C3_12416_737346

Request for Mortgage Assistance

If you’re experiencing a financial hardship and need help, please complete all the sections of this form. Once you’ve completed

this form, return the following to your loan servicer to be considered for foreclosure prevention options:

• Your Request for Mortgage Assistance (RMA) signed

• IRS Form 4506-C completed and signed

• All required income documentation identified in Section 4

By signing and dating this form, you guarantee and certify that all of the information you’ve provided is accurate and true.

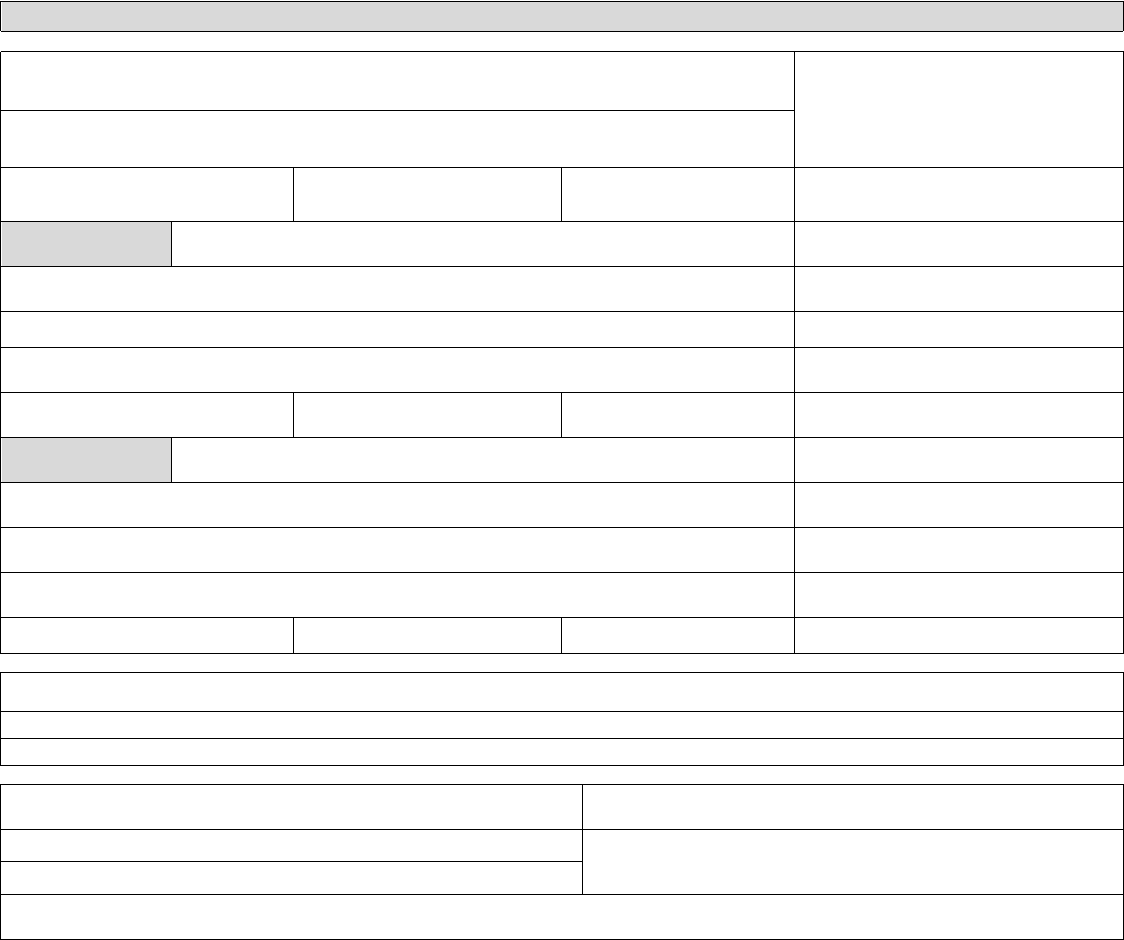

Section 1: Borrower Information

Property Address:

Lender Name & Address:

Address (additional):

City:

State: Zip Code:

Mortgage Loan Number:

Borrower: Name: Home Phone: ( )

