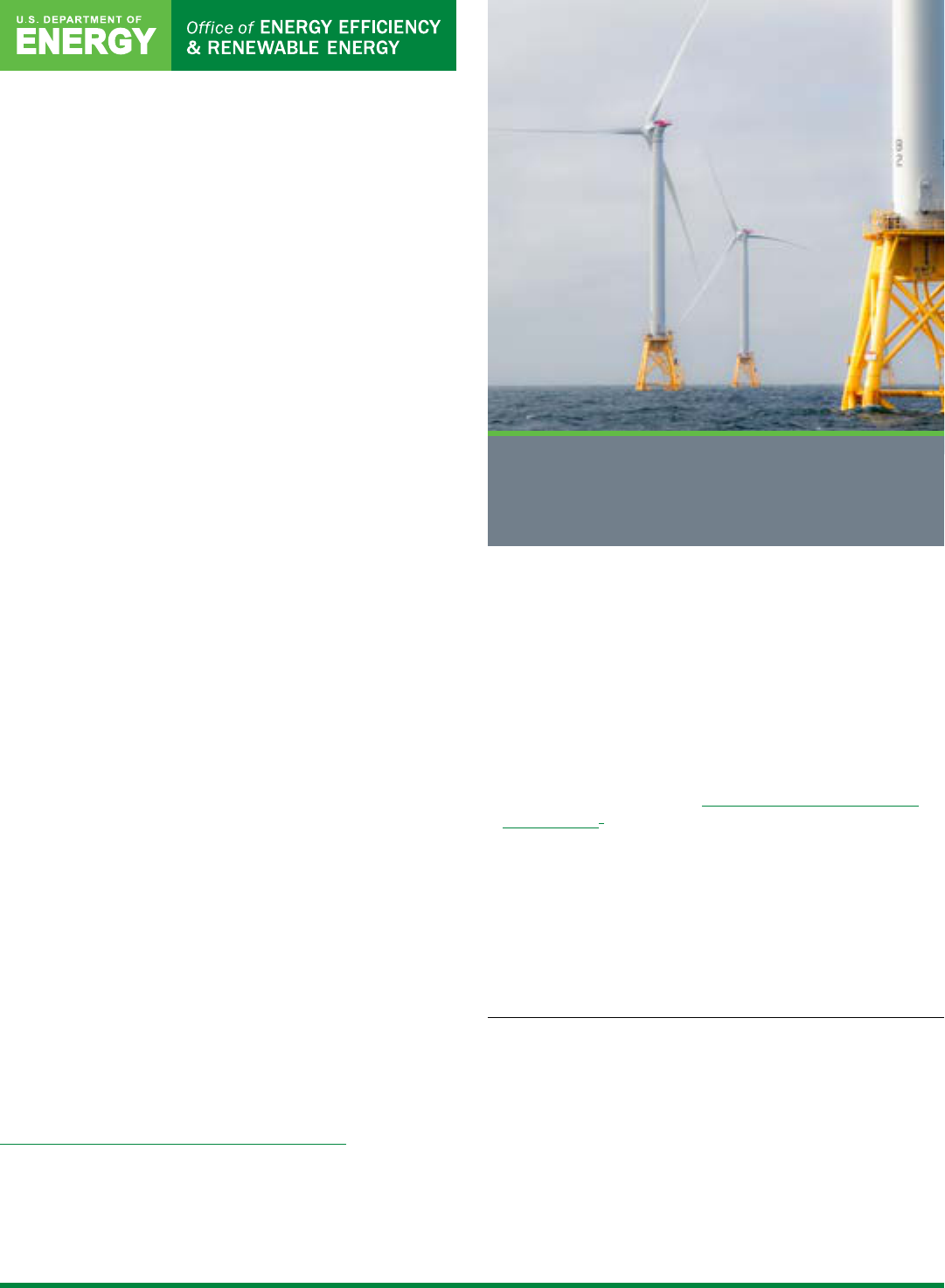

The Block Island Wind Farm, the rst U.S. offshore wind farm,

represents the launch of an industry that has the potential

to contribute signicantly to a reliable, stable, and affordable

energy mix.

Photo by Dennis Schroeder, NREL 41193

Advancing the Growth of the

U.S. Wind Industry: Federal

Incentives, Funding, and

Partnership Opportunities

Wind power is a burgeoning power source in the U.S.

electricity portfolio, supplying more than 10% of U.S.

electricity generation.

The U.S. Department of Energy’s (DOE’s) Wind

Energy Technologies Ofce (WETO) focuses on

enabling industry growth and U.S. competitiveness by

supporting early-stage research on technologies that

enhance energy affordability, reliability, and resilience

and strengthen U.S. energy security, economic growth,

and environmental quality. Outlined below are the

primary federal incentives for developing and investing

in wind power, resources for funding wind power, and

opportunities to partner with DOE and other federal

agencies on efforts to move the U.S. wind energy

industry forward.

Incentives for Project Developers and Investors

To stimulate the deployment of renewable energy technologies,

including wind energy, the federal government provides

incentives for private investment, including tax credits and

nancing mechanisms such as tax-exempt bonds, loan guarantee

programs, and low-interest loans.

