2 11/15/2023

Table of Contents

PAGE

INTRODUCTION ................................................................................................................. 3

ILLINOIS HOUSING DEVELOPMENT AUTHORITY ......................................................................... 4

IHDA MORTGAGE PROGRAMS ............................................................................................. 4

PROCESS OVERVIEW – BASICS ............................................................................................... 5

PRE-SCREENING FOR IHDA COMPLIANCE ................................................................................ 5

RESERVING/COMMITTING THE LOAN ...................................................................................... 6

TAX CODE COMPLIANCE REVIEW ........................................................................................... 7

FIRST-TIME HOMEBUYER/EXEMPT .......................................................................................... 7

HOUSEHOLD INCOME .......................................................................................................... 10

PURCHASE PRICE LIMIT AND QUALIFIED DWELLING ................................................................... 13

IHDA COMPLIANCE REVIEW PROCESS .................................................................................... 19

LOAN CLOSING REQUIREMENTS ............................................................................................. 20

FEES ................................................................................................................................ 22

QUALITY CONTROL ............................................................................................................. 22

POST CLOSE REQUIREMENTS ................................................................................................ 23

ADDENDUM A - MORTGAGE CREDIT CERTIFICATE (MCC) ........................................................... 24

ADDENDUM B – SMARTBUY PROGRAM .................................................................................. 28

ADDENDUM C – PROGRAM FACT SHEETS ................................................................................ 32

ADDENDUM D – RESOURCES ................................................................................................ 38

ADDENDUM E – GLOSSARY OF TERMS .................................................................................... 40

ADDENDUM F – FEDERAL RECAPTURE TAX .............................................................................. 45

ADDENDUM G – LOCK POLICY .............................................................................................. 49

ADDENDUM H – SERVICE RELEASE PREMIUM (SRP) GRID .......................................................... 52

3 11/15/2023

Welcome to the Illinois Housing Development Authority’s (IHDA) IHDA Mortgage Products

Procedural Guide. This Guide will assist in originating IHDA mortgage loan products. We address

our on-line loan origination system (IHDA LOS) in its own Commitment/Reservation guide, which

can be located at https://www.ihdamortgage.org/docs.

A resource page and glossary are located at the end of this guide for convenience. The procedures

contained herein are subject to change without notice. If there is no stated IHDA overlay, lenders

should follow Agency (FNMA, FHLMC, FHA, VA, USDA/RD) guidelines. Please consult the IHDA

Mortgage Partner Center on a regular basis for updates. This center is filled with resources

including an FAQ, marketing center, a full document library, access to rates, and other helpful

tools.

Should the need for any clarification or questions arise regarding information in this guide, email

our general email address at [email protected] or email your file’s assigned IHDA Mortgage

Compliance Specialist if the question is regarding a file currently in review.

You can reach a qualified homeownership staff member by dialing 877-456-2656. Our account

managers are also available to set up training.

U.S. Bank HFA Division acts as the Master Servicer for IHDA Mortgage. To reach them please visit,

Phone: 800.562.5165, Option 2

Email: [email protected]

Thank you for offering IHDA Mortgage programs! We are here to support you and your team,

please reach out!

Tara Pavlik

Managing Director, Homeownership Programs

4 11/15/2023

ILLINOIS HOUSING DEVELOPMENT AUTHORITY

The Illinois Housing Development Authority is a self-supporting state agency that finances the

creation and preservation of affordable housing throughout Illinois. The Authority utilizes

Mortgage Revenue Bonds and many federal and state funding sources for its single-family loan

program(s). IHDA is also a bonding authority and independently sells bonds, based on its own

good credit, to finance affordable housing in Illinois.

IHDA MORTGAGE PROGRAMS

IHDA Mortgage, a division of IHDA, offer programs with safe and reliable mortgage products with

affordable interest rates, which can include Down Payment Assistance (DPA) to first-time

homebuyers, qualified veterans, and non first-time homebuyers. All IHDA Mortgage products are

subject to income and purchase price limits (see limits at https://www.ihdamortgage.org/limits).

The borrower’s credit profile, Borrower(s) Income, and the Purchase Price of the property

determine eligibility for each product. The majority of IHDA Mortgage programs are available

statewide.

Currently, the following IHDA Mortgage programs are available (PROGRAM AVAILABILITY IS

SUBJECT TO CHANGE WITHOUT NOTICE):

1) Access Suite – includes three programs for FHA, VA, USDA, and Conventional (Fannie Mae

(FNMA) HFA Preferred and Freddie Mac (FHLMC) HFA Advantage), 1

st

mortgage loans for

first-time or non first-time homebuyers statewide. With no LLPA. New construction or

existing construction permitted on single-family Qualified Dwellings only (as defined here). If

the Lender provides the borrower an amount over the allowed assistance amount, IHDA

will only reimburse the correct amount.

a) Access 4% Forgivable – 4% of the purchase price, up to $6,000, for down payment and

closing cost assistance forgiven monthly over 10 years.

b) Access 5% Deferred – 5% of the purchase price, up to $7,500, for down payment and

closing cost assistance offered as an interest-free loan, deferred for the life of the 1

st

mortgage.

c) Access 10% Repayable – 10% of the purchase price, up to $10,000, for down payment

and closing cost assistance offered as an interest-free loan – repaid monthly over a 10-

year period.

2) Illinois HFA1 (suspended 9/12/2023) – includes FHA, VA, USDA, and Conventional (FNMA

HFA Preferred and FHLMC HFA Advantage) 1

st

mortgage loans for first-time and non first-

time homebuyers (or Exempt) statewide with an interest free DPA loan of $10,000 deferred

for the life of the 1

st

mortgage. With no LLPA, single-family Qualified Dwellings only (as

defined here).

3) Opening Doors (closed 11/13/2023) – includes FHA, VA, USDA, and Conventional (FNMA HFA

Preferred and FHLMC HFA Advantage) 1

st

mortgage loans for first-time and non first-time

homebuyers (or Exempt) statewide with a forgivable DPA loan of $6,000. With no LLPA,

single-family Qualified Dwellings only (as defined here).

-----FIND DETAILED INFORMATION REGARDING INDIVIDUAL LOAN PROGRAMS IN THE ADDENDUMS-----

5 11/15/2023

BASICS

1. Lender pre-screens borrower/co-borrower (and/or spouse in the case of first-time

homebuyer programs).

2. Lender commits/reserves loan(s) in the IHDA loan origination system (LOS).

3. Lender obtains signatures on all IHDA required documentation, performs and completes

tax code compliance review, and performs and completes credit underwrite in

accordance with Agency regulations/guidelines.

4. Lender closes loan and provides Federal Recapture Notice to borrower. Lender is

responsible for table funding both the first and second mortgage. IHDA does not provide

funds at the table. Master Servicer (U.S. Bank) reimburses Lender when loans are

purchased by the Master Servicer.

5. Prior to sending loan to IHDA, Lender validates loan data/information in the IHDA LOS.

6. Lender uploads:

a. Two packages to the IHDA LOS: 1) copy of the file delivered to U.S. Bank HFA

Division - the Investor Delivery File, and 2) Submission Cover with the IHDA

Delivery File.

b. Required file to U.S. Bank HFA Division via Doc Velocity and forwards original

note(s) to U.S. Bank HFA Division.

7. IHDA reviews all documents uploaded, verifies tax code compliance, and approves loan

for purchase.

8. Upon satisfactory completion and review of steps 5 - 7, U.S. Bank HFA Division will

purchase loan(s) from Lender. Lender is responsible for servicing both the first and second

mortgages until purchased by U.S. Bank.

PRE-SCREENING FOR IHDA COMPLIANCE – ALL BUYERS/BORROWERS

IHDA Mortgage definition of Household Income is as follows, the total income of any person who

is expected to a) live in the Qualified Dwelling; and b) be liable, or secondarily liable, on the Note.

The borrower and co-borrower(s) (and non-borrowing spouses in the case of first-time

homebuyer programs) should be pre-screened to determine whether borrower and any co-

borrower(s) are eligible for an IHDA Mortgage program. For bond compliant loans and loans

subject to IHDA Act, eligibility for the basic IHDA Mortgage program includes:

1. Borrower/co-borrower (and non-borrowing spouse) must be a first-time

homebuyer or Exempt* at time of application for any first-time homebuyer

programs.

PROCESS OVERVIEW

6 11/15/2023

2. Total Household Income must be below the program county limit. This income

includes borrower(s) that will reside in subject property and be obligated on the

note.

3. Property must be a Qualified Dwelling situated on less than or equal to five (5)

acres of land.

4. Purchase Price of property must be below the program county limit.

5. For Access, Illinois HFA1 (suspended 9/12/2023), and Opening Doors (closed

11/13/2023) Programs, borrower and co-borrower (including non-purchasing

spouse) can be first-time or non first-time homebuyers, purchasing a 1-2 unit (as

allowed by Agency) new or existing single-family Qualified Dwelling as a primary

residence throughout the State of Illinois.

If the loan officer determines that the applicant is eligible for an IHDA Mortgage program, the

loan application is completed. Before committing the loan, the loan officer/originator must make

a determination as to borrower’s income threshold in order to select the appropriate IHDA

Mortgage program (above 80% of the Area Median Income (AMI) or below 80% of the AMI). For

information on income thresholds, please see page 13.

*Exempt = qualified veteran (borrower or coborrower must be a veteran), or property is

in targeted area. Note that if only the spouse is a veteran, the spouse must also be a

borrower/mortgagor and obligated on the note. Provide a COE or DD214 showing

honorable discharge in closing package uploaded to IHDA.