SSN: Date of Birth: Email Address:

Mailing Address (If different from above): Cell Phone: ( )

Address (additional): Work Phone: ( )

City: State: Zip Code: Other: ( )

Co-Borrower: Name: Home Phone: ( )

SSN: Date of Birth: Email Address:

Mailing Address (If different from above): Cell Phone: ( )

Address (additional): Work Phone: ( )

City: State: Zip Code: Other: ( )

I want to: ◻ Keep the Property ◻ Sell the Property

The Property is my: ◻ Primary Residence ◻ Second Home ◻ Investment

The Property is: ◻ Owner Occupied ◻ Renter Occupied ◻ Vacant

Has any borrower filed for bankruptcy? ◻ Chapter 7 ◻ Chapter 13

Is any borrower a servicemember ◻ Yes ◻ No

Filing Date: Bankruptcy Case Number:

Have you recently been deployed away from your principal residence or

recently received a permanent change of station order? ◻ Yes ◻ No

Has your bankruptcy been discharged? ◻ Yes ◻ No

How many single family properties other than your principal residence do you and/or any co-borrower(s) own individually, jointly, or with others?

_____________________________________________________________________________________________________________

C3_12416_737346

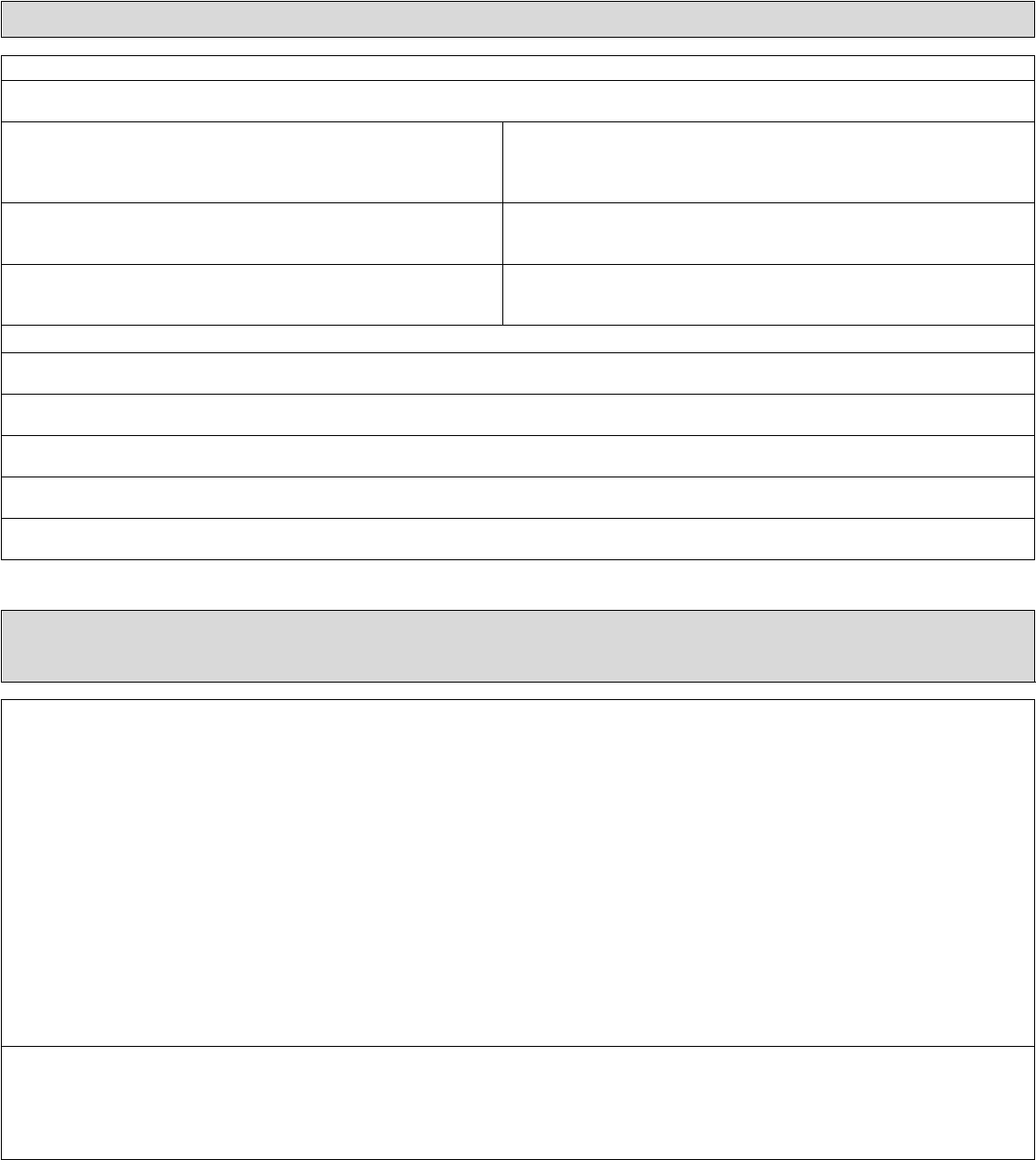

Section 2: Hardship Affidavit

Reason for Delinquency

I am requesting review for loan assistance or a foreclosure alternative program.

I am having difficulty making my monthly payment because of financial difficulties created by (Check all that apply):

◻ My household income has been reduced. Example:

Unemployment, underemployment, reduced pay or hours, decline in

business earnings, death, disability, or divorce of a borrower or co-

borrower.

◻ My monthly debt payments are excessive, and I am overextended with

my creditors. Debt includes credit cards, home equity, and other debts.

◻ My expenses have increased. Example: Monthly mortgage payment

reset, high medical or health care costs, uninsured losses, increased

utilities, or property taxes.

