2033 and 2034.

•

For Section 48 projects constructed after Jan 1, 2025:

o

Transition to the technology-neutral “Clean Electricity Production Credit” (Section 45Y) or

the “Clean Electricity Investment Credit” (Section 48E).

Taxpayer to opt for either the 45Y PTC or the 48E ITC.

Credits start to phase out by 2032 or when the electric power sector emits

75% less carbon than 2022 levels (whichever comes later).

o

Section 45Y PTC or Section 48E ITC is available for any “zero carbon” electricity

facility or technology.

45Y PTC = tax credit per kWh of “zero carbon” electricity produced and sold in

the 10- year period after the facility is placed in service.

• Base Rate of .5 cents per kWh.

• Bonus Rate of 2.5 cents per kWh (if prevailing wage/apprenticeship standards are met).

48E ITC = tax credit based on same Base Rate and Bonus Rate structure discussed above.

Inflation Reduction Act of 2022 Fact Sheet

Clean Energy Tax Incentives Relevant to U.S. Real Estate

July 31, 2023

7

• Base Rate: 6% of the cost investment in the “zero carbon” facility.

• Bonus Rate: 30% of the cost of investment in the facility (if prevailing

wage/ apprenticeship standards are met).

5-year depreciation for any qualifying “zero carbon” 45Y facility or 48E property.

30C Tax Credit for EV Charging Stations

•

Extended through 2032.

•

Same Base Rate (6%) and Bonus Rate (30%, if labor standards are met) structure discussed above.

•

Credit capped at $100K for each charging station or refueling pump installed at a property.

•

Third-party “transferability” applies.

•

Geographic limitations—charging station must be located in either:

o A low-income or high-poverty Census tract under New Markets Tax Credit (NMTC) criteria

(see NMTC tracking tool); or

o Not an "urban area" as defined by the U.S. Census Bureau. Guidance ideally forthcoming here.

Section 45L "New Energy Efficient Home" Tax Credit

Duration and Building Eligibility

•

Extended through 2032.

•

Pertains to new construction and “substantial rehabilitation.”

•

All residential buildings—single-family and multifamily—are eligible.

•

Multifamily and apartment buildings that are 4 floors or more can also qualify for

the Section 179D tax deduction discussed above (as they are in the scope of

ASHRAE 90.1 standard).

Primary Use of Building

•

Must be “residential.”

Inflation Reduction Act of 2022 Fact Sheet

Clean Energy Tax Incentives Relevant to U.S. Real Estate

July 31, 2023

8

•

Mixed-use buildings: “Dwelling” units and common space (excluding parking garages)

must exceed 50% of the building’s square footage.

For Multifamily Homes

•

Credit applies to “dwelling units” in a “building” eligible for EPA’s ENERGY STAR

“Multifamily New Construction Program.”

•

“Dwelling unit” must meet both:

o EPA’s most recent National Program Requirements; and

o Any applicable EPA regional program requirements (e.g., California)

Credit Amounts

•

Credits are “per unit” in a qualifying multifamily building.

o Increased amount if the unit meets U.S.-DOE’s Zero Energy Ready Home Multifamily

Program (in development).

o For single family: Increased credit amount if the home is certified by U.S.-DOE as

a “Zero Energy Ready Home.”

•

5x “Bonus Rate” if prevailing wage requirements are met.

o No apprenticeship hiring requirement for multifamily “Bonus Rate.”

o No prevailing wage “Bonus Rate” for single family.