All borrower loan files must be reviewed by Lender for IHDA compliance as well as

creditworthiness in accordance with Agency (FHA, VA, FNMA, FHLMC, USDA) regulations and

guidelines; and also, must comply with U.S. Bank HFA Division guidelines and federal regulatory

guidelines including CFPB, Dodd-Frank, OFAC check, TRID, etc.

RESERVING AND COMMITTING THE LOAN

In order to commit/reserve funds for any of the IHDA Mortgage programs, the Lender must lock

the loan using IHDA’s online loan origination portal, TPO Connect. The potential buyer(s) must

have a valid real estate contract in place prior to registration/commitment and/or have a valid

signed loan application (1003).

Additionally, the Homebuyer Education Certificate must be uploaded before you can confirm the

lock in TPO Connect for Pricing. The loan can still be imported, created, and registered, but it

cannot be locked until the Certificate has been uploaded. If your borrower has a DTI between

45.01% and 50.00%, they must take the Finally Home! Homebuyer Education

(https://www.finallyhome.org/en/homebuyer-education/).

Please note that the TPO Connect input is not included in this Guide. The document that

addresses online reservation system input (the IHDA Reservation Manual) is located at

https://www.ihdamortgage.org/tpotraining.

7 11/15/2023

All loans must close at the interest rate reserved in TPO Connect, which is confirmed by the lock

confirmation. Any loan that is re-priced will have a lock confirmation in TPO Connect showing the

updated values, if applicable.

See Addendum G for IHDA full Lock Policy on any IHDA Mortgage Program.

Note(s):

- The IHDA Lock Policy applies to any loan locked in any IHDA LOS.

- IHDA is under no obligation to purchase a loan that is not salable in secondary; including

reimbursement of any IHDA Down Payment Assistance (DPA) used.

Please Note: For the Access Programs the Lender will be responsible for any amount that they

reserve in error over the allowed assistance amount.

TAX CODE COMPLIANCE REVIEW

Tax Code Compliance Underwriting Review is unique to IHDA Mortgage loan programs and the

Lender must perform this review for all IHDA Mortgage programs with or without an MCC. A

Lender-signed certification attesting to review of and compliance with tax code is part of the

Income Calculator required to be in each file.

Tax Code Compliance Underwriting Review consists of documenting three basic determinations:

1. Is the borrower/co-borrower (and spouse) a first-time homebuyer or Exempt from this

requirement? OR is the borrower/co-borrower a non first-time homebuyer meeting

income, purchase price, and all other IHDA Mortgage program restrictions?

2. Is the borrower/co-borrower’s total Household Income within the allowable limits for the

area in which they intend to reside? Note that IHDA has developed the income calculator

for use in determining whether income is compliant or non-compliant. A presentation on

how to use the income calculator is located at https://www.ihdamortgage.org/training.

(Note: Download the calculator for each use, instead of saving it to the computer, to

ensure utilization of the most current version.)

3. Is the residence a Qualified Dwelling whose purchase price is within the allowable limits

for the area in which it is located?

The following are parameters for determining tax code compliance (which is the Lender’s

responsibility):

HOW TO DOCUMENT A FIRST-TIME HOMEBUYER(S)

Each borrower (first-time or non-first time) and spouse (whether borrowing or non-borrowing)

must certify on the Borrower Affidavit if they have had ownership interest in a principal residence

in the last three years. Lender is responsible for verifying that the information contained within

the file matches the certification. Verification methods may include, but are not limited to, the

1003, Credit Reports, other third-party sources, etc.

8 11/15/2023

ISSUES THAT MAY AFFECT FIRST-TIME HOMEBUYER(S) STATUS

PRIOR OWNERSHIP OF A MOBILE HOME: A prior ownership interest in a mobile home does not

disqualify a borrower as a first-time homebuyer as long as the Lender provides adequate

documentation* to confirm the following facts:

1. Components, which operate only during transportation (hitch and axles), have not been

removed.

2. The mobile home can be legally transported on state highways without first disassembling

into sections. The legal dimensional limits in Illinois are 14 feet 6 inches wide by 95 feet

long, (14’6”W X 95’L) (including the truck pulling the mobile home).

3. The mobile home does not have any permanent structures added. Such items include

affixed decks, room additions, etc. If a deck has been built and the mobile home is merely

sitting next to the deck, that would not constitute “permanently affixed.”

Prior ownership (within three years) of a “double-wide” mobile home will disqualify a possible

borrower since disassembly is required for transport.

*DOCUMENTATION: The best documentation is a photograph of the axles and hitch of the

mobile home. Include these photograph(s) in the loan file when submitting to IHDA.

TIMESHARES: Unless documentation shows the borrower residing in the timeshare as their

primary residence, the borrower is defined as a first-time homebuyer.

INHERITED PROPERTY: An expectancy to inherit property does not constitute an ownership

interest. However, if the person occupies the inherited property after acquiring a vested title

interest, the person is no longer a first-time homebuyer.

NEW MORTGAGE REQUIREMENT: The borrower cannot have had a prior mortgage or other

financing on the subject residence, except in the following cases:

Bridge or Construction Loans: A prior mortgage obtained for temporary financing, such as a

bridge or construction loan, is acceptable if the mortgage has a stated term of 24 months or

less. Evidence that the bridge loan has been recorded must be provided.

Contract for Deed: A contract for deed, or an installment sales contract, is considered seller

financed. Therefore, a contract purchaser is an eligible borrower as long as the contract has

a stated term of 24 months or less. The contract for deed or installment sales contract must

be recorded prior to the application for mortgage.

Lease with Option to Purchase: Seller financing is established when a rent credit is provided

under a lease with option to purchase. The renter is an eligible first-time borrower as long as

A) the lease provides a right of first refusal to purchase and no portion of the rent paid has

been, or will be, credited to the purchase price; or B) the term of the lease does not extend

beyond 24 months of the new IHDA loan closing date.

In order to substantiate any of the above exceptions, the financing document (mortgage,

contract, or lease) must have been recorded at the time of execution. Obtain a certified copy of

9 11/15/2023

the document from the recorder’s office and provide it to the Authority.

DIVORCE WITHIN THE LAST THREE YEARS: A borrower who has divorced within the last three (3)

years and had an ownership interest in another residence can still qualify as a first-time

homebuyer IF the borrower resided in another property for the three (3) years prior to the closing

of the IHDA loan. Please consult the Divorce Decree/Property Settlement for ownership interest

status (must be stated to be a non-marital property) and provide supporting documentation,

such as a lease, with a signed statement from the borrower attesting to primary residence status

if the borrower’s principal residence for the most recent three (3) years was another property.

MARRIED OR SEPARATED BORROWERS: For IHDA tax code compliance, a person is either married

or single; there is no gray area. Both borrower AND spouse need to be qualified in cases where

spouse is not borrowing. It must be verified that the borrower AND spouse are first-time

homebuyers or Exempt, even if the non-borrowing spouse will not be residing in the property.

RECENTLY MARRIED BORROWERS: Remember that if the borrower marries during the mortgage

loan process, documentation will need to include the new spouse to provide confirmation that

they are both first-time homebuyers. Obtain a copy of the marriage certificate and be sure that

the spouse signs the Borrower Affidavit.

Please note: this requirement only applies to tax code compliance underwriting within the

program. This is not an issue when performing the credit underwriting.

IHDA EMPLOYEES: Employees of IHDA are eligible for IHDA Mortgage programs. To prevent any

appearance of impropriety, IHDA must be notified of any loan that is coming through for an IHDA

employee prior to reservation. Please try to notify IHDA once the reservation is locked in the

IHDA LOS, so we are aware of the loan prior to receiving the post-close package.

HOME CONSTRUCTED ON LAND OWNED BY BORROWER: If borrower purchased land more than

two (2) years prior to start of construction, the cost of the land is not included in the acquisition

cost. Obtain a certified copy of the recorded deed in order to document and determine whether

cost of land should or should not be included in acquisition cost.

If the land was acquired within the two (2) year limitation, the value of the land must be included

in the acquisition cost and can be documented with a copy of the sales contract or closing

statement, if financed. If the borrower acquired the land through seller financing or inheritance,

the acquisition date is the date of the seller finance agreement or date of death. In all cases,

remember to follow Agency regulations for credit underwriting, appraisal requirements, etc.

FORECLOSURE: Remember to follow Agency regulations with regard to borrowers with prior

foreclosure.

NON-OCCUPANT CO-BORROWERS: All borrowers must occupy subject property within 60 days

of close. IHDA does not permit non-occupant co-borrowers.

10 11/15/2023

IHDA Mortgage definition of Household Income is as follows, the total income of any person who

is expected to a) live in the Qualified Dwelling; and b) be liable, or secondarily liable, on the Note.

The term “borrower” includes the borrower(s) and the co-borrower(s). IHDA’s income calculator

is a required tool to complete income calculation and is located under Income Calculators here:

https://www.ihdamortgage.org/docs.

A presentation on how to use the income calculator is located here:

https://www.ihdamortgage.org/training.

Download the most recent IHDA income calculator from the website each time income is

calculated for borrower(s). Once all sections are complete income must show as compliant. If the

income is over the income limit for the county and household size, the borrower is not eligible

for an IHDA Mortgage program. This applies to first-time AND non first-time homebuyers.

CALCULATION: Total Household Income is the annualized gross income of all income earned

by the borrowers/coborrowers. Annualized gross income is gross monthly income from

current job(s) (see Glossary in Addendum E), at the time of loan closing, multiplied by 12. (Tax

code requires that IHDA project income forward for one year). All income coming into the

household for both the borrower and the coborrower, no matter the length of employment,

must be included. This should include any income from self-employment, W-2s, or SSI/SSDI.

NOTE: If there is a change in income/job between the time of making the reservation and

closing the loan, the Lender must recalculate income to ensure the household is still within

the income limits for an IHDA loan.