◻ My cash reserves, including all liquid assets, are insufficient to maintain

my current mortgage payment and cover basic living expenses at the same

time.

◻ I am unemployed and (1) I am receiving/will receive unemployment

benefits or (2) my unemployment benefits ended less than 6 months

ago.

◻ Other (Please provide a detailed explanation):

Explanation (continue on a separate sheet of paper if necessary):

Section 3: Principal Residence Information

(This section is required even if you are not seeking mortgage assistance on your principal residence)

I am requesting mortgage assistance with my principal residence ◻ Yes ◻ No

If “yes” ◻ Keep the property ◻ Sell the property

Property Address: ________________________________________________________ Loan ID Number:________________

Other mortgages or liens on the property? ◻ Yes ◻ No Lien Holder / Servicer Name: _____________ Loan ID Number: _______________

Do you have condominium or homeowner association (HOA) fees? ◻ Yes ◻ No If “Yes,” Monthly Fee $________ Are fees paid current ◻ Yes ◻ No

Name and address that fees are paid to: ______________________________________________________________________________________

Does your mortgage payment include taxes and Insurance? ◻ Yes ◻ No If “No,” are the taxes and insurance paid current? ◻ Yes ◻ No

Annual Homeowner’s Insurance $_____________

Is the property listed for sale? ◻ Yes ◻ No If “Yes,” Listing Agent’s Name: ________________________ Phone Number:_______________________

List Date? _______________ Have you received a purchase offer? ◻ Yes ◻ No Amount of Offer $______________ Closing Date:________________

Complete this section ONLY if you are requesting mortgage assistance with a property that is not your principal residence.

Principal residence servicer name: __________________________________ Principal residence servicer phone number: ______________________

Is the mortgage on your principal residence paid? ◻ Yes ◻ No If “No,” number of months your payment is past due (if known): __________________