Tax Credits

The Ination Reduction Act (IRA), which became law on

August 16, 2022, extends and increases tax credits for wind

energy projects that begin construction prior to January 1, 2025.

Starting in 2025, the IRA converts energy tax credits into

emissions-based, technology-neutral tax credits available to

all types of power facilities with zero or net-negative carbon

emissions. The IRA begins phasing out either in 2032 or when

total greenhouse gas emissions in the power sector decline to at

least 75% below 2022 levels—whichever comes last.

To receive the increased credit amount, projects that began

construction on or after January 29, 2023 must satisfy

apprenticeship and prevailing wage requirements. A full

exception to this applies to small facilities, which must either

meet the prevailing wage and apprenticeship requirements

or have a maximum net output of less than 1 megawatt to

receive the increased credit amount. The base credit amount

for large projects that do not meet the wage and apprenticeship

requirements is 20% of the full credit amount.

Additionally, under the IRA, projects can receive stackable bonus

credits for any or all of the following:

• 10% for meeting domestic manufacturing thresholds of 100%

domestic steel or iron and 40% domestically-manufactured

components for land-based wind or 20% domestically-

manufactured components for offshore wind

1

• 10% for locating facilities in fossil-fuel-powered communities or

browneld sites

2

• 10% for locating projects less than 5 megawatts in low-income

communities or on tribal lands, or 20% for a low-income

residential building or economic benet project.

3

Finally, for some projects, the IRA allows entities to transfer

credits to another taxpayer and authorizes direct payments for

tax-exempt entities such as nonprot organizations, electric

cooperatives, and tribes.

1 Through 2024. Domestically-manufactured component requirements grow to 55% in

2027 for land-based wind and in 2028 for offshore wind.

2 https://www.irs.gov/pub/irs-drop/n-23-29.pdf

3 For facilities under 5 MW, 1.8 gigawatts per year of additional allocated environmental

justice bonus credits are available for:

• Locating facilities in low-income communities (10 percentage points)

• Locating facilities on tribal lands (10 percentage points)

• Locating facilities as part of a low-income residential building project (20 percentage

points)

• Locating facilities as part of a low-income economic benet project (20 percentage

points).

The environmental justice bonus credits are stackable with the other domestic content

and energy community bonuses noted above but are not stackable with each other.

Renewable Electricity Production Tax Credit (PTC)—The

PTC allows owners and developers of wind energy facilities

(land based and offshore) to claim a federal income tax credit on

every kilowatt-hour (kWh) of electricity supplied to the power

grid annually for a period of 10 years after a facility is placed

into service.

The IRA extends through 2024 the PTC, which previously

expired for wind at the end of 2021. Wind projects placed in

service after 2024 are eligible for a technology-neutral clean

energy PTC of the same value.

Utility-scale wind projects placed into service after Dec. 31,

2021, that satisfy the new wage and apprenticeship requirements

will receive an ination-adjusted credit of 2.6 cents per kWh for

the rst 10 years of electricity generation.