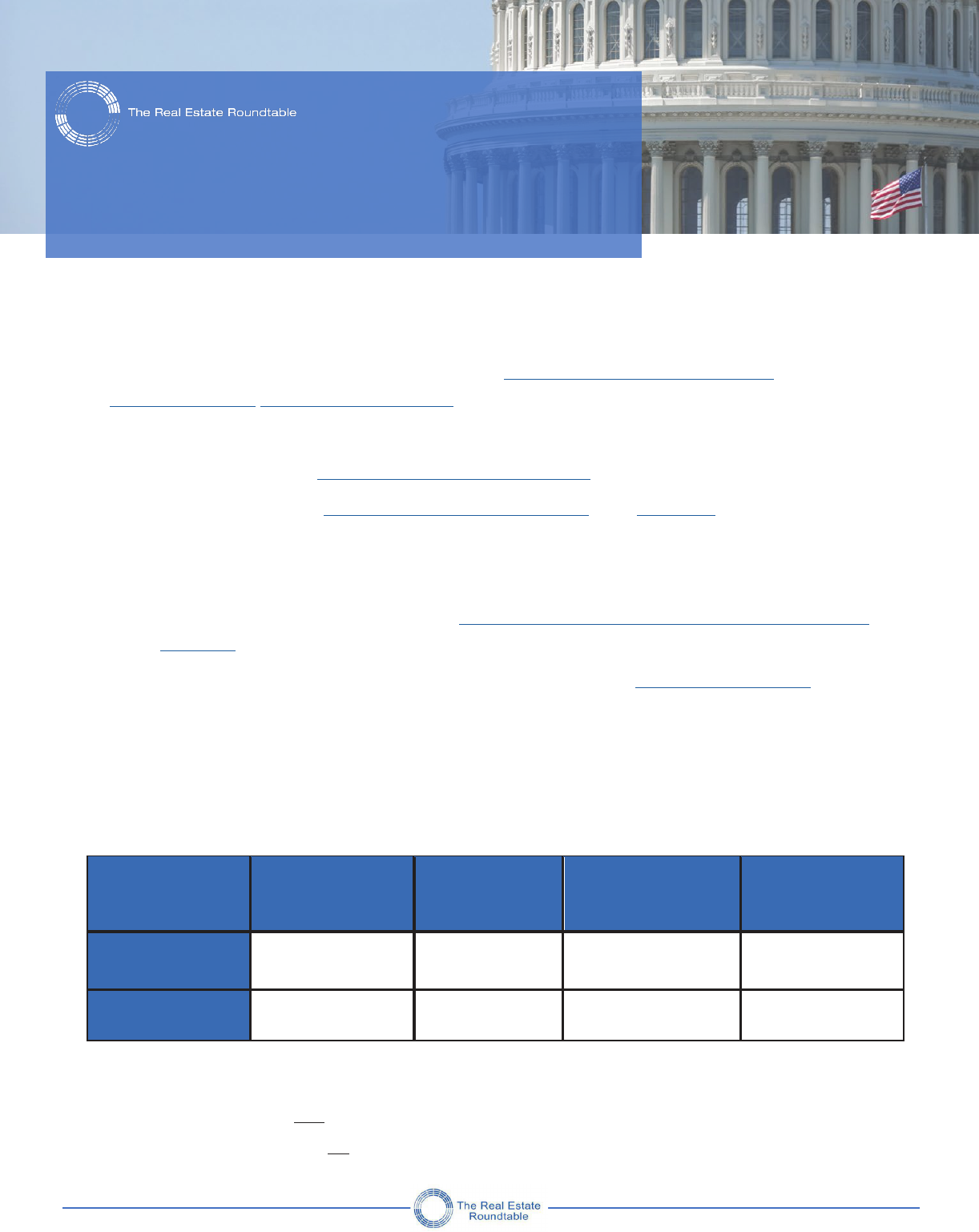

Base

Base

Zero Energy

Bonus

Bonus

Zero

Energy

Multifamily

$500

$1,000

$2,500

$5,00

0

Single-Family

$2,50

0

$5,000

n/a

n/a

Low-Income Housing

•

45L credit amounts do

not

reduce the basis of buildings supported by Section 42 LIHTCs.

•

However, 179D deductions

do

reduce the basis of LIHTC buildings.