C3_12416_737346

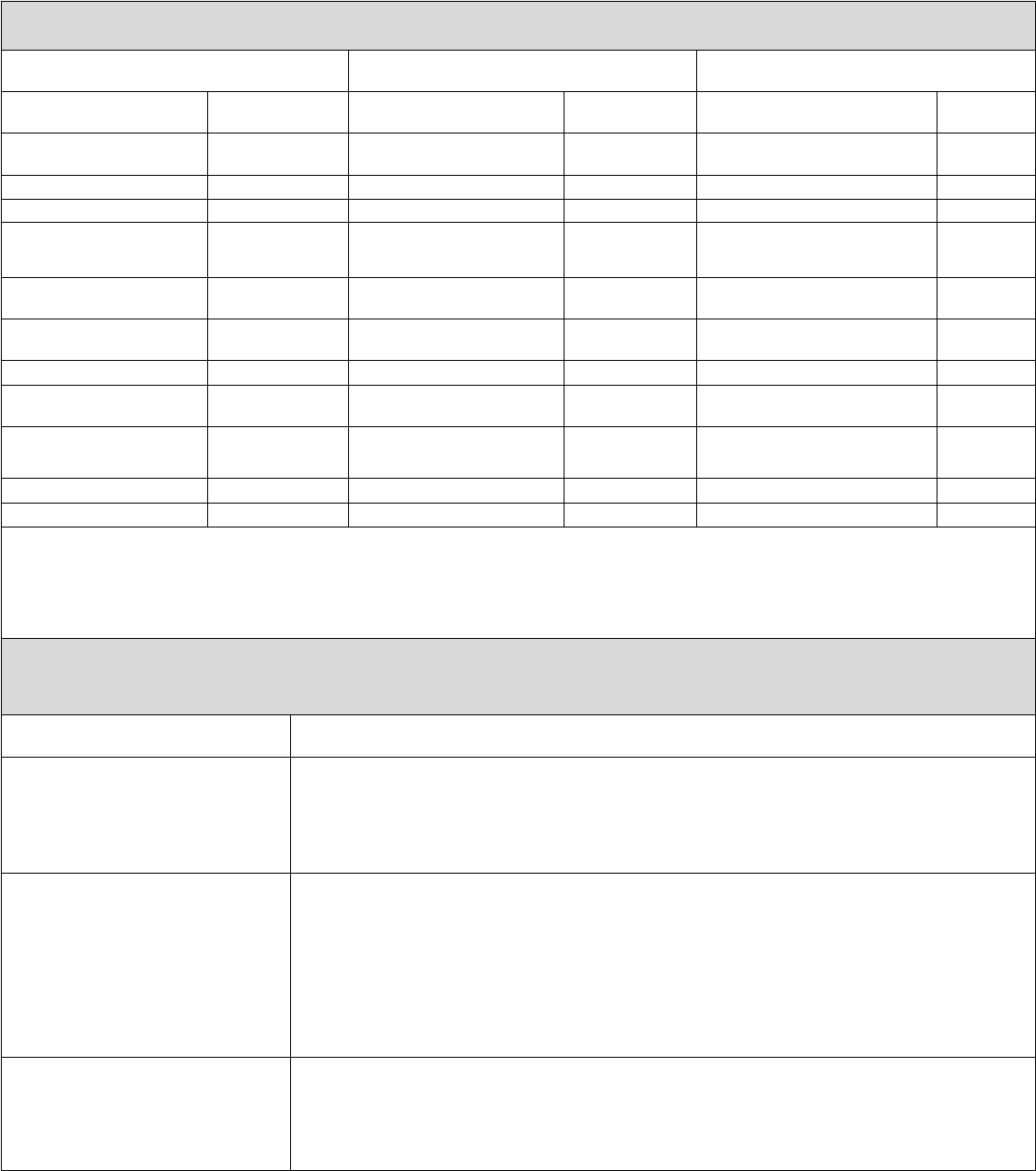

SECTION 4: COMBINED INCOME AND EXPENSE OF BORROWER AND CO-BORROWER

Monthly Household Income Monthly Household Expense/Debt

(*Principal Residence Expense only)

Household Assets

Monthly Gross Wages $ First Mortgage Principal &

Interest Payment*

$ Checking Account(s) $

Overtime $ Second Mortgage Principal &

Interest Payment*

$ Checking Account(s) $

Self-Employment Income $ Homeowner’s Insurance* $ Savings/Money Market $

Unemployment Income $ Property Taxes* $ CDs $

Untaxed Social Security/SSD $ HOA/Condo Fees* $ Stocks/Bonds $

Food Stamps/Welfare $ Credit Cards/Installment Debt

(total min. payment)

$ Other Cash on Hand $

Taxable Social Security or

retirement income

$ Child Support/Alimony $ $

Child Support/Alimony** $ Car Payments $ $

Tips, commissions, bonus and

overtime

$ Mortgage Payments other

properties****

$ $

Gross Rents Received*** $ Other $ Value of all Real Estate except

principal residence

$

Other $ $ Other $

Total (Gross income) $ Total Debt/Expenses $ Total Assets $

** Alimony, child support or separate maintenance income need not be disclosed if you do not choose to have it considered for repaying your

mortgage debt.