Projects placed into service on or before Dec. 31, 2021, remain

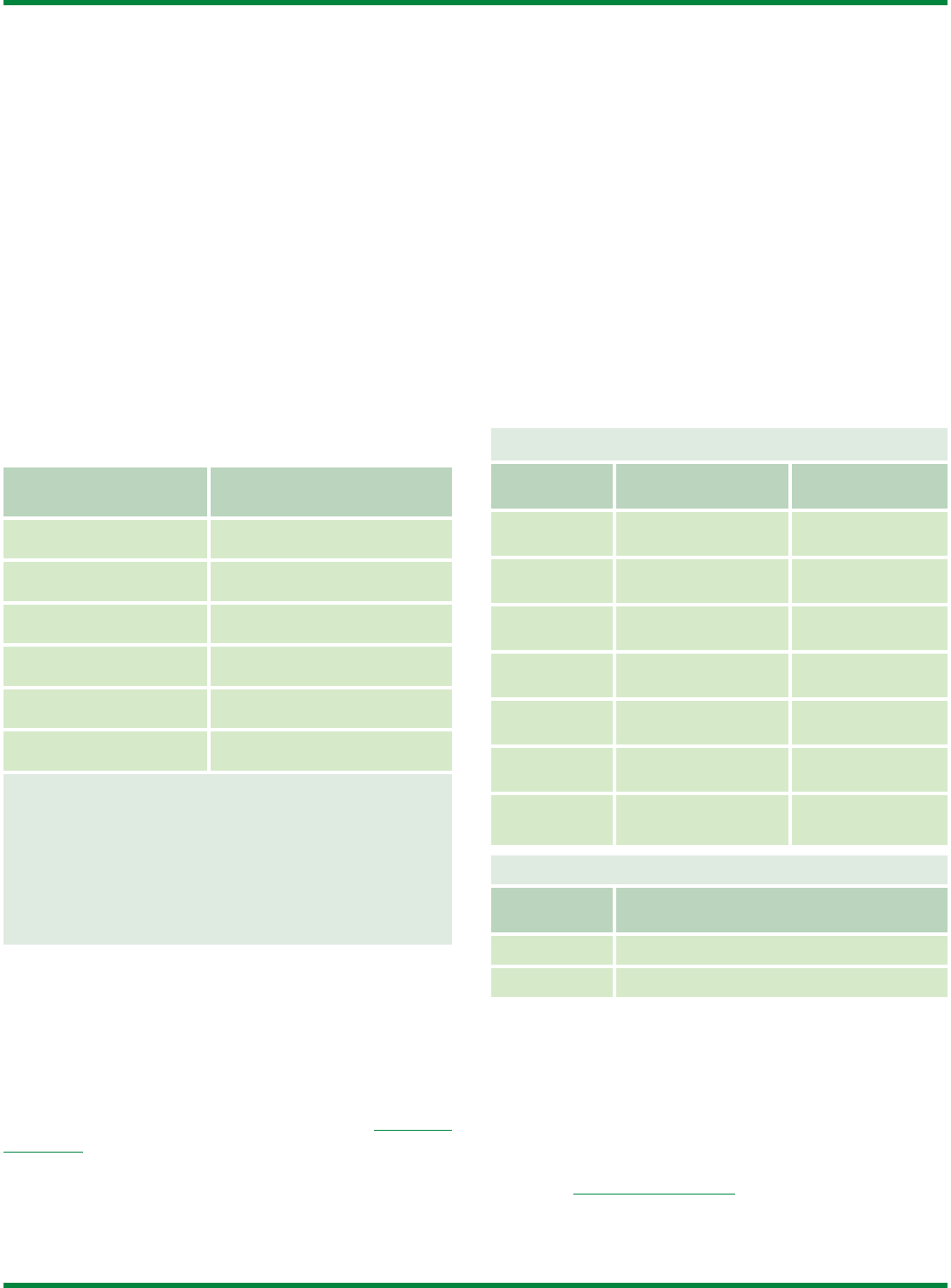

Construction Start Date

The estimated allowable

tax credit is…

After Dec. 31, 2016

1.9 cents/kWh

By Dec. 31, 2017

1.8 cents/kWh

By Dec. 31, 2018

1.4 cents/kWh

By Dec. 31, 2019

1 cent/kWh

By Dec. 31, 2021

1.5 cents/kWh

By Dec. 31, 2024

2.6 cents/kWh*

*Projects >1 megawatt that began construction on or after Jan. 29, 2023 must meet

apprenticeship and prevailing wage requirements to receive the full allowable credit

amount. For large projects that do not meet apprenticeship and prevailing wage

requirements, the allowable tax credit is 20% of the full value (e.g. 0.52 cents/kWh for

projects that begin construction by 2024). Values may be adjusted for ination in future

years. Additionally, the IRA adds 10% bonus credits for meeting domestic manufacturing

thresholds and for locating facilities in fossil-fuel-powered communities, low-income

communities, or on Tribal lands.

After commencing construction by the deadlines noted in the table, projects have four

years to begin producing electricity.

subject to the prior PTC phase-out.

Starting in 2025, the IRA converts energy tax credits into

emissions-based, technology-neutral tax credits.

Additionally, the IRA adds stackable 10% increases in the PTC

value for projects placed in service after Dec. 31, 2022, that meet

domestic manufacturing thresholds or site facilities in fossil energy

communities

, low-income communities, or on tribal lands.

programs.dsireusa.org/system/program/detail/734

Business Energy Investment Tax Credit (ITC)—The ITC is

a federal income tax credit for capital investments in renewable

energy projects. Unlike the PTC, this one-time credit is based

on the dollar amount of the investment and earned when the

equipment is placed into service. Owners and developers of large

land-based wind energy facilities that break ground (or, in the

case of developers, commence construction) can elect to claim

the ITC instead of the PTC; however, the value of the credit

depends on when the facility starts construction.

For large projects, the IRA sets the ITC at 6% or 30% of the

cost of installed equipment, depending on project size and

labor factors; projects over 1 megawatt must satisfy new

apprenticeship and prevailing wage requirements to receive the

30% ITC. For small wind projects (turbines up to 100 kilowatts)

that began construction after 2019 and were placed into service

For land-based wind

If construction

begins by…

The credit for large

wind turbines is…

The credit for small

wind turbines is…

Dec. 31, 2018

18% of expenditures

30% of

expenditures

Dec. 31, 2019

12% of expenditures

30% of

expenditures

Dec. 31, 2020

18% of expenditures

26% of

expenditures

Dec. 31, 2021

18% of expenditures

26% of

expenditures

Dec. 31, 2022

6% or 30% of

expenditures

30% of

expenditures

Dec. 31, 2023

6% or 30% of

expenditures

30% of

expenditures

Dec. 31, 2024

6% or 30% of

expenditures

30% of

expenditures

For offshore wind

If construction

begins by…

The credit for offshore wind turbines is…

Dec. 31, 2022

30% of expenditures

Dec. 31, 2024

6% or 30% of expenditures

by December 31, 2021, the ITC is 26%.