HOW TO DOCUMENT TOTAL HOUSEHOLD INCOME

Anyone liable on the note, or secondarily liable on the note, that does not earn or receive income

from any source, must provide a signed certification attesting to that fact.

PAY STUBS: Total Household Income is best documented by providing pay stubs, within 60 days

of close, covering the most current consecutive 30-day period (two (2) or three (3) pay stubs)

from each employer, documentation for any other source of income for each borrower. If the

pay stubs show that any borrower receives a bonus, overtime, or other sporadic income, obtain

a full Verification of Employment (VOE) when total income calculation puts income near the

income limit. The age of all credit documents must be compliant with Agency regulations for

salability.

COMMISSION, BONUS, OR OVERTIME: To determine commission, bonus, and overtime income:

average the income over the last year and the income from the current year to date (YTD). This

can be completed by using current YTD pay stubs and by obtaining a full VOE, which provides a

breakdown or itemization of income. Use the average monthly income to predict the income

The borrower(s) must have a total Household Income that does not exceed the applicable limit

in effect at the time of loan closing.

11 11/15/2023

forward (multiply monthly average by 12). Lender will need to verify and document any situation

such as one-time bonus or the like; a statement from borrower is not sufficient documentation.

SELF-EMPLOYED BORROWERS: When completing the IHDA Mortgage income calculator for a self-

employed borrower, average their income using most recent 2 years federal income tax returns

and a signed year-to-date Profit and Loss (P&L) Statement. The P&L must state the gross income,

the expenses, and the year-to-date net income. Note that the P&L Statement may need to come

from a third party if required for credit underwriting purposes. The lender will use year-to-date

plus prior 2 years net income; the income calculator allows for this calculation. Calculate the

historical monthly income and use that number to project the income forward (multiply monthly

average by 12). For self-employed borrowers, the income calculation allows for the exclusion of

legitimate operating expenses.

CHILD SUPPORT/ALIMONY: Child support and alimony payments must be included as Household

Income. The documentation needed to verify the amount of child support/alimony is a copy of

the appropriate (and most current) court order/divorce decree, which sets forth the amount of

the support.

NOTE: Child support and/or alimony must be included in Household Income calculations even

if it is not being used for credit underwriting purposes.

• If a formal court order exists, child support/alimony income must be calculated even

if the borrower is not receiving it. If not receiving the court ordered child support, and

this income puts household over IHDA income limits, please contact IHDA at

[email protected] to see if documentation can be provided to exclude it (such as a

printout from the state showing the borrower is not receiving it). This must be

reviewed and approved by IHDA before loan closing.

• If custody of child/children is held jointly, then the child/children can be included as

household occupants.

• If no formal court order exists, a signed LOX must be provided stating that no court

order exists and the amount received, if any, on a monthly basis. This amount must

be included in Household Income.

• If the file or documentation in the file indicates that borrower/coborrower could be

receiving child support, then the court order or LOX, as listed above, must be

provided.

NON-TAXABLE INCOME: Social Security Income, Social Security Disability Income, and other non-

taxable income are to be included in the income calculation for tax code compliance purposes.

Do not gross up income when calculating this type of income for tax code compliance.

JOB CHANGES/PREVIOUS EMPLOYMENT: If a borrower has changed jobs during the current, or

most recent, tax year (i.e., a contract in 2018 with a 2017 W-2 for an employer in which the

borrower is no longer employed), a prior VOE for any employment that has ended or been

terminated during the tax year and/or current year, must be obtained. Remember to obtain a

WVOE to verify the start date of new employment and use that to calculate income more

accurately.

12 11/15/2023

RENTAL INCOME: IHDA does not count future rental income for tax code purposes, but it can be

used to credit qualify.

BANK STATEMENTS: Follow Agency requirements, including transfers and deposits.

NON-BORROWING PERSONS

IHDA does not permit non-occupant co-borrowers regardless of loan type or program.

NON-BORROWING SPOUSES

IHDA relies upon our participating lenders to use their internal guidelines and follow all

applicable requirements regarding non-borrowing spouse, homestead, and manner of title.

IHDA requires all legally married non-borrowing spouses to execute:

• Borrower Affidavit (HO-012)

Non-borrowing spouses cannot sign:

• The 1

st

or 2

nd

Note

OCCUPANCY

If the non-borrowing spouse will not be occupying the subject property, a LOX (letter of

explanation) signed by the Borrower with explanation and confirmation that the spouse will

not occupy the property if the Borrower and Spouse are separated and not officially divorced

yet. Parties to civil unions have the same requirements.

DETERMINING IF TOTAL HOUSEHOLD INCOME IS BELOW COUNTY LIMIT

IHDA’s income calculator provides the means to determine whether a Household Income is

below or above the county limit (compliant or non-compliant), as the county limits are embedded

in the calculator. ALL IHDA Mortgage programs require use of the income calculator. Lender must

fully complete, sign, and date the income calculator. The calculator must be included in every

file submitted to IHDA. A PDF copy of the signed income calculator must be uploaded to the

IHDA LOS. Do not save the calculator to the desktop; download it from IHDA’s website each time

when calculating income to ensure you are using the correct version.

Documentation that will assist in determining household size would be the Loan Application and

the IHDA Borrower Affidavit, etc.

In the calculator, the following must be complete:

• income from all sources

• county in which the property is located

• names, ages, and total number of household members

• select whether income is above or below 80% AMI

• select whether the property is located in a targeted area

• select whether the borrower is taking an MCC

o Loans with MCCs may have different income limit requirements

• Mandatory Field: Enter checking, savings, etc. to determine income received from assets

If the calculator shows “non-compliant,” the loan is not eligible for IHDA Mortgage programs.

(FYI – It is strongly encouraged that a second review of the documentation is completed if income

13 11/15/2023

is within 4% of limit.)

Borrowers and non-borrowing spouses are required to complete and sign the Borrower Affidavit.

The Affidavit must include all individuals on the note or secondarily liable on the note and the list

of said borrowers must match that shown on the calculator. Discrepancies between dependents

listed on the application, Borrower Affidavit, etc. must be addressed, and documentation

provided, where applicable.

INCOME LIMITS

Income limit charts are available on our website for general income limits in targeted and non-

targeted areas. The link to General Income Limits for targeted and for non-targeted areas is

located here https://www.ihdamortgage.org/limits. These Program Income Limits typically

change on an annual basis and are always on the IHDA website.

Some borrowers fall into an income category that is below 80% of the AMI. That information is

also available on the income limits page under the “Below 80% AMI” charts.

Before a loan is closed, it is critical that the borrower be in the correct income category and that

it is correctly reserved/committed in the IHDA LOS. The Lender must update the IHDA LOS for

ANY changes to the loan PRIOR to uploading the file for review. Income must be below the county

limit at the time the loan is closed.

For each income category, the Lender must be certain the income is below the county limit. For

borrowers with income higher than the below 80% AMI limit, but below the general income

limit, the Lender will register the loan for the above 80% AMI category.

DETERMINING IF THE TOTAL PURCHASE PRICE IS BELOW THE LIMIT

Once the borrower’s total purchase price has been calculated, it must be compared against a

purchase price limit contained in the correct chart.

Chart 1:

If the borrower is purchasing in a non-targeted area, the total purchase price must be compared

against non-targeted areas of the General Purchase Price and Income Limit found here under

https://www.ihdamortgage.org/limits.

Chart 2:

If the borrower is purchasing in a targeted area, the total purchase price must be compared

against the purchase price limit found in the targeted areas chart on the same page.

The total purchase price must be within the applicable purchase price limits contained in the

The residence being financed must be a Qualified Dwelling and the total purchase price must

be within the applicable limit for the area (county) in which the property is located.

14 11/15/2023

appropriate chart. If the purchase price limits change prior to IHDA’s approval to close the loan,

then the new purchase price limits apply.

QUALIFIED DWELLING

In order for a property to be considered a Qualified Dwelling, A) the borrower must acquire a fee

simple interest in the real estate; B) the home must become (be) the principal place of residence

of the borrower within 60 days after the closing of the IHDA loan; C) the residence must be

located in Illinois; and D) designed for residential use.

Qualified Dwellings can be any of the following 1-2* unit residences:

1. Single family detached home

2. Townhome

3. Condominium unit (FHA/HUD, VA, FNMA, or FHLMC approved) must be

warrantable/approved. Must be reviewed by U.S. Bank if Lender is not delegated by U.S.

Bank to review (see chart on page 19).

4. Planned Unit Development (PUD) – single family

5. Duplex unit or zero lot line home, provided that a maintenance agreement is of public

record

6. Two-unit (one building) – as allowed by Agency

* For two-unit properties, as required by Agency all borrowers on loan must provide

certification of landlord counseling/education before close (see requirements in the credit

underwriting section), minimum investment and reserves must be met per Agency guidelines,

and AUS findings must be followed. Borrower must occupy one of the two units as their

primary residence.

Note: Co-op apartment units, manufactured, mobile, log homes, dome homes, any property with

unresolved “subject to” on appraisal and any property over 5 acres are not eligible. IHDA does not

permit anything above two (2) unit properties at this time. Remember that a specific program

may limit property type.

ADDITIONAL STANDARDS AND REQUIREMENTS OF A QUALIFIED DWELLING:

NEW CONSTRUCTION: This must be the first time the unit will be occupied as a residence for it to

qualify as new construction. A model home qualifies, provided it was never rented nor occupied

as a residence prior to sale. Likewise, conversion of an old factory into condominiums qualifies

as new construction because it was not previously occupied as a residence.

PROPERTIES WITH ACREAGE: Federal regulations prohibit IHDA from financing a residence located

on land in excess of that which is needed to “reasonably maintain basic livability.” This has been

interpreted to mean five (5) acres.