***Include rental income received from all properties you own EXCEPT a property for which you are seeking mortgage assistance in the Section

titled “Other Properties Owned.”

****Include mortgage payments on all properties you own EXCEPT your principal residence and the property for which you are seeking mortgage

assistance in the Section titled “Other Properties Owned.”

Required Income Documentation

(Your servicer may request additional documentation to complete your evaluation)

All Borrowers

◻ Include a signed IRS Form 4506-C.

◻ Do you earn a wage?

Borrower Hire Date ___________

Co-Borrower Hire Date_________

◻ For each borrower who is a salaried employee or hourly wage earner, please provide the two most recent pay

stub(s) that reflect all year-to-date income (Including bonus, tips and/or commission, if applicable).

◻ Are you self-employed? ◻ A complete signed individual income tax return, including all applicable schedules and forms.

AND

◻ Most recent signed and dated quarterly or year-to-date Profit and Loss Statement that reflects activity for the

most recent three months.

OR

Bank statements for the business account for the last two months to document continuation of business activity.

◻ Do you receive income from any other

source(s)?(i.e investments, room rental

income, or any additional household

contributions)

◻ Documentation describing the nature of the income, such as investment income statement, room rental

agreement, or non-borrower income.

OR

◻ Evidence of one month receipt of income from investments or room rental (i.e. bank statements)

C3_12416_737346

◻ Do you receive social security,

disability, death benefits, pension, public

assistance or adoption assistance?

◻ A copy of the benefits statement or letter from the provider that states the amount and frequency of the

benefit.

OR

◻ Evidence of one month receipt of income from this source (i.e. bank statements).

◻ Do you receive alimony, child support,

or separation maintenance payments?

◻ A copy of the divorce decree, separation agreement or other written agreement filed with the court that states

the amount and period of time the payment will be received and proof that the income will continue for at least 12

months.

AND

◻ Evidence of one month receipt of income from this source (i.e. bank statements).

Notice: Alimony, child support or separate maintenance income need not be disclosed if you do not choose to have

it considered for repaying your mortgage debt.

◻ Do you have income from rental

properties that are not your principal

residence?

◻ The current rental agreement(s) and evidence of one month receipt of rental income (i.e. bank statements).