Starting in 2025, the IRA converts energy tax credits into

emissions-based, technology-neutral tax credits.

Additionally, the IRA adds stackable bonus credits of ten

percentage points for projects placed in service after Dec. 31,

2022, that meet domestic manufacturing thresholds or site

facilities in fossil energy communities, low-income communities, or

on tribal lands.

programs.dsireusa.org/system/program/detail/658

2

Advanced Manufacturing Production Tax Credit—

The IRA also creates new advanced manufacturing production

credits for companies that domestically manufacture and sell

clean energy equipment in the United States between December

31, 2022, and December 31, 2032.

For wind turbine components, the amount of the credit varies

depending on the component type and is multiplied by the rated

capacity of the turbine (in watts).

- Blades: 2 cents times rated capacity

- Nacelle: 5 cents times rated capacity

- Tower: 3 cents times rated capacity

- Fixed-bottom offshore wind platform: 2 cents

times rated capacity

- Floating offshore wind platform: 4 cents

times rated capacity

- Distributed wind inverters: 11 cents times rated capacity.

• For critical minerals, the credit is 10% of the cost incurred to

produce the mineral.

• For offshore wind vessels, the credit is 10% of the vessel’s sale

price.

Beginning in 2030, the advanced manufacturing production

credit will be reduced by 25% each year and eliminated for

components sold after 2032.

Advanced Manufacturing Investment Tax Credit—The

IRA reestablishes the Advanced Manufacturing Tax Credit

(commonly referred to as 48C), which supports investment

in domestic clean energy manufacturing facilities through a

competitively awarded 30% investment tax credit. Qualied

facilities include property designed to produce or recycle wind

energy components, including both facilities and major tooling.

The IRA provides for $10 billion to be competitively awarded

for these projects, with at least $4 billion awarded to investments

in energy communities. Facilities that begin construction by Dec.

31, 2024 can choose either the Advanced Manufacturing PTC or

Advanced Manufacturing ITC.

Residential Renewable Energy Tax Credit—Taxpayers

who purchase and install a qualifying residential small wind

electric system (100 kilowatts or less) may claim the Residential

Renewable Energy Tax Credit for qualied expenditures on

systems placed into service on or before Dec. 31, 2034. The

law provides for a phase-down of this credit, as outlined

below. Qualied expenditures include labor costs for on-site

preparation, assembly, or original system installation, and for

piping or wiring to interconnect a system to the home. The credit

applies to existing homes, newly constructed homes, principal

residences, and second homes but not rental properties. There is

no maximum credit.

programs.dsireusa.org/system/program/detail/1235

New Markets Tax Credit (NMTC)—The NMTC Program

incentivizes community development, job creation, and

economic growth by attracting private investment to underserved

communities. The program allows individual and corporate

taxpayers to receive federal income tax credits in exchange for

making equity investments in vehicles certied as Community

Development Entities (CDEs) by the Treasury Department’s

Community Development Financial Institutions Fund. CDEs

that receive tax credit allocation authority under the program

are domestic corporations or partnerships that provide loans,

investments, or nancial counseling in low-income urban and

rural communities. An investor in a CDE will benet from a tax

credit equal to 39% of their original investment over a 7-year

period, in addition to the returns on the investment. The CDEs,

in turn, use the capital raised to provide exible, affordable

nancing for environmentally sustainable projects in low-income

communities. The NMTC Program has helped support

renewable energy projects, including the Coastal Energy Project,

a 6-megawatt wind farm in Grayland, Washington.

cdfund.gov/programs-training/programs/

new-markets-tax-credit

For residential wind

If system is placed

in service…

The estimated allowable tax

credit is…

By Dec. 31, 2019

30% of qualied expenditures

In 2020 or 2021

26% of qualied expenditures

In 2022–2032

30% of qualied expenditures

In 2033

26% of qualied expenditures

In 2034

22% of qualied expenditures

Future years

N/A

3

Financing Mechanisms

Rural Energy for America Program (REAP) Renewable

Energy Systems & Energy Efciency Improvement Loans &

Grants—Through REAP, the U.S. Department of Agriculture

provides agricultural producers and rural small businesses

with guarantees on loans for energy efciency improvements

and renewable energy systems, including small and large wind

generation projects. REAP provides guarantees on loans for up

to 75% of total eligible project costs. Applicants must provide at

least 25% of the project cost and demonstrate sufcient revenue

to repay the loan and cover any operation and maintenance

expenses. Established through the 2002 Farm Bill, REAP was

reauthorized in the 2014 Farm Bill because of its demonstrated

success in helping to increase American energy independence

and, over time, lower the cost of energy for farmers, ranchers,

and rural small business owners. Since 2009, REAP has

supported more than 340 wind energy projects nationwide.

rd.usda.gov/programs-services/energy-programs/rural-

energy-america-program-renewable-energy-systems-energy-

efciency-improvement-guaranteed-loans

Title 17 Innovative Clean Energy Loan Guarantee Program—

Established as part of the Energy Policy Act of 2005, this program

helps stimulate the nancing of groundbreaking energy efciency,

renewable energy, environmental remediation, greenhouse gas

reduction and sequestration, and advanced transmission and

distribution projects. Designed to accelerate the deployment of

innovative clean energy technology, the Title 17 loan program

authorizes the DOE Loan Programs Ofce to guarantee the debt

on energy production or manufacturing facilities associated with

a broad spectrum of energy technologies, including renewables.