PROPERTIES WITH MORE THAN ONE LIVABLE STRUCTURE: Properties containing a main structure

and a “coach house” are eligible as long as the other livable structure (the coach house) has never

been occupied as a residence. This may be puzzling since a two-flat is eligible under the program

even if both units have previously been occupied as residences.

15 11/15/2023

Why the difference in eligibility? The IRS has made the determination that units sharing a wall

(i.e., two-flat) are considered one dwelling. However, if the units do not share a common wall

(i.e., main house & coach house) the IRS views them as two separate dwellings. If the coach house

was once used as a residence, the buyer is purchasing two separate housing units in the eyes of

the IRS. The units MUST be contiguous.

APPRAISED VALUE EXCEEDS PURCHASE PRICE LIMIT/NON-ARMS-LENGTH TRANSACTION: If the

appraised value exceeds the purchase price limit, but the acquisition cost is below the limit AND

the transaction is clearly “arms-length” (not a relative), the dwelling may qualify. A statement

from the buyer(s) and seller(s) indicating that no relationship exists will be required.

For Non-Arms-Length transactions, both the appraised value and purchase price cannot exceed

IHDA purchase price limits, and all Agency guidelines must be followed.

TOTAL PURCHASE PRICE - ACQUISITION COST

In order to qualify, the residence must have a total purchase price no greater than the allowable

limit at the time of application. The price includes ALL amounts paid, either in cash or in kind, to

the seller as consideration for the residence.

Purchase price can include the following:

▪ The cost of completing an incomplete or unfinished residence. Incomplete or unfinished

means that occupancy is not permitted under the law, or that the residence lacks certain

elements needed to provide adequate living space for the intended occupants.

▪ If the borrower intends to have a home built on land already owned, the cost of the land

must be included in the total purchase price if the land was acquired within two (2) years

prior to the commencement of construction. The cost of the land is determined based on

the following:

⎯ The sales contract or the closing statement can substantiate the value of the land.

⎯ If the borrower acquired the land through inheritance the value must be established

by an appraisal, and the acquisition date is the date of death.

⎯ If the borrower acquired the land through some form of seller financing, the

acquisition date is the date of the seller finance agreement.

DOCUMENTATION: If the land was purchased within the two (2) year window, include a

certified copy of the deed from the Recorder’s Office and submit it to IHDA with the file.

If the land was purchased more than two years ago, the cost of the land cannot be

included in the total purchase price.

Total purchase price does not include:

▪ usual and reasonable settlement and financing costs,

▪ the unpaid value of services (“sweat equity”) performed by the borrower or members of

his or her family in completing the residence,

▪ items of personal property which are not fixtures and/or are not permanently affixed to

the property, or

16 11/15/2023

▪ the cost of minor repairs paid for by the borrower but performed after closing.

DPA cannot be used to make up the difference between sale price and value. If borrower

proceeds with purchase of property valued less than sale price, they need to use their own funds.

CREDIT UNDERWRITING

The Lender is responsible for performing the credit underwriting. However, IHDA does have some

specific program requirements. Remember that applicable Agency (FHA, VA, FNMA, FHLMC,

USDA) credit underwriting requirements and regulations apply to the first mortgage loan. The

IHDA Mortgage products matrix provides an overview of some of the credit “overlays.” This is

located at https://www.ihdamortgage.org/docs under Guides, Manuals, and Program Matrix.

Note: U.S. Bank HFA Division will not purchase any loan without IHDA’s approval.

IHDA’s specific program requirements are as follows:

▪ Minimum credit score of 640 for all loan types. IHDA Mortgage will accept less than three

scores as long as the lowest score, or only score, is 640 or higher and AUS is

Approve/Eligible. Co-borrowers with no credit scores are acceptable if AUS is

Approved/Eligible.

▪ Proof of Mortgage Insurance required per Agency guidelines (FNMA HFA Preferred and

FHLMC HFA Advantage may have reduced MI, follow DU or LPA findings). Borrower paid

monthly, split premium, and single premium is allowed. LPMI is not available on any IHDA

Mortgage loan.

▪ If borrower(s) will own more than one property at the time of closing, the subject

property MUST be owner occupied/principal residence. All Agency and U.S. Bank

guidelines and overlays must be followed. For IHDA Mortgage first-time homebuyer

programs, borrowers or non-borrowing spouses cannot have ownership in a principal

residence within the last (3) years, unless they are Exempt.

▪ Maximum total debt-to-income (back end) ratio of 50.00% with AUS approval, effective

8.15.2023. (Loans with DTI 45.01% - 50.00% (i) must use Finally Home! Homebuyer

Education (https://www.finallyhome.org/) prior to close and (ii) FHA/USDA/VA loans

must have a credit score of 680 or higher.)

▪ The borrower must contribute a minimum investment to the transaction, which is

required to be the greater of 1% of the purchase price or $1,000.00, which will be

evidenced on the Loan Estimate and Closing Disclosure.

o The borrower may not use the tax proration toward the borrower's minimum

investment, those funds must be from the borrower's own funds or if allowable

by the AUS (DU, LPA, etc.) from properly sourced gift funds.

o Earnest money, appraisal paid by borrower, inspection paid by borrower, pre-paid

insurance paid by borrower, and money brought to the table can count towards

their minimum investment. Please list any borrower pre-paid items on the CD as

“POC.”

o All borrowers are required to participate in pre-purchase homeownership education

or counseling – PRIOR TO CLOSE. This includes non first-time homebuyers. The course

must meet standards defined by HUD or the National Industry Standards for

Homeownership Education and Counseling. This can be in the form of a workshop,

17 11/15/2023

one-on-one counseling, or online but the borrower and co-borrower must receive a

certificate. If there is a line for signatures, it must be signed. The lender must retain a

copy of the certificate of course completion in the loan file.

▪ Examples of acceptable courses and further details can be located at

www.ihdamortgage.org/edu

▪ Whatever option is chosen the course must provide a certificate and be

completed prior to close. You must also follow the appropriate agency (FHA,

VA, USDA, FNMA, or FHLMC) guidelines as well.

▪ For Conventional 2 Units Landlord Education is required in addition to

homebuyer education. Please note that there are no requirements on who

provides the education for the borrower. Fannie Mae has also created this

document, which can be used in conjunction with the landlord education or as

an extra resource for the borrower.

▪ No manufactured homes permitted for any loan type.

▪ Manual underwrites – effective on reservations 3/5/2020 and after IHDA will no longer

accept manual underwrites

▪ High Cost

o Not allowed by U.S. Bank and/or IHDA

▪ High Price

o U.S. Bank and IHDA allow when U.S. Bank runs a test via the Federal Financial

Institutions Examination Council (FFIEC).

IHDA Mortgage loans require borrowers to escrow regardless of LTV.

IHDA requires both first and second mortgages to be in compliance with the State of Illinois Anti-

Predatory Lending Database (APLD) program requirements. For information regarding APLD

requirements, refer to the APLD website (https://www.ilapld.com/Overview.aspx).

For Homeowners and Flood Insurance deductibles Lender must follow U.S. Bank HFA Division

requirements.

IHDA does not have a minimum loan amount. High-cost loans are not accepted.

IHDA does not have a maximum amount that a borrower can put down. However, all programs

must be tied to an IHDA 1

st

mortgage.

If the Lender has a qualified FHA Direct Endorsement underwriter, qualified VA LAPP underwriter,

or delegated MI underwriter on staff, the Lender performs the credit underwriting.

Loans run through Loan Product Advisor (LPA) will be acceptable ONLY for FHLMC HFA

Advantage, FHA, or VA loans. FHLMC loans cannot be run through DU.

U.S. Bank HFA Division no longer performs credit underwriting on any FHA loans. In addition,

they will no longer provide any type of underwriting services for Conventional (exception noted

above), RD/RHS, or VA loan products when the Lender employs underwriters with the required

level of approval to underwrite the loan product. Contact U.S. Bank HFA division for more

information at 1-800-562-5165.

The above requirements are IHDA’s minimum requirements. Keep in mind that Agency (FHA, VA,

FNMA, FHLMC, USDA) regulations must be followed in regard to all credit requirements. All credit

18 11/15/2023

underwriting decisions are to be made by the underwriting entity. It is up to the Lender to be

sure that all AUS findings and warnings have been addressed pertaining to the specific loan

type being used. Caution is advised when reviewing DU or LPA findings for conventional loans as

some requirements may differ in some significant ways from what is permitted for IHDA loans.