Inflation Reduction Act of 2022 Fact Sheet

Clean Energy Tax Incentives Relevant to U.S. Real Estate

July 31, 2023

9

Credit Transfers Allowed To Third Parties

•

Companies with little or no tax liability that cannot typically benefit from tax credits—like REITs—

have the option to “transfer” certain IRA credits to another taxpaying entity that can use them.

•

REITs, etc., can transfer the full or partial amount of a credit.

o Transferability allowed for credits under Sections 30C, 45Y, 48, and 48E.

o Transferability is

not

allowed for the Section 45L credit.

o Transferability of 179D (called an “allocation”) is only allowed by government, tribal, and

non-profit building owners. They can allocate the deduction to architects and designers

responsible for the building project. 179D transfer is

not

allowed by private sector, for-profit

building owners.

•

The recipient of the credit (the “transferee taxpayer”) must pay for the credit “in cash.”

o Joint Committee on Taxation report (JCX-5-23) at p. 98): Transferee taxpayer bears “recapture

risk.”

o That is, the buyer of tax credits is responsible to payback any credit amounts if the property

ceases to be used to generate solar, wind, used for storage, EV charging, etc.

o To create a robust market for IRA credits, transferee buyers will likely require contractual

indemnities and other protections from building owner taxpayers upon the sale of credits.

•

The “transferee taxpayer” must be unrelated to the company making the transfer.

•

Transferred credit amounts are not “income” to the company making the transfer.

•

Transferred credit amounts are not deductible by the “transferee taxpayer.”

•

REITs can transfer the full amount of the credit.

The Real Estate Roundtable (RER) does not intend this communication to be a solicitation related to any particular company, nor does it intend to provide investment,

legal, or tax advice. Nothing herein should be construed to be an endorsement by RER of any specific company or products as an offer to sell or a solicitation to buy any

security or other financial instrument or to participate in any trading strategy. RER expressly disclaims any liability for the accuracy, timeliness, or completeness of

data in this publication.