The government guarantee on the debt lowers the risk associated

with funding wind and other clean energy projects, making more

capital available to the industry. For each loan guarantee awarded,

the government sets aside a credit subsidy—a sum of money that

serves as insurance in case the project fails.

energy.gov/lpo/innovative-clean-energy-loan-guarantees

Sources of Funding for Renewable Energy

Research, Development, Demonstration, and

Deployment

A number of federal government agencies also provide funding

to support renewable energy research and development (R&D),

demonstration, commercialization, and deployment through

grants or cooperative research and development agreements

(CRADAs). Some of the leading funding organizations and

associated programs are listed in upcoming sections. These

funding opportunities are available through federal agencies

that are subject to annual Congressional appropriations, so

availability of funds may vary over time.

R&D Grants and Cooperative Agreements

DOE Wind Energy Technologies Ofce—WETO works with

businesses, industry, universities, and other organizations that

focus on technological developments to improve the reliability and

affordability of wind energy and address barriers to deployment.

One way WETO encourages the growth of these technologies is

by offering competitive Funding Opportunity Announcements

for technology development and demonstration. WETO supports

high-impact projects that can signicantly advance its mission to

help industry develop more efcient wind-energy technologies that

help America lower the cost of wind energy.

energy.gov/eere/wind/wind-energy-funding-opportunities

DOE Ofce of Energy Efciency and Renewable Energy

(EERE)—Through funding opportunities offered by various

ofce programs (including WETO), EERE offers nancial

assistance to businesses, industry, universities, and other

organizations to encourage the development and demonstration

of renewable energy and energy efciency technologies with the

goal of increasing their adoption.