Effective on all reservations as of October 1, 2017, IHDA follows TRID guidelines on all 1

st

and 2

nd

mortgages and requires an LE & CD for both mortgages, regardless of if there is a payment or

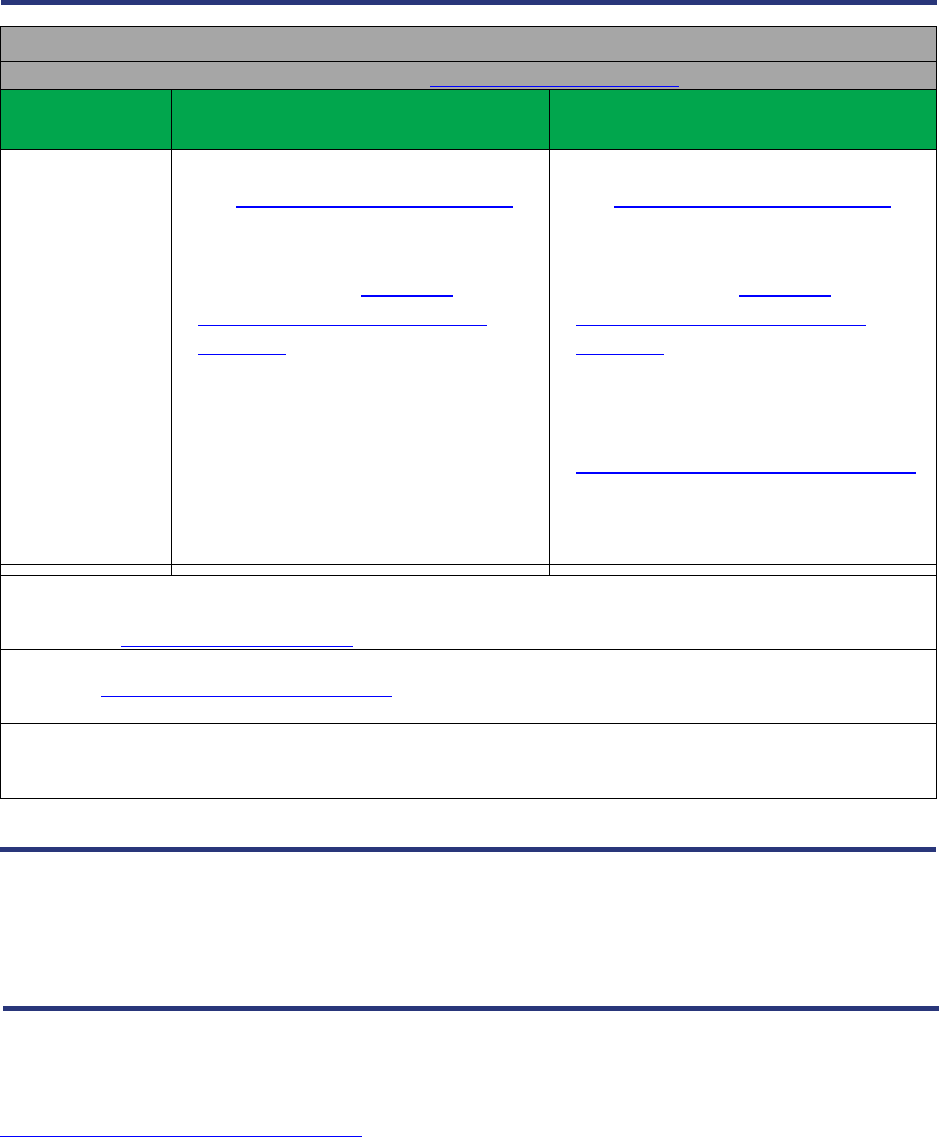

not. On the second mortgage, only recording fees are allowed. See chart below.

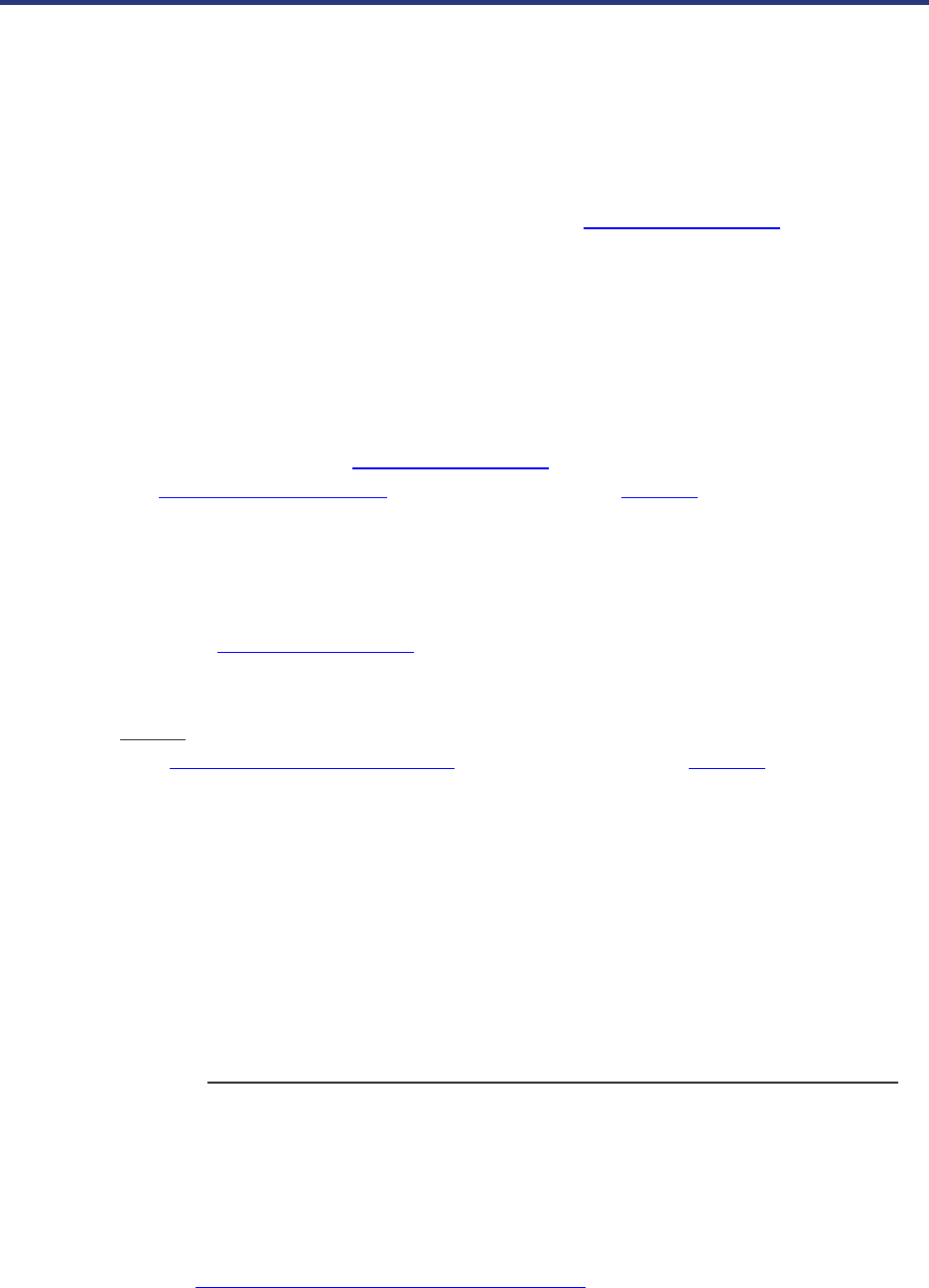

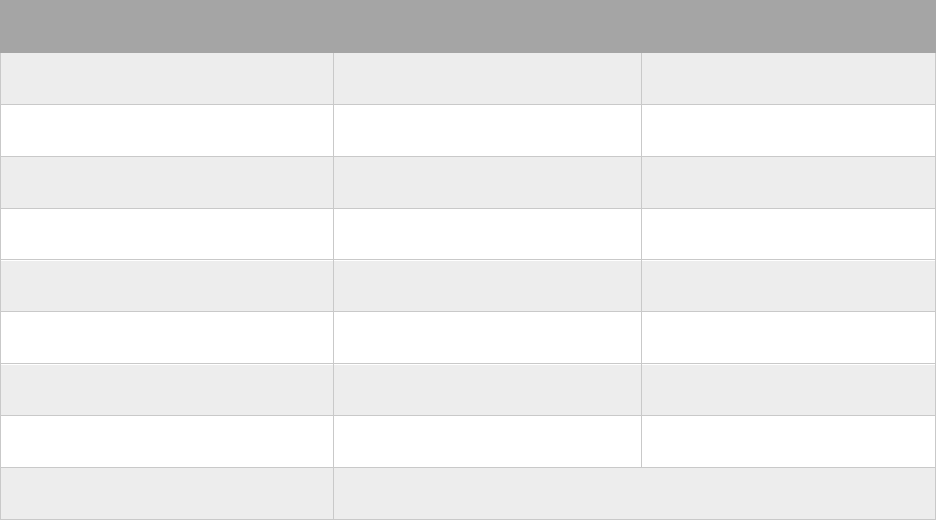

DISCLOSURE REQUIREMENTS (TRID)

PROGRAM

LE on 2

nd

Mortgage

CD on 2

nd

Mortgage

4%

Forgivable

Initial LE required (dated within 3 days of

application), along with all Change of

Circumstances (COC) and their

corresponding LEs, if applicable

Need both an initial and final CD

5%

Deferred*

Initial LE required (dated within 3 days of

application), along with all Change of

Circumstances (COC) and their

corresponding LEs, if applicable.

Need both an initial and final CD

10%

Repayable

Initial LE required (dated within 3 days of

application), along with all Change of

Circumstances (COC) and their

corresponding LEs, if applicable

Need both an initial and final CD

Opening

Doors

(closed

11/13/2023)

Initial LE required (dated within 3 days of

application), along with all Change of

Circumstances (COC) and their

corresponding LEs, if applicable

Need both an initial and final CD

Illinois

HFA1*

(suspended

9/12/2023)

Initial LE required (dated within 3 days of

application), along with all Change of

Circumstances (COC) and their

corresponding LEs, if applicable.

Need both an initial and final CD

All 1

st

Mortgages must ALWAYS follow TRID guidelines

* The 5% Deferred and Illinois HFA1 must be notated as a balloon because it is a true balloon loan that will all become

due at the end of the term.