Inflation Reduction Act of 2022 Fact Sheet

Clean Energy Tax Incentives Relevant to U.S. Real Estate

July 31, 2023

10

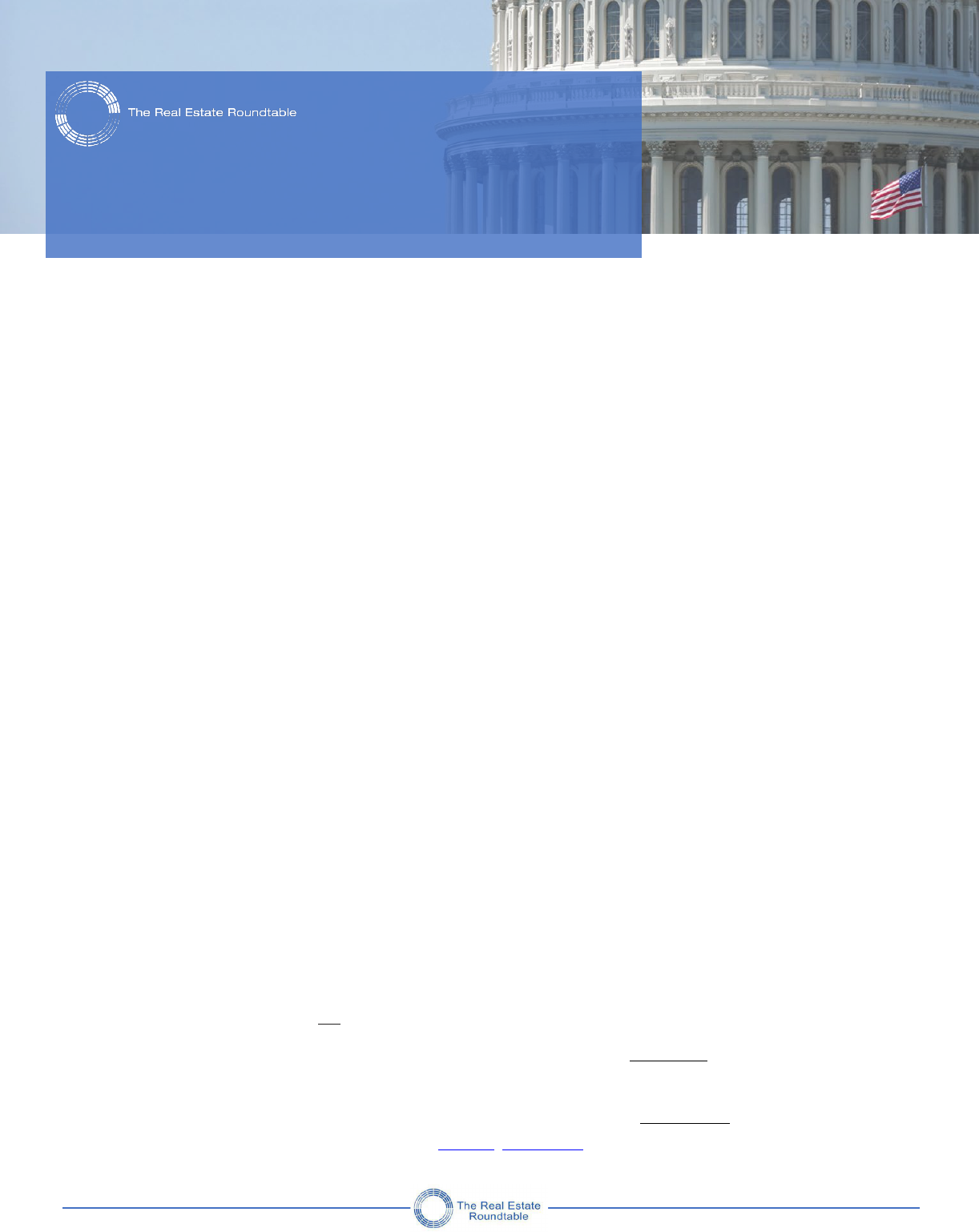

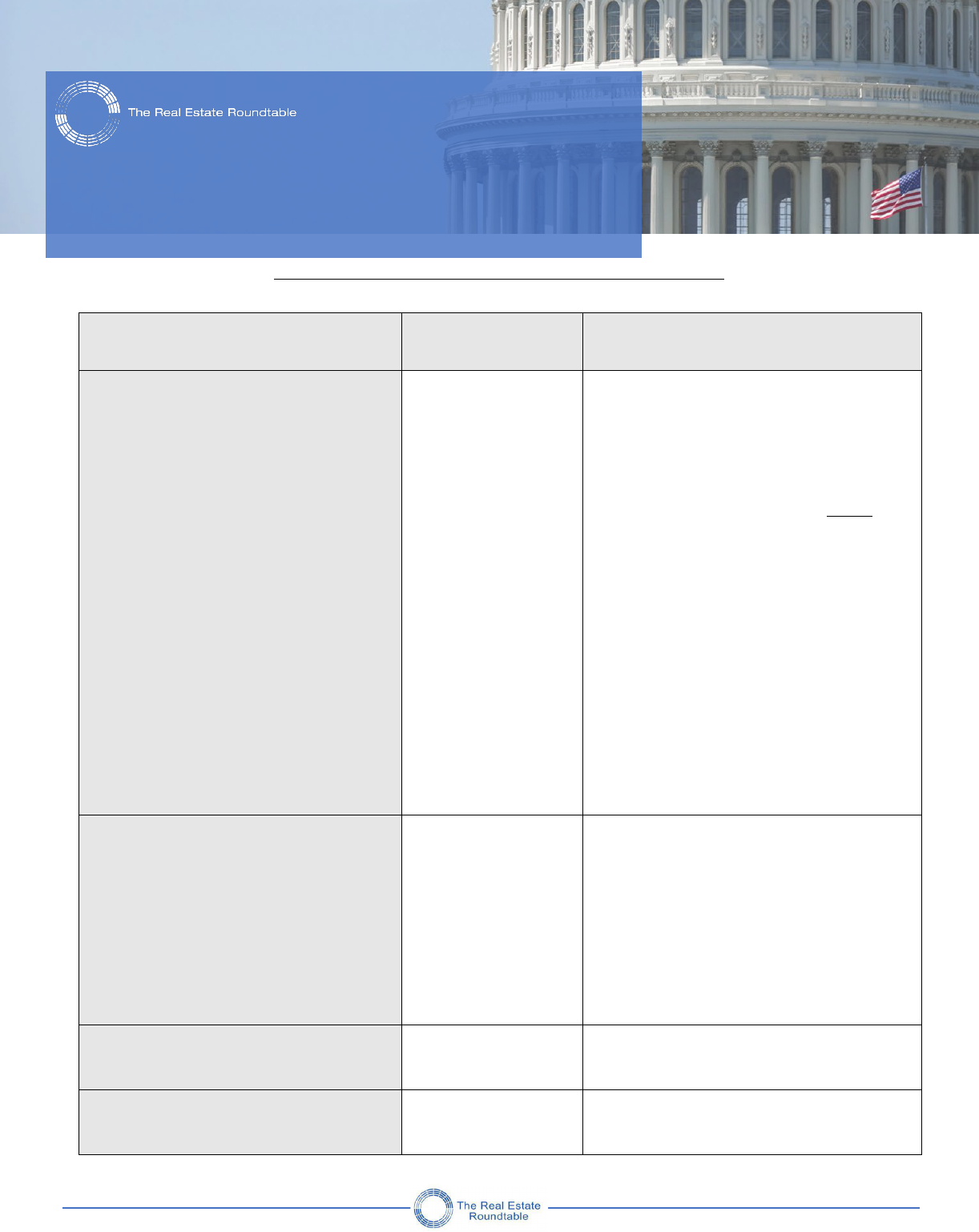

Who Can Buy and Sell IRA Tax Credits -- Summary

IRA Tax

Incentive

Direct Pay from

U.S. Government

Optional Transfer of Incentive

•

179D Tax Deduction for Energy

Efficient Commercial and Larger

Multifamily Buildings

Not allowed

Who can transfer:

•

Only specified “tax-exempt entities” that

own buildings can “allocate” 179D amounts.

•

This includes federal/state/local

government, tribal, and non-profit building

owners.

•

Private sector building owners

cannot

transfer 179D amounts.

Who can receive:

•

Only the “person primarily responsible for

designing” the energy-efficient property

can receive allocated 179D amounts.

•

E.g., Architects, engineers,

efficiency contractors/consultants

NOTE:

Earnings and Profits “conformity” for

REITs—i.e., full amount of 179D deduction

reduces E&P in the same year that the REIT

claims the deduction.

•

Section 48 Investment Tax Credit

(projects constructed in 2023 or 2024)

•

Section 48E Clean Electricity

Investment Tax Credit (projects

constructed in 2025 or later)

•

Section 45Y Clean Electricity

Production Tax Credit (projects

constructed in 2025 or later)

Direct pay eligibility

limited to state/local

governments, tribes,

rural electric coops.,and

non-profits.

Who can transfer:

•

All business taxpayers that are not eligible

for “direct pay.”

•

E.g., REITs, partnerships, corporations

Who can receive:

•

Any unrelated third-party that pays taxes

(the “transferee taxpayer”), and that buys

the credit amount “in cash.”

•

Section 30C EV Charging Station Tax

Credit

Same as immediately

above for Section 48

ITC, etc.

Same as immediately above for Section 48 ITC,

etc.

•

45L Tax Credit for New Energy

Efficient Homes (Single- and

Multifamily eligibility)

Not allowed

Not allowed