energy.gov/eere/funding/eere-funding-opportunities

4

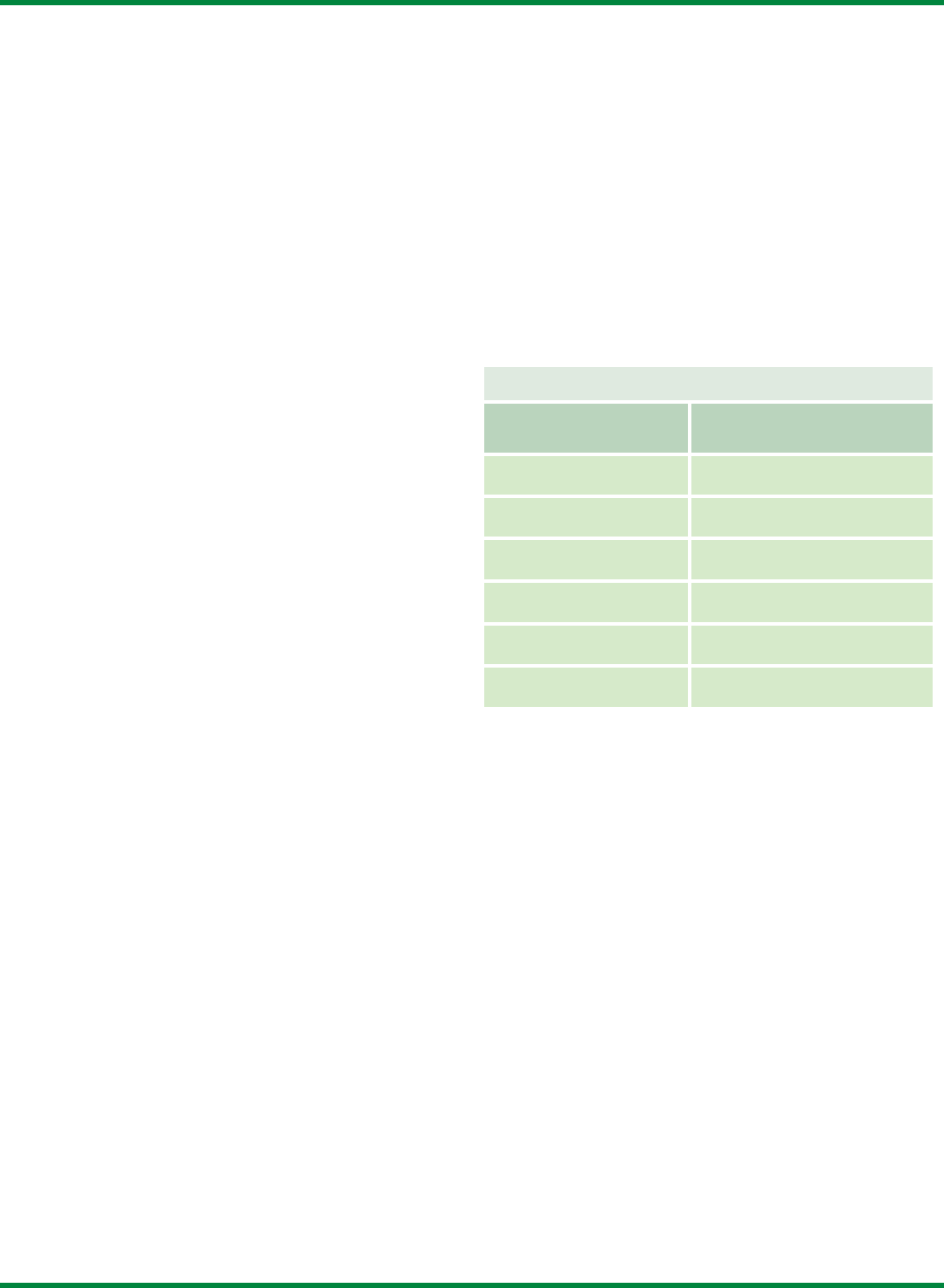

Small and large wind generation projects can benet from

the U.S. Department of Agriculture’s Rural Energy for America

Program Renewable Energy Systems & Energy Efciency

Improvement Loans & Grants.

Photo from NREL, 11919

DOE’s Advanced Research Projects Agency-Energy (ARPA-E) Aerodynamic Turbines Lighter and Aoat with Nautical Technologies and

Integrated Servo-control program funded a variety projects to enable the next generation of efcient and cost-optimized oating

turbine designs.

Photo by Senu Sirnivas, NREL 27582

DOE Ofce of Clean Energy Demonstrations (OCED)—

Established in 2021 as part of the Bipartisan Infrastructure Law to

accelerate clean energy technologies from the lab to the market,

OCED delivers clean energy demonstration projects at scale in

partnership with the private sector to accelerate deployment,

market adoption, and the equitable transition to a decarbonized

energy system.

energy.gov/oced/ofce-clean-energy-demonstrations

DOE Advanced Research Projects Agency-Energy

(ARPA-E)—ARPA-E funds short-term, technology-focused,

applied R&D aimed at creating real-world solutions to important

problems in energy creation, distribution, and use. The agency’s

focus is advancing high-impact energy technologies that are

too early for private-sector investment but have the potential to

radically improve U.S. economic security, national security, and

environmental well-being.

arpa-e.energy.gov/about/apply-for-funding

Small Business Innovation Research (SBIR) program—The

Small Business Administration’s SBIR program encourages U.S.

small businesses to engage in federal R&D that has potential for

commercialization. Its mission is to support scientic excellence

and technological innovation through the investment of federal

research funds in critical American priorities to build a strong

national economy. Eleven federal agencies, including DOE,

participate in the program, soliciting grant proposals from small

businesses and making awards on a competitive basis.

sbir.gov

Technology Deployment Grants

DOE Ofce of Indian Energy—The Ofce of Indian Energy

provides nancial assistance, including grants and technical

assistance, to federally recognized tribal governments and

Alaska Native corporations to develop and deploy renewable

energy projects on tribal lands. In addition, the Ofce of Indian

Energy’s Energy Development Assistance Tool provides

information for tribes about federal grant, loan, and technical

assistance programs available from more than 10 federal

agencies to support energy development and deployment in

Indian Country and Alaska Native villages.

energy.gov/indianenergy/funding

DOE Ofce of Technology Transitions Technology

Commercialization Fund (TCF)—The TCF leverages the R&D

funding in DOE’s applied energy programs to advance energy

technologies with the potential for high impact. It uses 0.9% of

the funding for DOE’s applied energy research, development,

demonstration, and commercial application budget for each

scal year from the Ofce of Electricity, EERE, Ofce of Fossil

Energy, and Ofce of Nuclear Energy. These funds are matched

with funds from private partners to promote promising energy

technologies with the goal of increasing the commercialization

and economic impact of energy technologies developed at

DOE’s national labs.

energy.gov/technologytransitions/

technology-commercialization-fund

5

Rural Energy for America Program (REAP) Renewable

Energy Systems & Energy Efciency Improvement Loans

& Grants—In addition to loan guarantees, REAP provides

grant funding to agricultural producers and rural small

businesses to install renewable energy systems or make energy

efciency improvements. These renewable energy system

grants, which range between $2,500 and $250,000, can be used

to fund up to 25% of total eligible project costs and can be

combined with loan guarantee funding to fund up to 75% of

total eligible project costs.

rd.usda.gov/programs-services/energy-programs/rural-

energy-america-program-renewable-energy-systems-energy-

efciency-improvement-guaranteed-loans

Small Business Technology Transfer (STTR) program—

The Small Business Administration’s STTR program funds

collaborative efforts between small businesses and research

institutions with the goal of transferring technologies and

products from the laboratory to the marketplace. STTR’s focus

is on bridging the gap between the performance of basic science

and the commercialization of resulting innovations. Five federal

agencies, including DOE, participate in the program, soliciting

grant proposals from small businesses and making awards on a

competitive basis.

sbir.gov

State Energy Competitive Financial Assistance Program—

DOE’s EERE offers competitive grants through its State Energy

Program. Designed to meet DOE’s nationally focused energy

initiatives, the funding provides states and territories with

opportunities to develop public and private partnerships to deploy

energy efciency and renewable energy technologies and programs

with high potential for regional and local economic impact.

energy.gov/eere/wipo/state-energy-program-competitive-

nancial-assistance-program

6

The Lakota Nation installed a 65-kW Nordtank turbine that annually supplies 120 MWh of power to KILI, the Pine Ridge Reservation

radio station known as the voice of the Lakota Nation in South Dakota.