19 11/15/2023

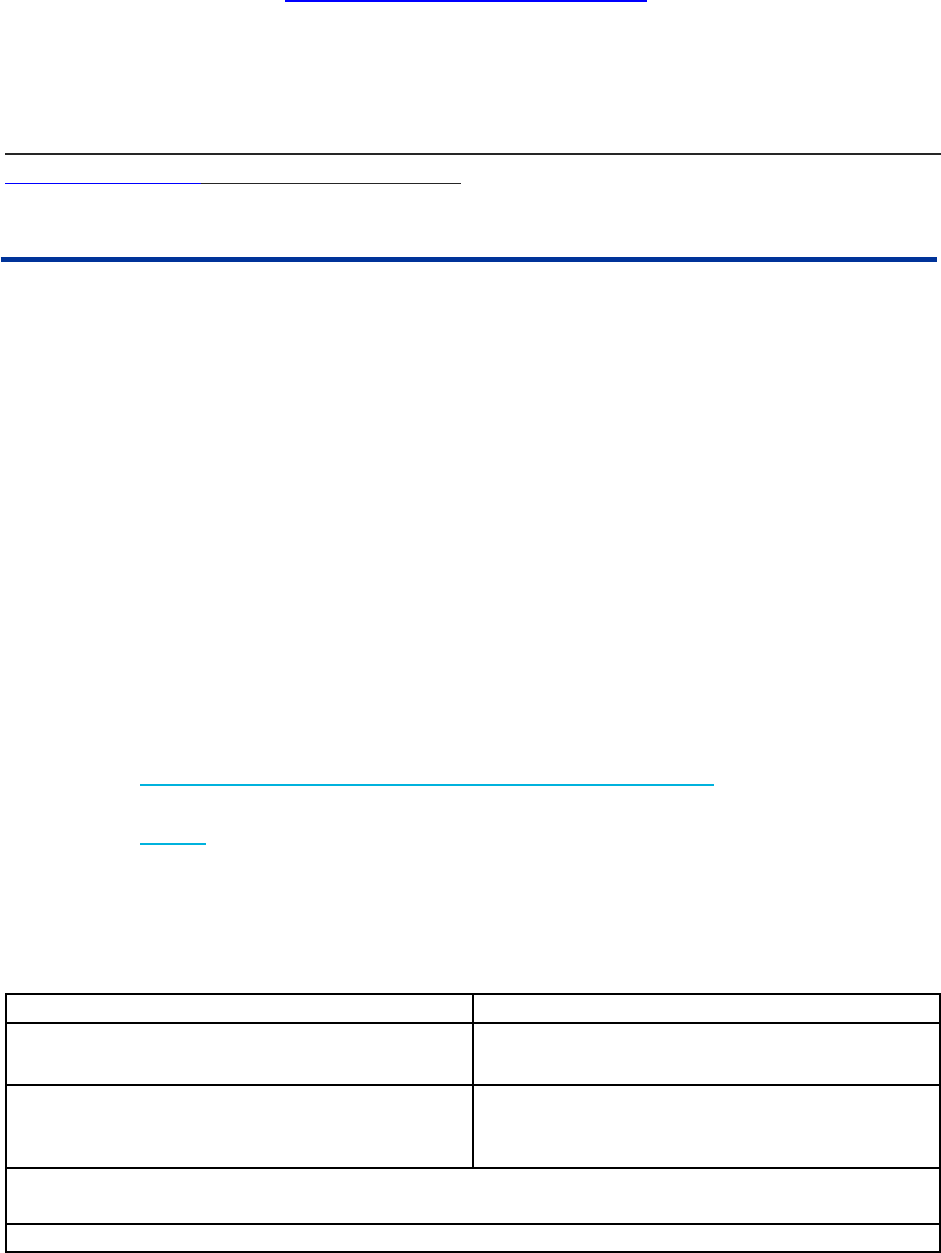

CONDO INFORMATION

FEDERAL RECAPTURE TAX

For detailed information, please refer to:

1) Final Recapture Notice (HO-035)

2) Federal Recapture Tax of this Procedural Guide

IHDA COMPLIANCE REVIEW PROCESS

The Lender is responsible for ensuring that each loan meets IHDA’s compliance guidelines for all

programs prior to closing, including loans with an MCC. IHDA has provided a Lender checklist to

assist with the compliance review located under Checklists on

https://www.ihdamortgage.org/docs. For an exhaustive list of documents required for a

complete file, please refer to the checklist, as the Guide is not all-inclusive.

While the checklist is not required with the IHDA docs, but is strongly recommended, the Lender

certification as part of the Income Calculator must be in each file, which can also be located in

Condo Approval

Condo Questions - [email protected]

Lenders Delegated to Approve

Condos (by U.S. Bank)

Lenders Not Delegated to Approve

Condos (by U.S. Bank)

Condos with

LTV 97.00%

and below

• Condos reflected as APPROVED on

the U.S. Bank Reviewed Projects

list, nothing further is required.

• Condos on the Declined or

Ineligible on the U.S. Bank

Reviewed Projects list are not

eligible.*

• The Lender can underwrite all

other projects to determine

eligibility of the condo.

o The Lender must follow all

Agency and U.S. Bank

guidelines indicated for condo

approval.

• Condos reflected as APPROVED on

the U.S. Bank Reviewed Projects

list, nothing further is required.

• Condos on the Declined or

Ineligible on the U.S. Bank

Reviewed Projects list are not

eligible.*

• All other projects must be

submitted to U.S. Bank Project

Approval Department (PAD),

for review.

Important Note: Delegated Condo Approval is a distinct and separate process from Delegated Loan Underwriting

Approval. For questions on Delegated Condo Approval, please contact Lender Support at (800) 562-5165 Option

2 or by email HFA.Programs@usbank.com.

*If you, as the Lender, believe the original reasoning for the condo denial has been cured, please email the U.S.

Bank PAD ([email protected]) with the necessary information & supporting documents so that

they can review the status of the condo.

In the event there is any conflict or inconsistency between the information listed here and guidelines provided

in the U.S. Bank AllRegs, the information provided by U.S. Bank shall take precedence. Always check U.S. Bank

guidelines for their updates or changes to these guidelines.

20 11/15/2023

the appropriate category on https://www.ihdamortgage.org/docs.

Once the loan has been determined to be tax code compliant and credit compliant (as previously

described), the Lender will close the loan. Lender will be required to repurchase any loan files

determined to be non-compliant or not saleable after purchase from U.S. Bank HFA Division.

If there is uncertainty about any portion of the compliance review process, please contact

[email protected] or a Compliance Specialist.

LOAN CLOSING REQUIREMENTS

Remember that the first mortgage loan closes in the Lender’s name, and the IHDA Rider is

attached to, and recorded with, the first mortgage. If the borrower is to receive a DPA second

mortgage, the DPA 2

nd

will close in IHDA’s name; NO IHDA Rider should be attached to the second

mortgage.

Given that our programs require occupancy by borrowers within 60 days of close, and that

borrowers must always maintain occupancy, do not use an “Assignment of Rents” in connection

with the mortgage.

AT CLOSING REMINDERS

1. For Purchase Programs,

a. Borrowers must contribute a minimum investment for the greater of $1,000 or

1% of the purchase price.

b. Borrowers can leave the table with $250 plus anything above and beyond the

borrower’s minimum investment of 1% or $1,000, whichever is greater (all other

funds should be used for principal reduction).

Borrower Contributions (appraisal fees paid by borrower, EM deposit, POC, etc.)

– Minimum Required Investment (greater of 1% or $1000)

= Allowable Cash Back to Borrower

+ $250

= Maximum Cash Back to Borrower

Any amount greater than the Maximum Cash Back to Borrower or any non-

borrower contributed credits (tax proration, seller credit, lender credits, etc.) that

may be due to the borrower must be applied to principal reduction.

Borrower Investment

Maximum Cash Back to Borrower

Exactly 1% or $1,000* (as required by IHDA

guidelines)

$250

1% or $1,000* + additional borrower

contributions (appraisal fees paid by borrower,

EM deposit, POC, etc. paid by the borrower)

$250 + any amount over the required 1% or

$1,000

Any amounts greater than the Maximum Cash Back to Borrower or contributed by outside parties

beyond the amounts listed above must be applied to principal reductions.

* Tax proration does not count towards the borrower's required minimum investment

21 11/15/2023

After the loan has closed, Lender will:

1. Validate final loan data in the IHDA LOS,

2. Submit (via upload) loan package to U.S. Bank HFA Division as per their requirements,

3. Upload the entire Investor Loan Delivery File to the IHDA LOS (same file sent to U.S.

Bank HFA Division), and

4. Upload IHDA documentation to the IHDA LOS (include income documentation in this

upload).

IHDA has a reference checklist for delivery, which is similar to U.S. Bank’s delivery checklist, but

which includes some key differences, such as the requirement for verbal VOEs for employment

terminated in the most recent tax year, etc. Therefore, IHDA highly recommends use of our

checklist located under located under Checklists on https://www.ihdamortgage.org/docs.

The IHDA Reservation manual provides information on uploading documents and is available on

https://www.ihdamortgage.org/docs currently under “Program Matrix, Income Limits, Guides, &

Program Matrix.”

For every file, the fully completed IHDA Submission Cover with IHDA documents must be included

in the upload to the IHDA LOS in the IHDA Delivery File category. Completion of this form is

extremely helpful to us. When completed correctly, the Submission Cover will auto populate

many of the fields in the document set and auto calculate 2

nd

mortgage amounts, saving time

and reducing errors.

Every loan reserved must include a Borrower Affidavit which addresses recapture information

(HO-012) and a Final Recapture Notice (Notice to Mortgagor of Maximum Recapture Tax (HO-

035)); the borrower(s) must sign both. The Final Recapture form is fillable and requires entering

the total loan amount; once the total loan amount of the first mortgage is entered, the total

maximum recapture tax will calculate automatically and is equal to 6.25% of the total first

mortgage amount.

SIGNATURE REQUIREMENTS

IHDA requires a wet (not electronic) signature on the mortgage, note, and rider(s) to the

mortgage. All other IHDA documents may be electronically signed in accordance with federal

and state law.

TITLE POLICY REQUIREMENTS

• No IHDA transaction may close in a trust.

• IHDA relies upon our participating lenders to use their internal guidelines and follow all

applicable requirements regarding manner of title.