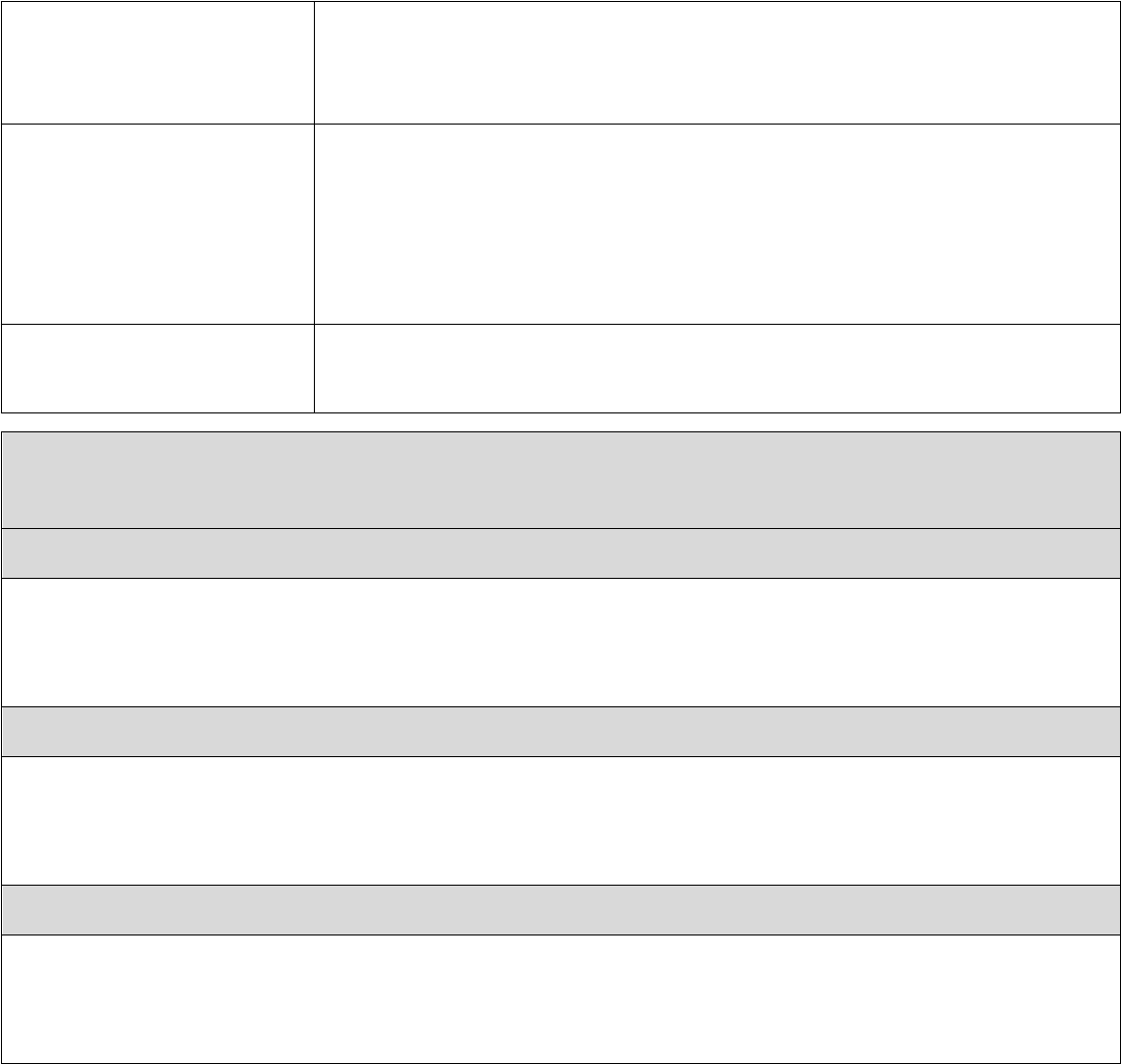

SECTION 5: OTHER PROPERTIES OWNED

(You must provide information about all properties that you or the co-borrower own, other than your principal residence and any

property described in Section 5 below. Use additional sheets if necessary.)

Other Property #1

Property Address: ______________________________________________________________ Loan ID Number: ____________________

Servicer Name: _____________________________________ Mortgage Balance $ ______________________ Current Value $ _________________

Property is: ◻ Vacant ◻ Second or seasonal home ◻ Rented Gross Monthly Rent $ ___________ Monthly mortgage payment* $ __________

Other Property #2

Property Address: ______________________________________________________________ Loan ID Number: ____________________

Servicer Name: _____________________________________ Mortgage Balance $ ______________________ Current Value $ _________________

Property is: ◻ Vacant ◻ Second or seasonal home ◻ Rented Gross Monthly Rent $ ___________ Monthly mortgage payment* $ __________

Other Property #3

Property Address: ______________________________________________________________ Loan ID Number: ____________________

Servicer Name: _____________________________________ Mortgage Balance $ ______________________ Current Value $ _________________

Property is: ◻ Vacant ◻ Second or seasonal home ◻ Rented Gross Monthly Rent $ ___________ Monthly mortgage payment* $ ________

* The amount of the monthly payment made to your lender – including, if applicable, monthly principal, interest, real property taxes and

insurance premiums.

C3_12416_737346

OTHER PROPERTY FOR WHICH ASSISTANCE IS REQUESTED

(Complete this section ONLY if you are requesting mortgage assistance with a property that is not your principal residence.)