Photo by Bob Gough, NREL 16258

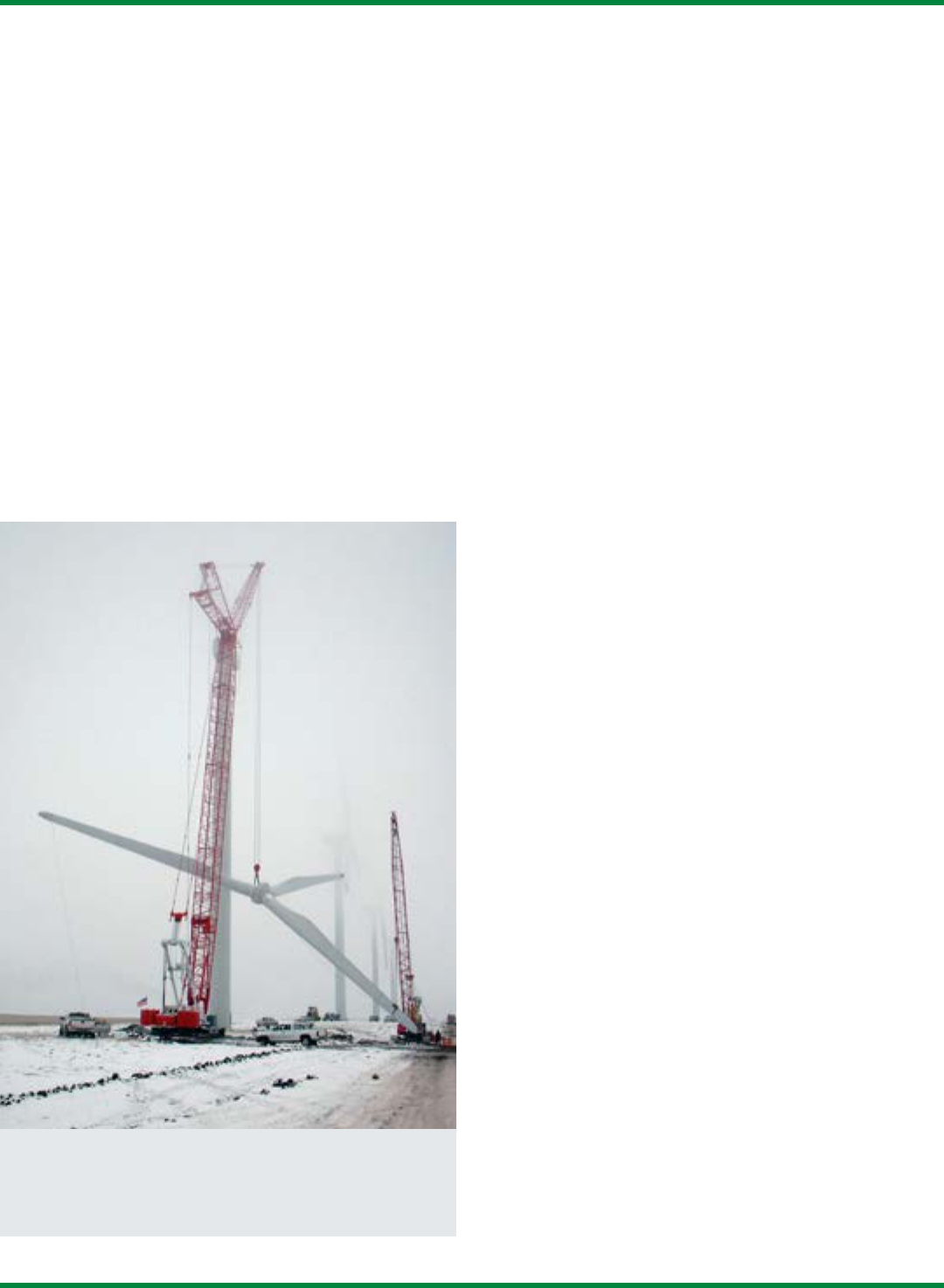

Partnership Opportunities with DOE National Laboratories

In addition to offering a wide range of nancial incentives

and resources designed to spur wind energy technology

development and deployment, the federal government actively

seeks opportunities to collaborate with industry, government

agencies, academia, small businesses, international organizations,

and nonprots to advance the development and deployment

of wind energy. This collaboration is possible through DOE’s

national laboratories—facilities where partners can access

technical expertise and highly specialized commercialization and

deployment capabilities.