• A separate title policy for IHDA second mortgages is not permitted, therefore you will not

need to provide a CPL. Only recording fees may be charged to the second mortgage. Any

fees charged to the second mortgage, with the exception of the recording fee, will deem the

file non-compliant and ineligible for delivery to IHDA.

POWER OF ATTORNEY (POA) – BORROWER AND SELLER

IHDA allows POAs for all documents signed at closing, provided that all POAs on IHDA files follow

22 11/15/2023

applicable Agency regulations, State laws, and any overlays set forth by IHDA’s Master Servicer,

U.S. Bank. The POA must be specific to the transaction. Note: VA loans require a special form -

without it, the loan is not saleable.

IHDA does NOT allow POA on all pre-closing documents signed by borrower(s) or non-borrowing

spouse unless there is an extenuating circumstance such as an active military member stationed

overseas. Management must approve all these exceptions.

FEES

• Lenders will receive 2.0% of the principal loan balance amount as a Service Release

Premium (SRP) for all loans. Details can be found in Addendum H.

▪ As our programs are designed to be affordable for borrowers, Lender fees to buyer are

limited. If an origination fee is charged, it must not exceed 1% + $1,200 (plus all

reasonable and customary fees). (Reg. Z compliance required)

o Fees paid to third parties such as courier fees and title company fees are allowed

and are not included in the $1,200 in allowable fees.

o No fees can be charged on the second except the recording fee.

▪ Note that U.S. Bank HFA Division will charge a tax service fee ($84.00 as of reservations

7/17/2022) and a funding fee ($400.00 as of 11/1/2015) which will be deducted at time

of purchase.

▪ There are currently no fees paid directly to IHDA (unless the loan includes an MCC).

▪ A $350.00 MCC fee is required for all loans with MCCs and must be made payable to

Illinois Housing Development Authority (IHDA) and sent to IHDA as noted below with a

completed fee transmittal form. Lender may include a copy of the MCC

reservation/commitment if they so choose. Should Lender choose to do so, $150.00 may

be charged for MCC processing, for a total of $500.00 for MCC. The appropriate

disclosures (LE/CD) must reflect MCC fee(s) paid and to whom.

Please note that lenders must review specific Agency guidelines and regulatory requirements

on which fees may be charged to the borrower.

QUALITY CONTROL – PRE-PURCHASE/POST CLOSE AND POST FUND

QC reviews a minimum of 5% of overall production prior to funding and selects a minimum of

10% of loan files for QC review after funding. A discretionary review of a minimum 5% of loans

determined to be of greater risk (i.e., Lender on watch list, high default rate, high LTV with low

credit score, etc.) is performed as well. Since every loan file delivered to IHDA has the potential

of being reviewed by our QC vendor, it is crucial that each file be compliant with all applicable

mortgage lending regulations and that a complete saleable loan file be uploaded to the IHDA LOS.

Each file must be compliant with all applicable federal, state, and local regulations with regard to

mortgage lending including CFPB requirements of “Know Before You Owe.” IHDA may

occasionally increase loan file reviews should it become necessary due to consistent issues.

23 11/15/2023

If the loan file provided to IHDA is incomplete, a compliance specialist or QC staff person will

request Lender to resubmit the entire file and/or specific documentation. Should any deficiency

be discovered during a QC review, the Lender will be notified to remedy it immediately. If a

deficiency is beyond remediation or if fraudulent activity is discovered, the loan may not be

saleable.

POST CLOSE REQUIREMENTS

The Lender must upload the entire closed loan package pursuant to IHDA's Delivery checklist for

review after the loan has closed. A package must also be uploaded to U.S. Bank for an

independent review.

The Lender should use the checklist available at www.ihdamortgage.org/docs under the correct

program for the most recently updated document list. It is also included in the doc sets for each

program.

Reminder: The originating Lender is responsible for collecting all payments until U.S. Bank

purchases the loan. This is true for the first and the second mortgage. Please review the servicing

or payment letter provided for each program for specific instructions.

Please note that U.S. Bank HFA Division requires that the entire loan file be delivered via Doc

Velocity for review in order to purchase the loan. The Investor Delivery File uploaded to the

IHDA LOS must be exactly the same file delivered to U.S. Bank HFA Division. Contact the U.S.

Bank Client Support Center at 1-800-562-5165 for information on their specific requirements

and/or review their requirements as per their manual at

https://www.allregs.com/tpl/Main.aspx.

ADDENDUM A

MORTGAGE CREDIT CERTIFICATE

24

W

HAT IS AN MCC?

An MCC is a certificate issued by IHDA as authorized by the IRS, which permits a borrower to

receive a tax credit.

HOW DOES THE MORTGAGE CREDIT WORK?

Homebuyers who qualify for the program receive an MCC from IHDA, which can be used to

reduce their household’s tax burden every year for the life of their mortgage loan. With an MCC,

a percentage of what the homeowner pays in mortgage interest (25%, maximum $2000 per year),

becomes a tax credit that can be deducted dollar-for-dollar from his/her income tax liability. The

remaining 75% of the mortgage interest continues to qualify as an itemized tax deduction, as

long as the homeowner has sufficient tax liability.

Click h

ere to view our video fully describing the MCC.

WHAT ARE THE BASIC ASSUMPTIONS?

• Borrower is first-time homebuyer (or Exempt*),

• Income is below county limit,

• Purchase price is below county limit, and

• Property is a Qualified Dwelling situated on less than or equal to 5 acres of land.

*Exem

pt = qualified veteran (borrower must be a veteran), or property is in targeted area.

Note that if only the spouse is a veteran, the spouse must also be a borrower/mortgagor and

obligated on the note. Provide a COE or DD214 showing honorable discharge in closing

package uploaded to IHDA.

HOW IS THE MCC RESERVED?

An MCC can only be reserved in conjunction with an IHDA Mortgage first mortgage product

(currently only with the Access Programs). The IHDA Mortgage reservation guide, found on the

website

, provides information as to how to commit/reserve the M

CC.

Note: A

s of 9/1/2018, the MCC reservation must be separately locked after the first and second

mortgage are reserved through the IHDA LOS. Once the first mortgage is locked, click on the

reserve a second button located in the upper boxes of the Loan Detail screen of the first

mortgage. After selecting the corresponding MCC Program, enter the first mortgage amount and

then submit the MCC loan to get the confirmation.

WHAT UNDERWRITING IS INVOLVED?

As noted above, the Lender is responsible for determining tax code compliance. The same basic

assumptions apply to an MCC as to IHDA first mortgage tax code compliance review. As with all

M

ORTGAGE

C

REDIT

C

ERTIFICATE

(MCC)

Suspended effective 6/17/2020

8/2023 25

IHDA programs, borrowers (and spouse), must provide three (3) years signed federal tax returns

or transcripts from IRS. Both borrower and spouse must be first-time homebuyers or Exempt.

WHAT DOCUMENTATION IS REQUIRED FOR AN MCC?

The MCC documentation required to be signed prior to close is as follows:

• MCC 25 – Informational Acknowledgment

• MCC 26 – Borrower Application Affidavit (non-borrowing spouse also signs)

• MCC 27 – Income Tax Affidavit (as required) – Any borrower not required to file federal

income tax returns for a specific year would need to sign this.

• MCC 29 – Lender Initial Certification

• MCC 34 – Notice of potential RECAPTURE TAX ON SALE OF HOME (Initial MCC Recapture

Notice) (Replaces HO-034)

The documentation required to be completed and signed on or after close is as follows:

• MCC 32 – Borrower Closing Certification (non-borrowing spouse also signs)

• MCC 33 – Lender Closing Certificate (any changes from original application must be noted

in 6B)

• MCC 35 – Notice to Borrower of Maximum Recapture Tax and Method to Compute

Recapture Tax on Sale of Home – must be signed on or after close and properly completed

with total loan amount and total amount of potential recapture tax (Replaces HO-035)

The appro

priate disclosures (LE/CD) must reflect MCC fee of $350.00 payable to IHDA. Lender is

permitted to charge an additional $150.00, which must be reflected on the appropriate

disclosures (LE/CD) as payable to Lender.

Effec

tive February 1, 2016, the MCC check for $350, payable to Illinois Housing Development

Authority (IHDA), must be promptly forwarded to our lockbox with a copy of the Transmittal Fee

form attached. Submit the check to one of the following addresses:

Via regular mail to: OR via UPS or FedEx to:

Illinois Housing Development Authority JP Morgan Chase Bank

PO Box 93397 Attn: Lockbox 93397

Chicago, IL 60673 Illinois Housing Development Authority

131 S. Dearborn, 6

th

Floor

Chicago, IL 60603

The M

CC is issued directly to borrower. At year-end, the Lender will receive a report, which

provides the information necessary to file the 8329 form with the IRS.

HOW DOES REISSUANCE WORK?

If a borrower currently has an MCC on their primary residence, and the borrower refinances their

first mortgage loan, they may request reissuance of their MCC as long as the property remains

their primary residence. Processing time varies.

To request a re-issued MCC, borrower provides the following documentation:

8/2023 26

• Request for re-issued MCC on primary residence with contact information,

• Copy of signed Closing Disclosure from refinance,

• Copy of existing (and any other re-issued) MCC, and

• Check in the amount of $150.00 payable to Illinois Housing Development Authority.

DO

NOT SEND REQUESTS FOR REISSUANCE TO THE LOCKBOX.

Forward the above listed re-issuance documentation ONLY to:

Illinois Housing Development Authority

111 E. Wacker Drive, Suite 1000

Chicago, IL 60601

Attn: Homeownership Programs

8/2023 27

ADDENDUM B

SMARTBUY PROGRAM

28

It is expected that Lender will utilize the SmartBuy Checklist to assure that all documents

required are in the file when delivered to IHDA for prior review and for post-close purchase

review.