I am requesting mortgage assistance with a rental property. ◻ Yes ◻ No

I am requesting mortgage assistance with a second or seasonal home. ◻ Yes ◻ No

If “Yes” to either, I want to: ◻ Keep the property ◻ Sell the property

Property Address: ______________________________________________________________ Loan ID Number: ____________________

Do you have a second mortgage on the property? ◻ Yes ◻ No If “Yes,” Servicer Name: ________________ Loan ID Number: _____________

Do you have condominium or homeowner association (HOA) fees? ◻ Yes ◻ No If “Yes,” Monthly Fee $ ________________

Are HOA fees paid current? ◻ Yes ◻ No

Name and address that fees are paid to: _______________________________________________________________________________________

Does your mortgage payment include taxes and insurance? ◻ Yes ◻ No If “No,” are the taxes and insurance paid current? ◻ Yes ◻ No

Annual Homeowner’s Insurance $ ___________________ Annual Property Taxes $ ________________________

If requesting assistance with a rental property, property is currently: ◻ Vacant and available for rent.

◻ Occupied without rent by your legal dependent, parent or grandparent as

their principal residence.

◻ Occupied by a tenant as their principal residence.

◻ Other _____________________________________________________

If rental property is occupied by a tenant: Term of lease / occupancy ____ / ____ / ____ -- ____ / ____ / ____ Gross Monthly Rent $ __________

If rental property is vacant, describe efforts to rent property: ____________________________________________________________________

___________________________________________________________________________________________________________________

If applicable, describe relationship of and duration of non-rent paying occupant of rental property: ______________________________________

____________________________________________________________________________________________________________________

Is the property for sale? ◻ Yes ◻ No If “Yes,” Listing Agent's Name: __________________________ Phone Number: ________________________

List date? ___________ Have you received a purchase offer? ◻ Yes ◻ No Amount of offer $ _____________ Closing Date: _____________

C3_12416_737346

RENTAL PROPERTY CERTIFICATION

(You must complete this certification if you are requesting a mortgage modification with respect to a rental property.)

◻ By checking this box and initialing below, I am requesting a mortgage modification with respect to the rental property described in this Section # and I hereby

certify under penalty of perjury that each of the following statements is true and correct with respect to that property:

1. I intend to rent the property to a tenant or tenants for at least five years following the effective date of my mortgage modification. I understand that

the servicer, may ask me to provide evidence of my intention to rent the property during such time. I further understand that such evidence must show

that I used reasonable efforts to rent the property to a tenant or tenants on a year-round basis, if the property is or becomes vacant during such five-

year period.

Note: The term “reasonable efforts” includes, without limitation, advertising the property for rent in local newspapers, websites or other commonly

used forms of written or electronic media, and/or engaging a real estate or other professional to assist in renting the property, in either case, at or

below market rent.

2. The property is not my secondary residence and I do not intend to use the property as a secondary residence for at least five years following the

effective date of my mortgage modification. I understand that if I do use the property as a secondary residence during such five-year period, my use of

the property may be considered to be inconsistent with the certifications I have made herein.

Note: The term “secondary residence” includes, without limitation, a second home, vacation home or other type of residence that I

personally use or occupy on a part-time, seasonal or other basis.

3. I do not own more than five (5) single-family homes (i.e., one-to-four unit properties) (exclusive of my principal residence).

Notwithstanding the foregoing certifications, I may at any time sell the property, occupy it as my principal residence, or permit my legal

dependent, parent or grandparent to occupy it as their principal residence with no rent charged or collected, none of which will be considered to

be inconsistent with the certifications made herein.

This certification is effective on the earlier of the date listed below or the date the RMA is received by your servicer.

Initials: Borrower ________________ Co-borrower _______________

C3_12416_737346

Section 6: Acknowledgement and Agreement

1. All of the information in the Request for Mortgage Assistance (RMA) is truthful.

2. The Servicer, applicable federal and state government entities, the owner, insurer, and guarantor of my mortgage loan,

and their respective agents, may investigate the accuracy of my statements, may require me to provide additional

supporting documentation and that knowingly submitting false information may violate federal or other applicable law.