7

Agreement Type Denition Cost

Estimated

Timeline*

Benets

Cooperative

Collaboration between Lab and One month • Leverage and optimize resources

Research and

Development

Agreement

(CRADA)

a lab and one or more

partners outside the

federal government

(usually from industry,

nonprot organiza-

tions, or academia,

participant

may share

costs or

participant

pays 100%

funds-in.

• Share technical expertise in a protected

environment

• Option to obtain license to the lab

CRADA- generated intellectual property

(IP) on agreed-upon terms and conditions

domestic or foreign) to

• Five-year data protection

collaborate and share

• Each partner may take title to its own

the results of a jointly

CRADA-generated IP

conducted R&D

project.

Agreement for

ACT is an agreement Varies, Two to four • Leverage and optimize existing

Commercializing

type allowed by DOE depending on months to capabilities at lab, freedom to negotiate

Technology (ACT)

for its laboratory

contractors to use

third-party terms and

conditions for work

circumstance.

Participant

pays 100% for

laboratory

establish,

depending

on U.S. or

foreign

as lab, releasing DOE from obligation

• Option to work at the speed and style of

industry partners: operating more like a

business

performed with or for

that third party.

DOE IP provisions are

required. ACT permits

a more exible cost

structure to enable the

laboratory contractor

to cover certain costs,

such as insurance,

contractor’s

cost of work.

Example:

lab and

participant

may share

costs or

participant

pays 100%

ownership

and length of

terms

negotiations

(about the

same as

other

agreement

types)

• Terms exibility provides room to

modularize each aspect of the agreement

and to explore more thoroughly the risks

(nancial, performance, funding,

resources/skills)

• Allows lab to engage in more relevant,

impactful work, such as accepting funds

from foundations

associated with funds-in.

project risks.

Strategic

Labs conduct work for Participant One month • Access to unique facilities, services,

Partnership

Project

non-DOE entities such

as industry, small

businesses, or other

pays full cost

of the lab’s

effort.

and/or technical expertise

• Flexible terms for IP and licensing rights

federal agencies and

may utilize DOE

facilities.

User Facility

Users may access User pays Two weeks • Generated data treated as proprietary (if

Agreement

facilities, specialized approved user proprietary user facility agreement)

equipment,

instrumentation,

personnel, etc., to

rate or each

party covers

its own cost.

• Access to unique facilities and equipment

to validate or improve user technology

conduct proprietary or

nonproprietary

research.

Agreement Type Denition Cost

Estimated

Timeline*

Benets

Technical Service

Agreement

Lab staff provide short-

term technical

assistance to

organizations with

technical problems

requiring expertise that

is not available

commercially.

Participant

pays full cost

of the lab’s

effort.

Five to 10

business

days

• Access to expertise of lab scientists and

engineers

Licenses

Companies acquire IP

rights (such as

patents, copyrights,

and trademarks) to

commercialize

technology developed

by the lab.

Payment (in

the form of

issue fees,

royalties on

sales, equity

in company,

etc.) is

nonrefundable

and provided

by the

licensee.

One month or

more

depending on

the license

• Leverage cutting-edge inventions to drive

technology commercialization

• Licenses may be nonexclusive or

exclusive

• Opportunity available to small and large

businesses

University

Partnerships

In partnering with

universities and

colleges, national

laboratories combine

scientic knowledge

and state-of-the-art

facilities to research

and deploy renewable

energy and energy

efciency technologies.

Varies,

depending on

circumstance.

One month or

more

• Enhance research collaboration

• Foster the exchange of ideas

• Attract rising stars in scientic and

engineering disciplines

• Create pathways for graduate and

undergraduate students—as well as

postdoctoral researchers

• Explore new ways to engage with a range

of educational institutions

Note that this table does not capture all partnering mechanisms, and there might be differences among each of the national laboratories.

Please contact the potential laboratory partner being considered for additional information.

*The exact timeline for completing agreements is determined on a case-by-case basis (the estimated timelines above reect time to complete

agreements after the statement of work and funding have been agreed upon). Agreements with non-U.S. entities take longer.

Working Together To Move the Wind Industry Forward

For additional information on the unique partnering opportunities available at each national laboratory, visit their

partnering, technology transfer, and commercialization web pages.

Argonne National Laboratory National Renewable Energy

This fact sheet focuses on federal government

anl.gov/work-with-us Laboratory

support for wind energy. For information on state-

level policies and incentives, see .

Idaho National Laboratory

nrel.gov/wind/work-with-us.html

dsireusa.org

inl.gov/td Oak Ridge National Laboratory

Lawrence Berkeley National

ornl.gov/partnerships

Laboratory Pacic Northwest National

ipo.lbl.gov Laboratory

Lawrence Livermore National

pnnl.gov/industry-partnerships

For more information, visit:

Laboratory Sandia National Laboratories

energy.gov/eere/wind

llnl.gov/doing-business sandia.gov/working-with-sandia

DOE/GO-102022-5832 • April 2023

Los Alamos National Laboratory

lanl.gov/collaboration

8