NOTE: A PRE-CLOSE REVIEW BY IHDA IS REQUIRED. We expect the file has been fully underwritten

and ready to close when submitted to IHDA for review. Once reserved and at least 5 business days

prior to close, Lenders will be required to submit the following items for review via upload to the

IHDA LOS including but not limited to:

1. Completed SmartBuy Pre-Close Submission Cover

2. Completed/signed Student Loan Attestation (auto filled by submission cover)

3. SmartBuy Checklist

4. IHDA Borrower Affidavit

5. IHDA Initial Recapture

6. IHDA Certification of Income

7. U.S. Bank Authorization

8. IHDA Tax Code Certification

9. IHDA Income Calculator

10. Pre-Purchase Homebuyer Education Cert (signed, as applicable, and dated by borrower and

co-borrower)

11. All of the most recent income documentation (i.e., paystubs, child support, etc.)

12. Payoff statements for all student loans (within 30 days of closing)

13. Copies of most recent student loan monthly statements

14. Credit report

15. Sales Contract and any addendums

16. Copy of 1003 (with most current assets and liabilities listed)

17. Evidence of Underwriter Approval

18. AUS results

o In DU,

The existing student loan(s) marked as “paid at closing”

The Student Debt that is being covered in the SmartBuy transaction would be input

as “unsecured, no payment, forgivable personal loan with $0 monthly payment for

36 months”

o In LPA,

The existing student loan(s) marked as “paid at closing”

The Student Debt that is being covered in the SmartBuy transaction would be input

as “gift or grant”, marked paid at closing, and included in the Asset calculation

PLEASE NOTE: It will take up to 5 business days for IHDA to review the pre-close package. If any

items are updated after IHDA's pre-close review, you must submit for pre-close approval. The 5-

day clock will restart IHDA review if a second review is needed.

S

MART

B

UY

P

ROGRAM

(CLOSED FOR NEW L

OCKS AS OF 05/21/2021)

8/2023 29

After the documentation is received and approved, IHDA will generate the following documents in

TPO Connect in the folder named “SmartBuy IHDA Docs.” Lender will receive notification via email

that the pre-close file was approved, with instructions on how to download.

Guaranty Letter to be signed by Lender

Completed Promissory Note for signature by Borrower(s) at close

Completed Deed Restriction for signature by Borrower(s) at close

If ANY loan level details change (i.e., purchase price), the lender must email compliance office to

request an update to the Promissory Note, Deed Restriction, and/or Guaranty Letter for corrected

data.

Once closed, Lender will upload signed IHDA documents to IHDA via TPO Connect in IHDA Delivery

File with full closing package to Investor Delivery.

IHDA Delivery file will include signed IHDA specific docs and all closing documentation, including, but

not limited to:

1. Completed SmartBuy Post Close Submission Cover

2. SmartBuy Checklist

3. SmartBuy 2nd Mortgage

4. SmartBuy 2nd Note

5. IHDA Mortgage Rider

6. SmartBuy Signed Servicing Letter

7. IHDA Impact Assistance Letter

8. IHDA Final Recapture

9. Final Signed CD to show all student loans being paid off and IHDA SmartBuy Assistance

10. All agency required documents as listed on the IHDA Delivery Checklist, as applicable

11. Signed Guaranty Letter (released by IHDA staff in TPO Connect)

12. Signed Promissory Note (released by IHDA staff in TPO Connect)

13. Signed Deed Restriction (released by IHDA staff in TPO Connect)

If any items are found to be missing during the post close review, the file will be suspended.

Fannie Mae (FNMA)

Guidance on Entering in the URLA for FNMA

• The Asset Section 2B is the only asset section that should be used.

• Section 2b –

o Add an “Other” Asset type labeled liquid asset with amount of assistance being

received.

• Section 2c –

o All student loans should be listed and shown as being paid at closing.

o SmartBuy Assistance amount added as a new liability. This is an unsecured personal

installment loan with $0 monthly payments for 36 months.

8/2023 30

• Section 4B –

o Add IHDA 2nd as subordinate lien with $5,000 loan amount.

Guidance on DU

Lender would mark the existing student loan as being “paid at closing” – when that selection is

made in DU, the following message would appear in the DU Findings:

• Include evidence of payoff of the following debts (other than 30-day accounts) in the

loan file:

o Borrower|Creditor|Account Number|Balance

The Stude

nt Debt that is being covered in the SmartBuy transaction would be input as

“unsecured, no payment, forgivable personal loan with $0 monthly payment for 36 months” –

when that input is made in DU, the debt that has no payment would not be included in the

CLTV, nor would it be counted against the DTI ratios. Lenders would see the following message

in the DU Findings:

• The risk assessment of the loan casefile may not be accurate because the following

accounts on the loan application did not have a minimum monthly payment and DU was

unable to calculate an accurate debt-to-income ratio. The lender must ensure the DTI

used in the risk assessment is accurate. If a payment must be included in the DTI, the

payment amount must be entered on the loan application and the loan casefile

resubmitted to DU. If the minimum monthly payment is $0, the lender must include

documentation in the loan file confirming the $0 payment amount. Deferred installment

debts must be included as part of the borrower's recurring monthly debt obligations. For

student loans, the lender may qualify the borrower with the $0 payment if there is

documentation to support that the $0 payment is associated with an income-driven

repayment plan; alternatively, the lender must either use 1% of the outstanding balance

as the estimated payment or derive a fully amortizing payment using the student loan

documentation.

o Borrower|Creditor|Account Number|Balance

8/2023 31

A

DDENDUM C

PROGRAM FACT SHEETS

32

4% DPA / $6,000

P URPOSE

To assist homebuyers with down payment and/or closing costs associated with

purchasing a home in the State of Illinois. The Illinois Housing Development Authority

(IHDA) IHDA Mortgage offers Access 4%. This Down Payment Assistance (DPA) is offered

as a recorded forgivable 2

nd

mortgage for qualified borrowers.

D ATE

Reservations for IHDA Mortgage – Access 4%, opened in February 2018 and will run until

IHDA has closed the program for reservations in the TPO Connect.

U SAGE

The funds provided are in the form of a forgivable 2

nd

mortgage for an owner occupied,

primary residence purchase. The DPA 2

nd

is required to be used in conjunction with an

IHDA 30-year fixed rate 1

st

mortgage. Please Note: with all IHDA Mortgage programs,

cash back at closing for borrowers may not exceed $250 + plus any amount over their

required minimum investment (any additional should be principal reduction).

D OWN P AYMENT

A SSISTANCE

The DPA or “assistance” amount shall be recorded as a 2

nd

lien and may be used to cover

down payment and/or closing costs. Assistance is limited to 4% of the purchase price

up to $6,000. The 2

nd

mortgage shall be forgiven pro rata on a monthly basis over a 10-

year forgiveness period. The 2

nd

mortgage may not be re-subordinated.

2

ND

M ORTGAGE

P AYMENT

No monthly payment due. Full repayment is required following certain qualifying

repayment events. (Review Mortgage and Note for full terms.)

I NTEREST R ATE

( SET BY IHDA)

Daily IHDA rates apply on the 1

st

mortgage. The 2

nd

mortgage carries 0% interest.

M INIMUM

B ORROWER

I NVESTMENT

The greater of 1% or $1,000 of the purchase price. (The borrower may not use the tax

proration toward the borrower's contribution of 1% or $1,000.00 (whichever is greater)

into the transaction, those funds must be from the borrower’s own funds or from gift

funds if allowable by the AUS.) Please defer to the Program Matrix and IHDA Procedural

Guide for details.

R EPAYMENT AND

R ECAPTURE

The 2

nd

mortgage funds will be forgiven pro rata on a monthly basis over a 10-year

forgiveness period. The DPA 2

nd

is required to be used in conjunction with an IHDA 30-

year fixed rate 1

st

mortgage.

The 1

st

mortgage will carry a 30-year term and must be insured by FHA, guaranteed by

VA or USDA, or carry Private Mortgage Insurance as may be required for FNMA HFA

Preferred or FHLMC HFA Advantage.

Both may be subject to repayment or recapture depending on terms of Recapture Notice.

E LIGIBILITY

•

Borrowers can be a first-time homebuyer or non first-time homebuyer in Illinois.

• Minimum credit score - 640 for all loan types

• FHA, VA, USDA, FNMA HFA Preferred, FHLMC HFA Advantage only

o AUS Approve/Eligible or Accept/Eligible findings required

o Manual Underwrites – See Procedural Guide details

• Maximum total debt-to-income (back end) ratio of 50.00%. (Loans with DTI 45.01%

- 50.00% (i) must use Finally Home! Homebuyer Education prior to close and (ii)

FHA loans must have a credit score of 680 or higher.)

• IHDA income and property purchase price limits apply

• Property must be a qualified single family dwelling (this includes condos,

townhomes, and 2-units as allowed by Agency)

• Pre-purchase homeownership counseling is required for each borrower - PRIOR

TO CLOSE (PTC) or the loan is unsaleable

• No manufactured homes

Borrowers must meet all eligibility requirements established for the IHDA Mortgage

programs, U.S. Bank overlays, and Agency guidelines.

I NCOME

R EQUIREMENT

Borrower’s income must be at or below the limits of the county in which the property

is located. The lenders must calculate income using the calculator posted on The

Document Library to qualify for IHDA Mortgage DPA.

D ISCLOSURE OF

F UNDS

All 1

st

and 2

nd

mortgages require TRID (TILA-RESPA-INTEGRATED DISCLOSURE). On the

2

nd

mortgage, only recording fees are allowed.

DISCLAIMER

The terms and conditions are subject to change until the lender locks the loan in TPO Connect. A potential borrower should contact an approved lender