3. I authorize the Servicer, and its agents and assigns, to obtain, assemble and/or use a current consumer report on me,

and to investigate my eligibility for assistance and the accuracy of my statements and any documents that I provide in

connection with my RMA. These consumer reports may include, without limitation, a credit report, and may be

assembled and used at any point during and after the application process to assess each borrower's eligibility. I

further authorize the Servicer and Other Loan Participants to obtain, use and share tax return and tax transcript

information for purposes of determining or confirming my eligibility for mortgage assistance, verifying data,

maintaining, managing, auditing, monitoring, servicing, enforcing, selling, insuring and securitizing my loan, or for any

other purpose permitted by applicable law. The term Servicer includes Servicer’s affiliates, agents, service providers,

and any of their respective successors and assigns. The term Other Loan Participants includes any actual or potential

owners of the loan, or acquirers of any beneficial or other interest in the loan, any mortgage insurer, guarantor, any

servicers or service providers for these parties, and any of their respective successors and assigns.

4. If I have intentionally defaulted on my existing mortgage or engaged in fraud, or if any statement or information in the

documents that I provide is deemed materially false and that I was ineligible for assistance, the Servicer or its agents,

may terminate my participation, including any right to future benefits and incentives that otherwise would have been

available and also may seek other remedies available at law and in equity, such as recouping any benefits or incentives

that I previously received.

5. I certify that any property for which I am requesting assistance is a habitable residential property that is not subject to

a condemnation notice.

6. I certify that I am willing to provide all requested documents and to respond timely to all Servicer communications.

Time is of the essence.

7. If I am eligible for assistance and accept the terms of a notice, plan, or agreement, I agree that the terms of this

Acknowledgment and Agreement are fully incorporated into such notice, plan, or agreement by reference. My first

timely payment, if required, after my Servicer's notification of my eligibility or prequalification for assistance may, at

my Servicer’s option, serve as my acceptance of the terms set forth in that notice, plan, or agreement.

8. My Servicer will collect and record personal information that I submit during the evaluation process, such as my name,

address, telephone number, social security number, credit score, income, payment history, government monitoring

information, and information about my account balances and activity.

9. I consent to being contacted about this RMA at any e-mail address or telephone number I have provided to the

Servicer, including text messages and telephone calls.

10. I understand that the Servicer will use the information I provide to evaluate my eligibility for available relief options

and foreclosure alternatives, but the Servicer is not obligated to offer me assistance based solely on the

representations in this document or other documentation submitted in connection with my request.

11. I am willing to commit to credit counseling if it is determined that my financial hardship is related to excessive debt.

C3_12416_737346

The undersigned certifies under penalty of perjury that all statements in this document are true and correct.

______________________________________ ______________________

Borrower Signature Date

______________________________________ ______________________

Social Security Number Date of Birth

______________________________________ ______________________

Co-Borrower Signature Date

______________________________________ ______________________

Social Security Number Date of Birth

C3_12416_737346

LOAN COUNSELING IS AVAILABLE

If you’d like, a counselor approved by the U.S. Department of Housing and Urban Development (HUD) can review your financial situation, and

may be able to suggest other options. You can contact them by visiting http://www.hud.gov/offices/hsg/sfh/hcc/hcs.cfm or calling

800.569.4287, or for hearing impaired, (TDD) 800.877.8339.

NOTICE TO BORROWERS

Be advised that by signing this document you understand that any documents and information you submit to your servicer in

connection with the retention program are under penalty of perjury. Any misstatement of material fact made in the completion

of these documents including but not limited to misstatement regarding your occupancy of your property, hardship

circumstances, and/or income, expenses, or assets may subject you to criminal prosecution and civil liability. By signing this

document you certify, represent and agree that: “Under penalty of perjury, all documents and information I have provided to my

servicer in connection with the retention program, including the documents and information regarding my eligibility for the

program, are true and correct.”

Beware of Foreclosure Rescue Scams. Help is FREE!

• There is never a fee to get assistance or information about the retention program from your lender or a HUD-approved

housing counselor.

• Beware of any person or organization that asks you to pay a fee in exchange for housing counseling services or

modification of a delinquent loan.

• Beware of anyone who says they can “save” your home if you sign or transfer over the deed to your house. Do not sign

over the deed to your property to any organization or individual unless you are working directly with your mortgage

company to forgive your debt.

• Never make your mortgage payments to anyone other than your mortgage company without their approval.